The VIX is low. So what?

Volatility is not predictive of future returns.

September 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Some investors increase hedging when the VIX is low

- However, future returns were not negative when volatility was low

- Investors should also not be concerned about high volatility

INTRODUCTION

Since U.S. President Trump launched his tariff war in April 2025, equity markets have rebounded, valuations have returned to record highs, and the VIX has declined. This combination is making some investors uneasy, as tariffs are generally expected to weigh on economic growth. Concerns are further compounded by a lack of fiscal discipline of the U.S. government and the resulting upward pressure on U.S. interest rates.

In response, demand for defensive strategies has surged. Defined outcome ETFs, which aim to limit drawdowns during market declines, are experiencing strong inflows. U.S. asset managers have even gone a step further, introducing structured ETF products that provide 100% capital protection – naturally at the cost of reduced participation in market upside.

While it may seem intuitive to hedge against downturns using the VIX as a guide, we show in this research article why it is not an effective risk management framework.

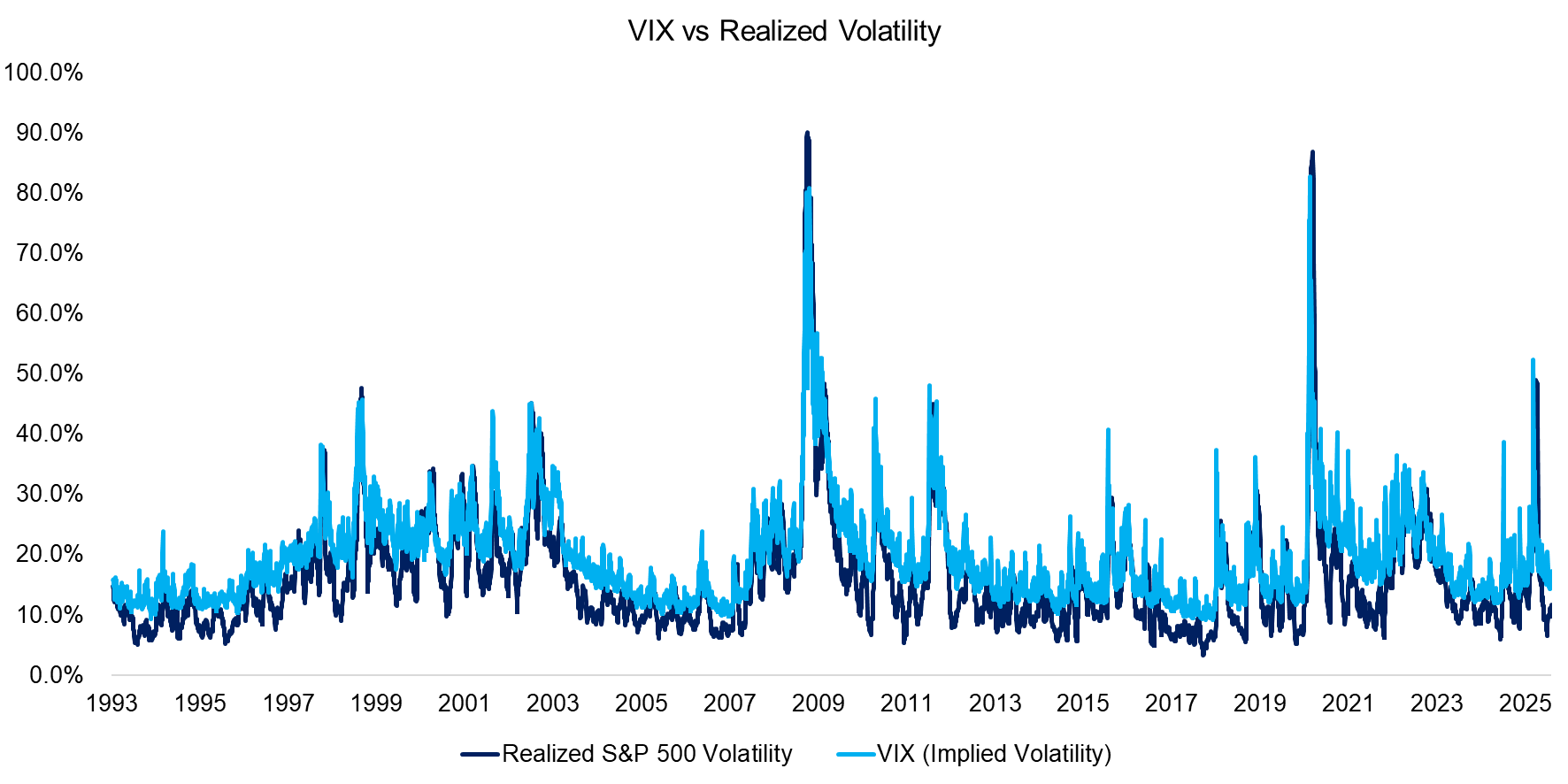

IMPLIED VS REALIZED VOLATILITY

The VIX measures the implied volatility of a basket of short-term S&P 500 options. It tends to spike during sudden market crashes, but not necessarily during slow-moving bear markets such as in 2022. On average, the VIX closely tracks the realized volatility of the S&P 500, though it generally sits at a modest premium. This so-called variance risk premium can be harvested, but in practice it largely represents a diluted form of equity risk (read The Variance Risk Premium: What Premium?).

Source: Finominal

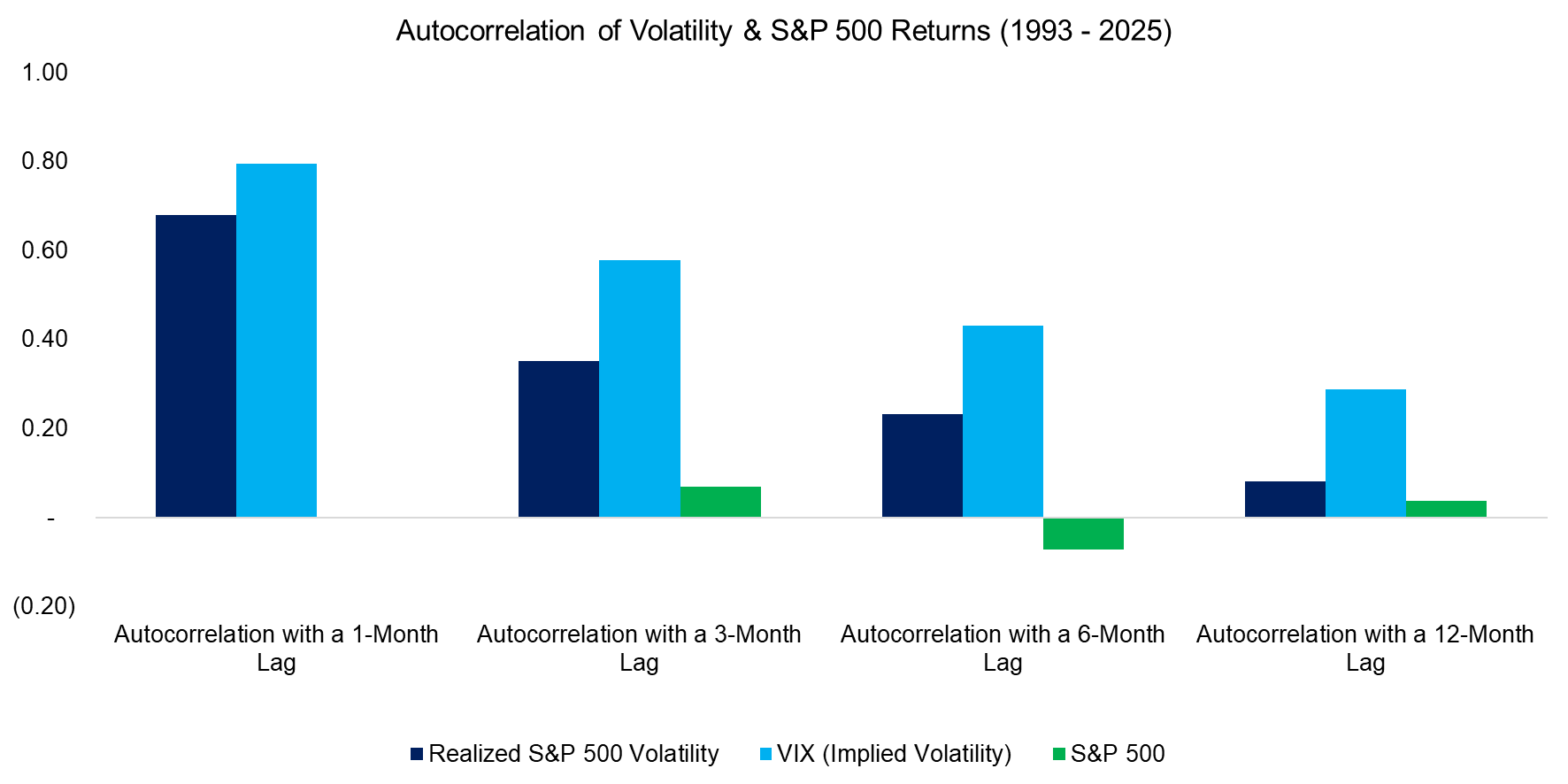

AUTOCORRELATION OF VOLATILITY

Unlike returns, volatility is known to cluster and exhibits some predictive characteristics. This can be illustrated by examining the autocorrelations of realized S&P 500 volatility, the VIX, and S&P 500 returns. The results show that volatility tends to remain moderately correlated for up to six months – meaning that when markets are volatile today, they are likely to stay volatile in the near future. By contrast, the autocorrelation of monthly S&P 500 returns is close to zero across all horizons.

Source: Finominal

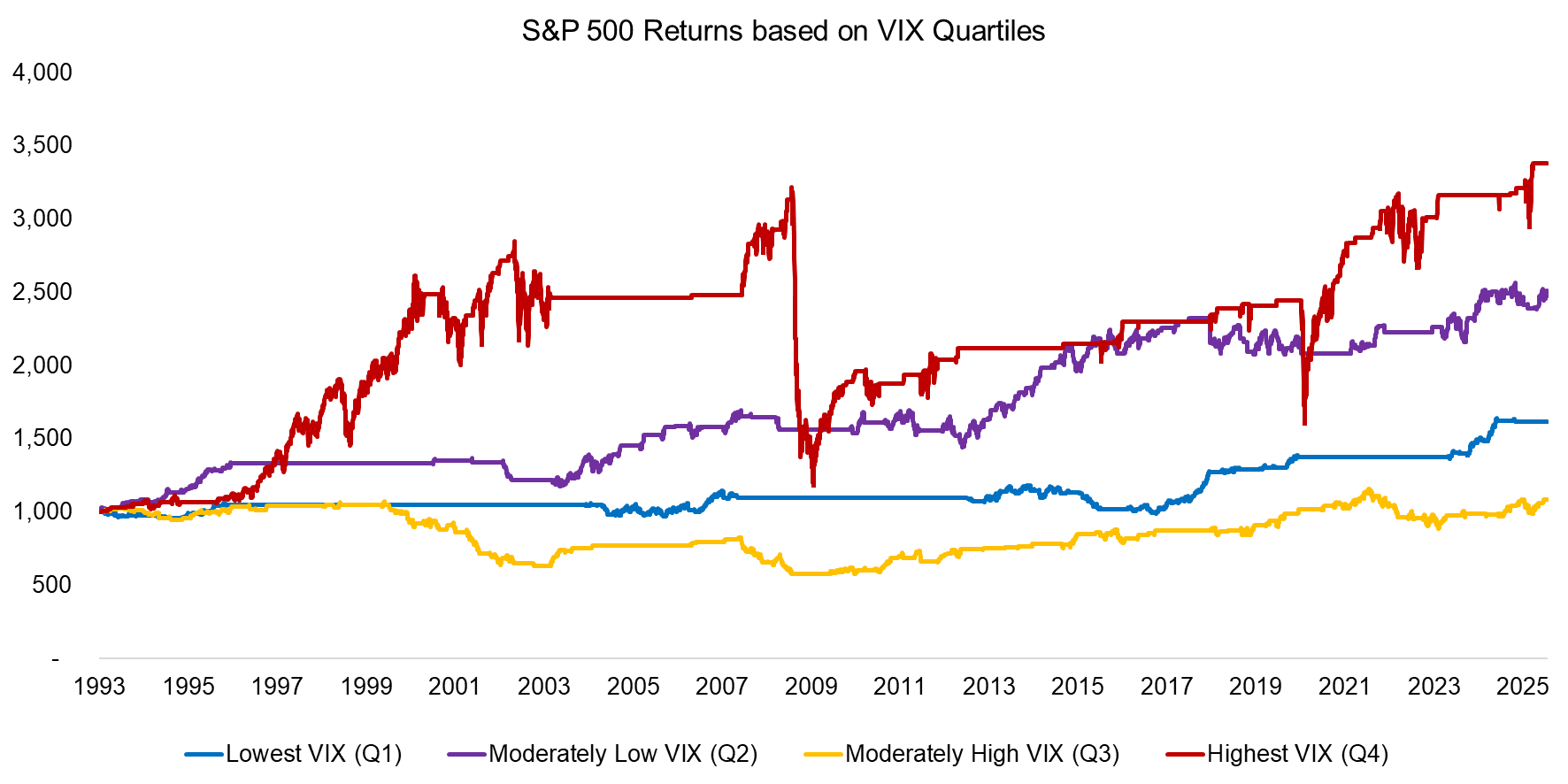

VOLATILITY & STOCK MARKET PERFORMANCE

Next, we examine the relationship between the VIX and stock market performance. Using rolling data since 1993, we sort the VIX into quartiles and analyze returns within each range. The results show that a large share of equity gains occurred during the most volatile periods. For instance, the VIX was exceptionally high during the tech bubble from 1997 to 2001, yet market returns were robust. Repeating the exercise with realized S&P 500 volatility instead of the VIX yields a similar perspective.

Source: Finominal

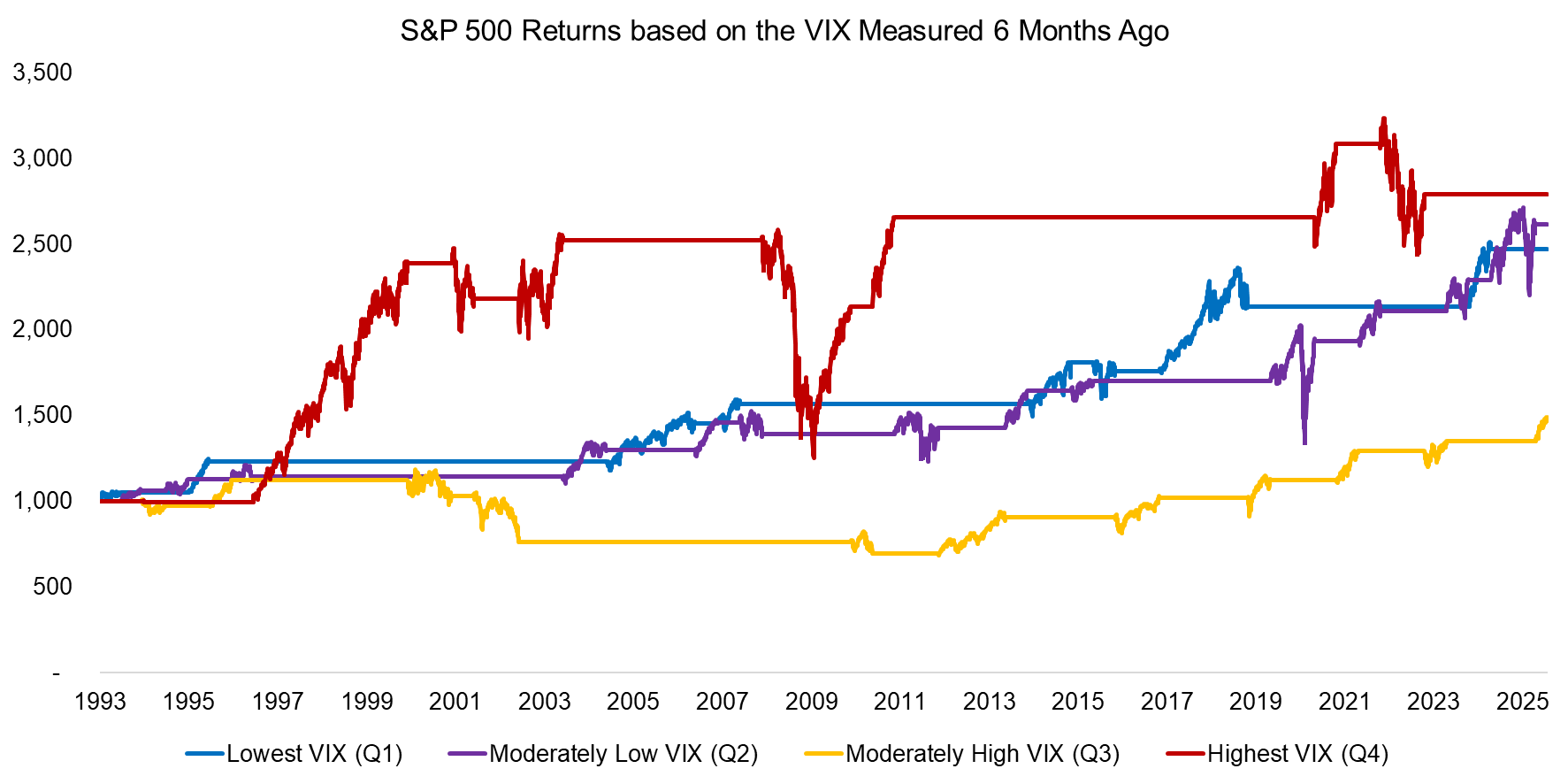

USING VOLATILITY TO FORECAST RETURNS

We also test whether current volatility has predictive power for future returns. To do this, we lag the VIX by six months and compare the results. The findings show an indifference from using contemporaneous volatility as an indicator: most equity gains occurred when volatility was highest six months earlier.

Source: Finominal

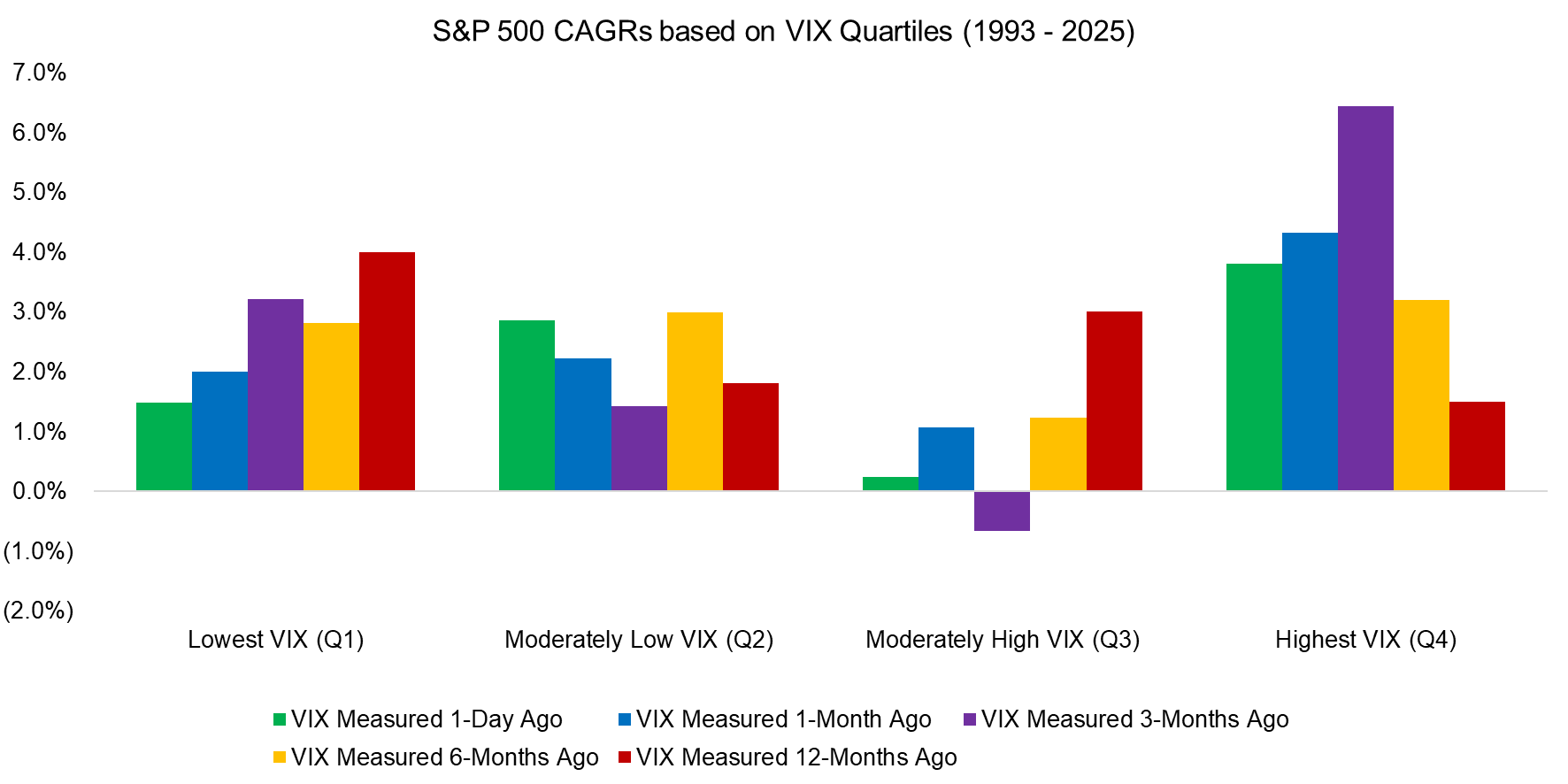

We extend the analysis by calculating the CAGR of returns across quartiles of the VIX, incorporating different lags – specifically, the VIX from 1, 3, 6, and 12 months prior.

The results show that the VIX has no predictive power for future returns, regardless of whether we look one month or twelve months ahead, and irrespective of whether volatility is high or low.

Source: Finominal

FURTHER THOUGHTS

With implied and realized volatility currently at low levels, should investors be worried?

Our analysis suggests not: historically, future returns have been positive even when volatility was in the lowest quartile. Encouragingly, the data also shows that staying invested during periods of high volatility can be rewarding, as the S&P 500 has generated much of its long-term returns in such environments. That said, just as with insurance, prudent risk management should remain in place at all times – regardless of market conditions.

RELATED RESEARCH

Volatility-based Equity Allocations

Volatility, Dispersion & Correlation – Friends or Foes?

Stock Market Returns and Volatility

Risk-Managed Equity Exposure II

Risk-Managed Equity Exposure

Market Timing vs Risk Management

Market Timing with Multiples, Momentum, and Volatility

Market Timing via the VRP?

The Variance Risk Premium: What Premium?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.