The Juggernaut Index

Do the largest value creators outperform?

November 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

- Selecting the top 10 stocks that created the most shareholder value is not a sound investment strategy

- Neither is selecting the top 10 stocks with the largest market capitalizations

- As expected, most of the stocks were technology companies

INTRODUCTION

The Nifty Fifty was a group of popular high-growth large-cap U.S. stocks pitched as “buy and hold forever stocks” in the 1960s. Although many of these are still trading today, some, like General Electric, have fallen from Olympus, and others, like Eastman Kodak, have entered bankruptcy.

Three years ago, we had the FANG stocks, which comprised Facebook, Amazon, Netflix, and Google. Today this group has evolved into the Magnificent 7, although that is changing given Broadcom´s strong performance given the boom in stocks providing exposure to artificial intelligence (read Thematic versus Momentum Investing).

Given the frequent change in such groups, it is questionable if it is worth chasing such juggernaut stocks.

In this research article, we will create and analyze a juggernaut index.

PERFORMANCE OF THE JUGGERNAUT INDEX

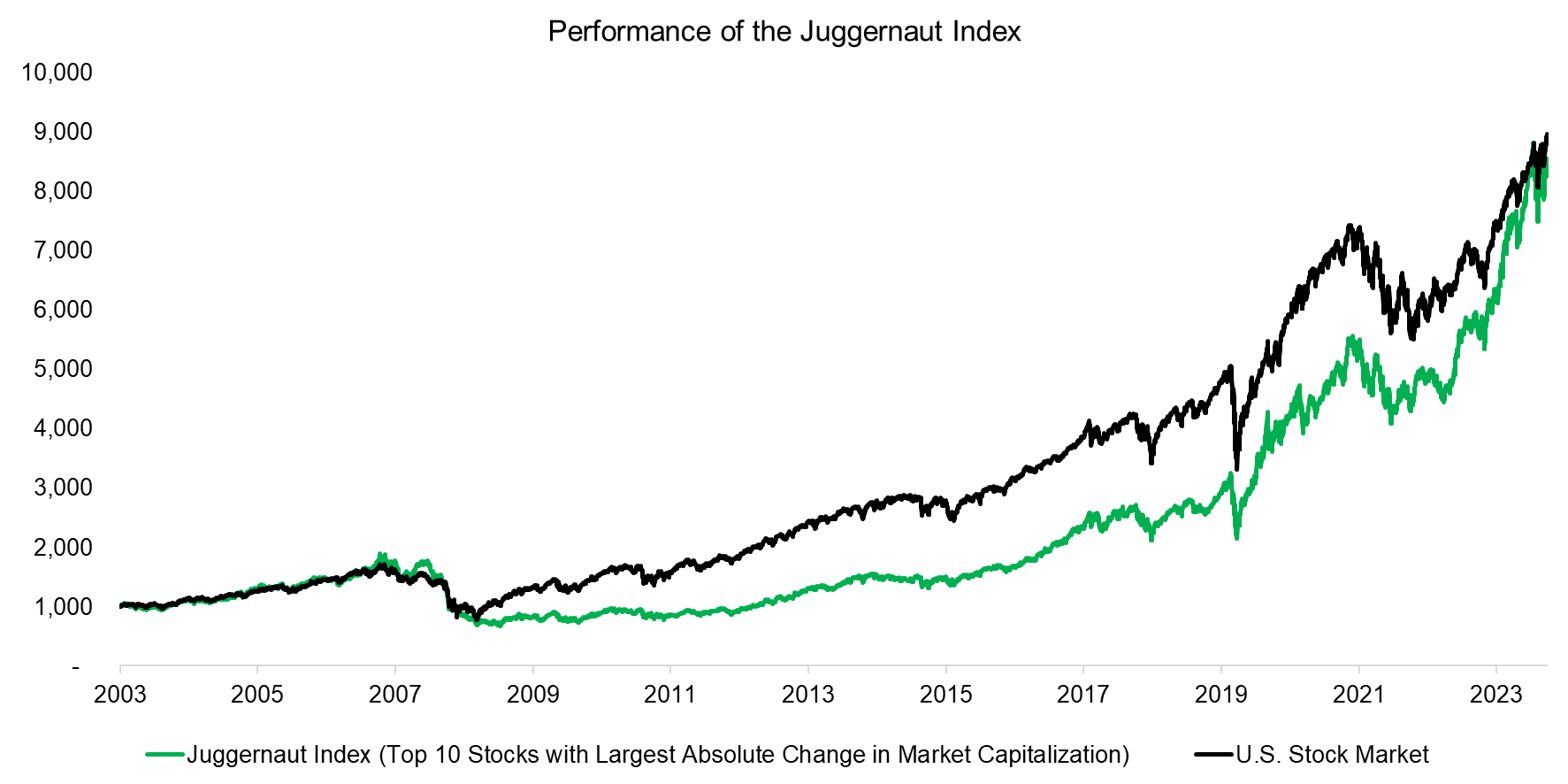

We create an index (the “Juggernaut Index”) of the top 10 stocks in the U.S. that had the largest absolute change in market capitalization over the last 12 months. The portfolio is equal-weighted, rebalanced monthly, and assumes 10 basis points of transaction costs. Currently, the portfolio is comprised of NVIDIA, Apple, Microsoft, Meta Platforms, Broadcom, Amazon.com, Eli Lilly, Alphabet, Berkshire Hathaway, and JPMorgan Chase.

Despite the constant hype about these few stocks, the Juggernaut Index did not outperform the U.S. stock market in the period between 2003 and 2024. The median market capitalization and price-to-book multiple were $212 billion and 4.6x over the last 20 years, compared to $4 billion and 2.5x for the entire stock market.

Source: Finominal

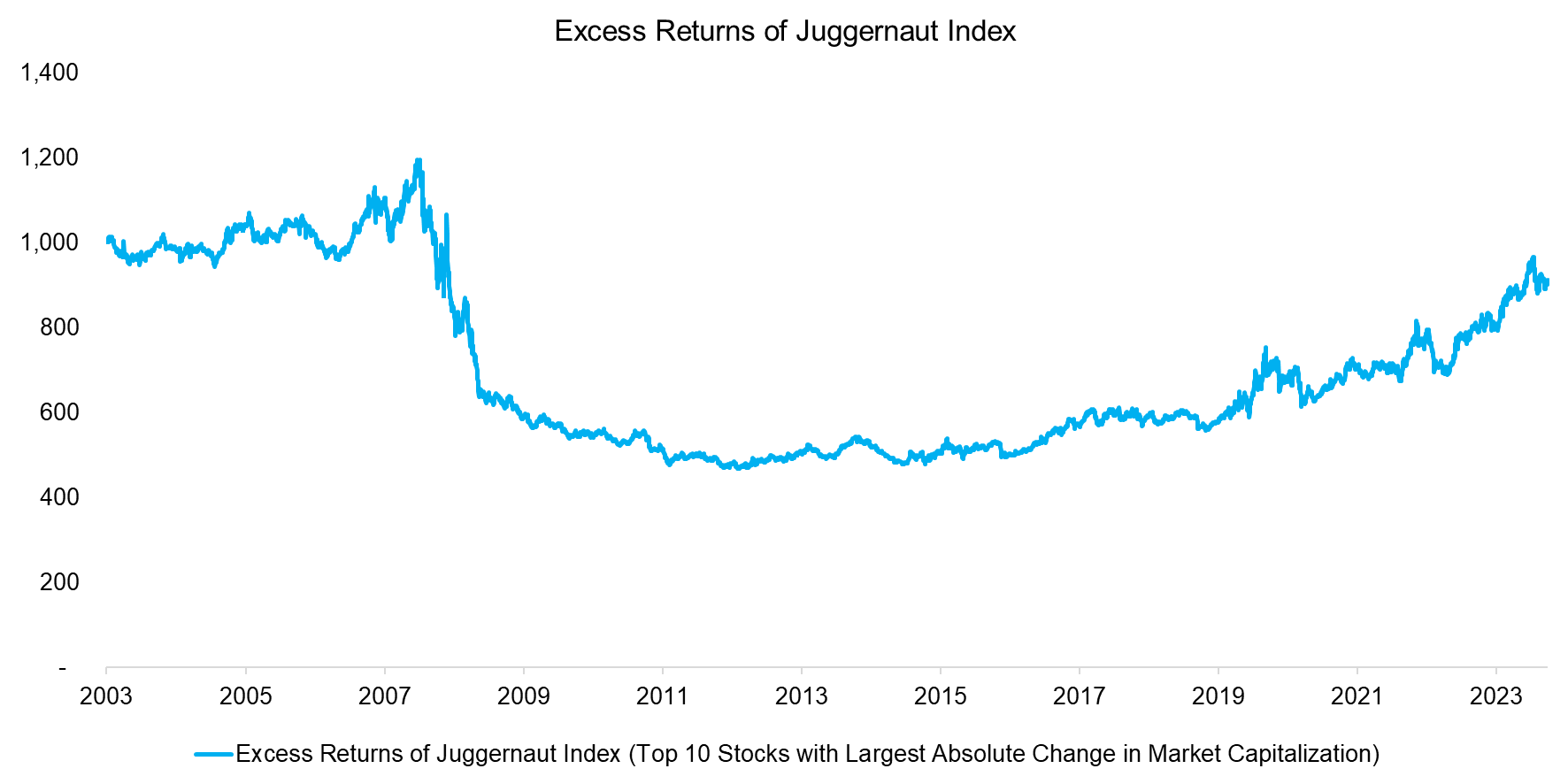

We can analyze the performance further by computing the excess returns of the Juggernaut Index, which highlights a crash starting in the summer of 2008. Factor investing specialists might assume that the index experienced the same crash as the long-short momentum factor, but that started later in March 2009.

The returns of the index were flat post that crash and then started to become consistently positive from 2015 onward. However, overall this represents a poor investment strategy as the total excess return over the last twenty years remains negative.

Source: Finominal

BREAKDOWN BY SECTORS

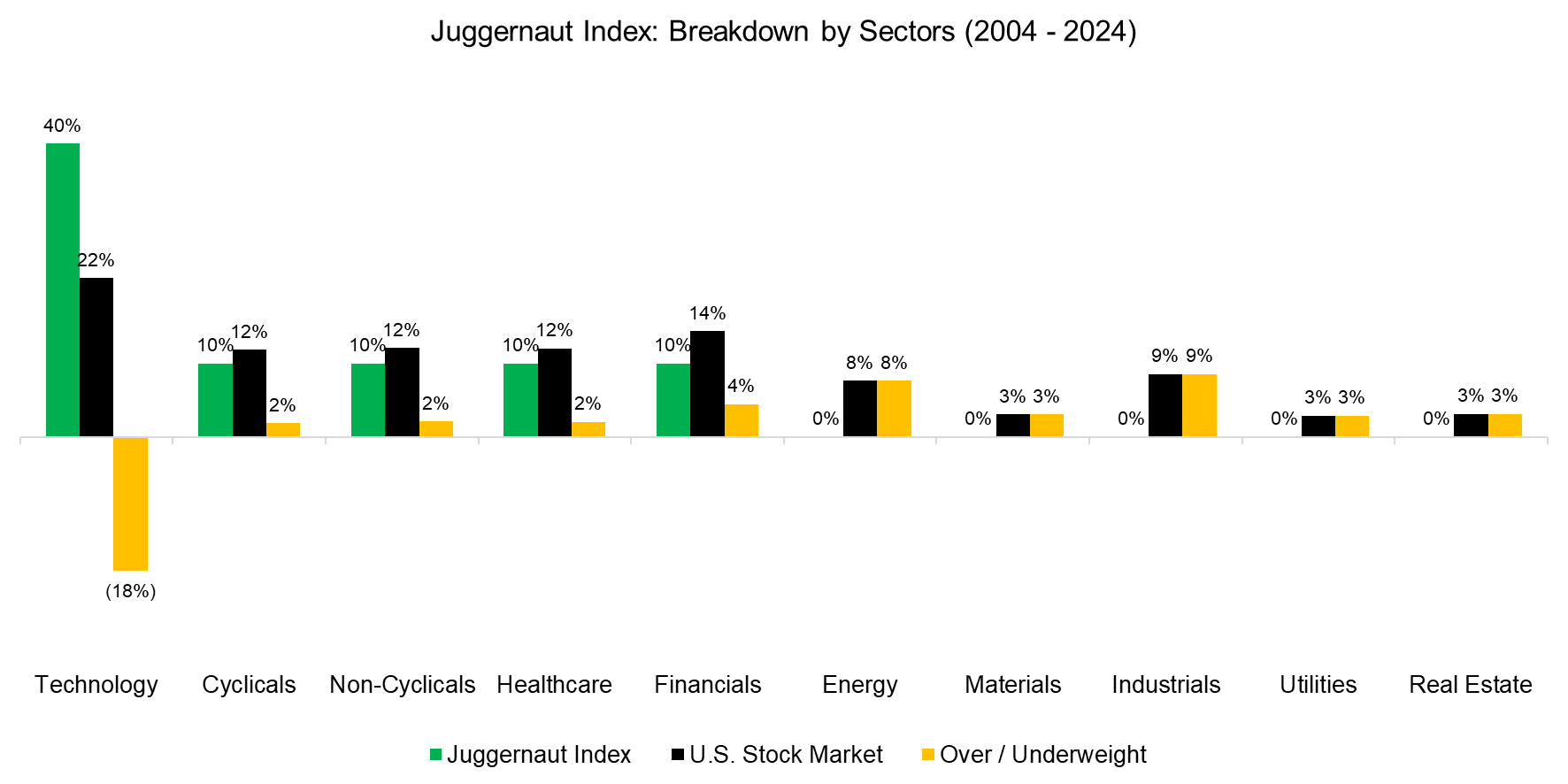

Although most investors will know the juggernaut stocks of 2024, e.g. NVIDIA or Apple, they are less likely to guess the stocks going back further in time. We compute the breakdown by sectors to provide an overview and observe a significant overweight to technology stocks. The energy, materials, industrials, utilities, and real estate sectors did not contribute any stocks over the last 20 years, which reflects the scalable and high-growth business models of technology companies.

Source: Finominal

MEGA CAP INDEX

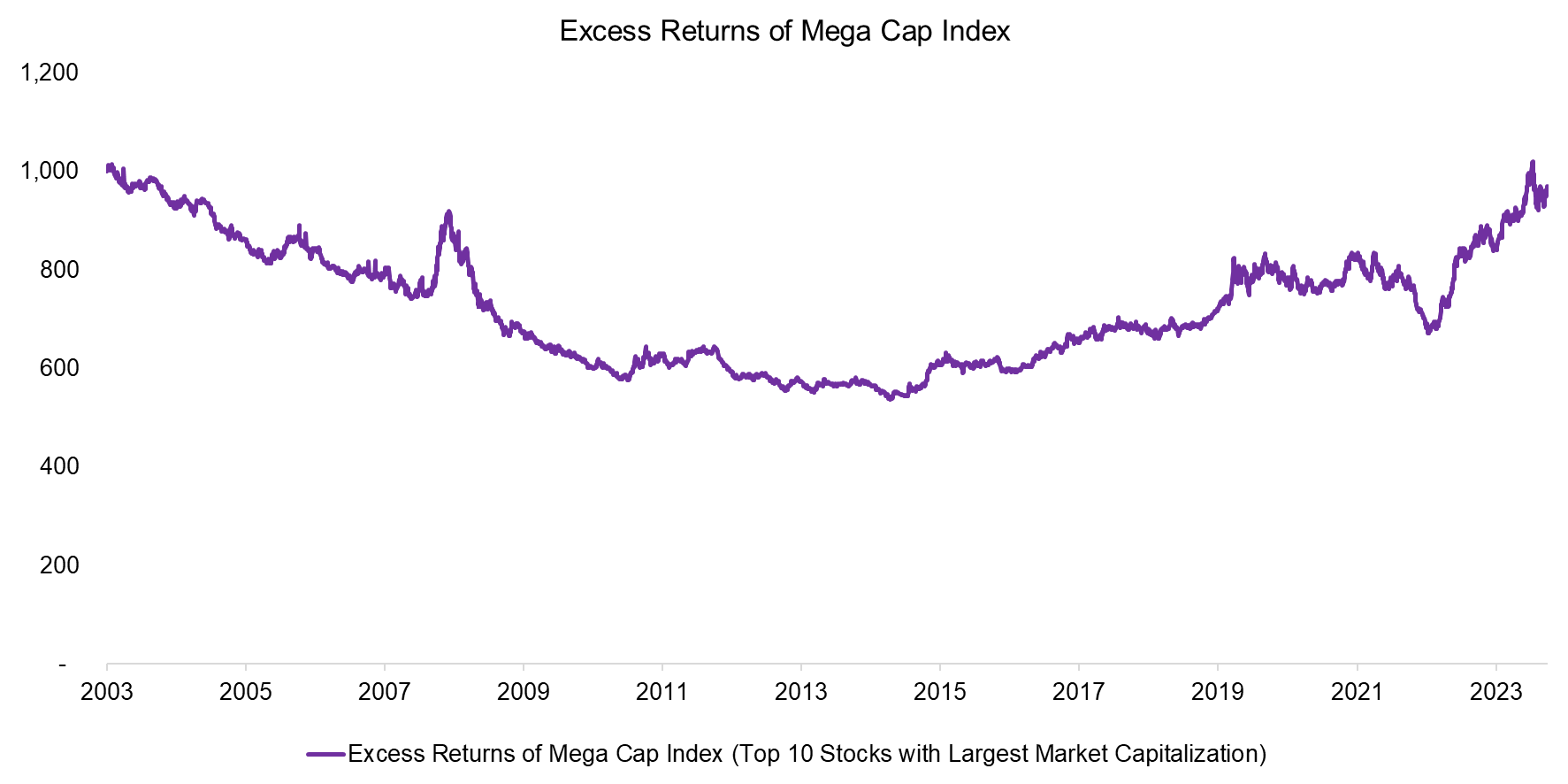

Perhaps the absolute change in market capitalization is less relevant than the market capitalization itself, so we create a second index called the Mega Cap Index that selects the top 10 stocks by market capitalization, again with monthly rebalancing, equal weights, and 10 basis points of transaction costs.

However, the excess return profile of the Mega Cap Index is approximately the same as that of the Juggernaut Index, i.e. negative returns from 2003 to 2015 and then positive returns thereafter.

FURTHER THOUGHTS

Some of the largest companies by market capitalization seem invincible today, e.g. how could Amazon be disrupted? However, the moats of Apple or Nvidia may be less strong than assumed. We do not even need to go back in history as far as Nokia, which dominated the mobile phone in the early 2000s and is of no relevance in that market today, but we can simply look at Intel, which only a few years ago was the pre-eminent chip maker and now has been eclipsed by Nvidia and Broadcom.

Modern capitalism is brutally competitive and the hunter often becomes the hunted. Given that it´s almost impossible to identify who will dethrone Apple or Nvidia, diversification is key to investment success.

RELATED RESEARCH

What´s Better than the S&P 500?

Outperformance via Leverage

Chasing Mutual Fund Performance

Thematic versus Momentum Investing

Cap-Weighted Benchmarks: Good Momentum Bets?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.