Thematic Indices: Looking at the Past or the Future?

Actually, both.

April 2022. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Thematic indices from MSCI have outperformed their benchmark since 2018

- However, they have a rather unattractive factor mix

- Going against decades of research is not a sound investment strategy

INTRODUCTION

Although much of the future is uncertain, some technological innovations are rather certain. At some point, we will all have self-driving cars, robots that help us with daily chores, can travel to space, and have artificial intelligence assist us in our jobs and lives.

It is more a question of when rather than if. However, timing is investors’ primary risk when making specific bets on technology and human evolution, compared to passive index investing. Elon Musk’s SpaceX has revolutionized the space industry and created an entire ecosystem of startups dedicated to this space (pun intended).

However, there was a similar boom in the 1970s, when NASA intended to build a 10,000 orbiting community. Unfortunately, none of these ambitions were realized and a cottage industry collapsed.

Today, investors can cost-efficiently take bets on technologies via thematic ETFs from boutique and well-known index providers. MSCI, one of the largest index providers, offers nine indices that provide exposure to themes like the ageing society and future mobility. In this research note, we will analyze these nine thematic indices (read Thematic Investing: Thematically Wrong?).

PERFORMANCE OF THEMATIC ETFS

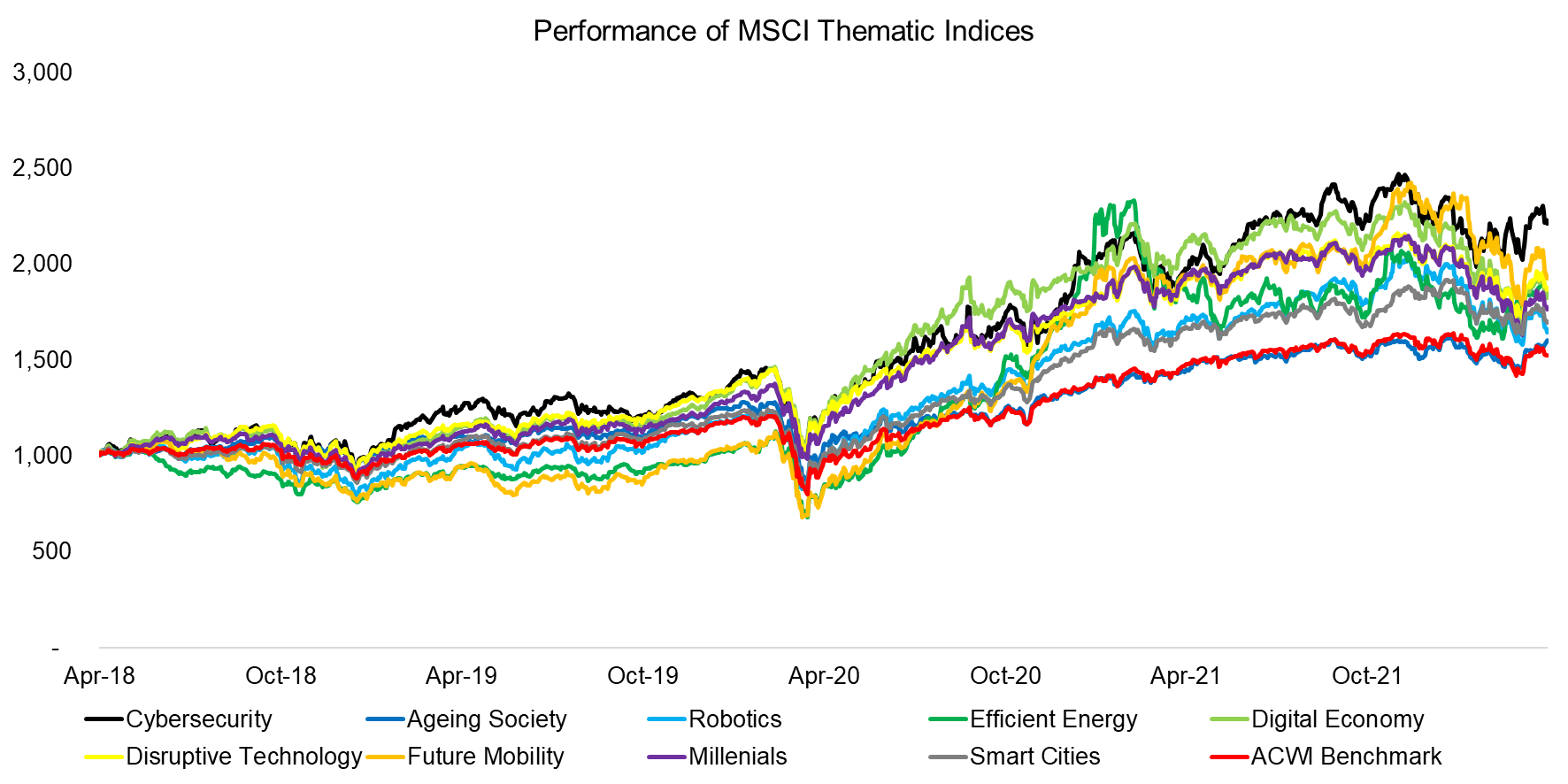

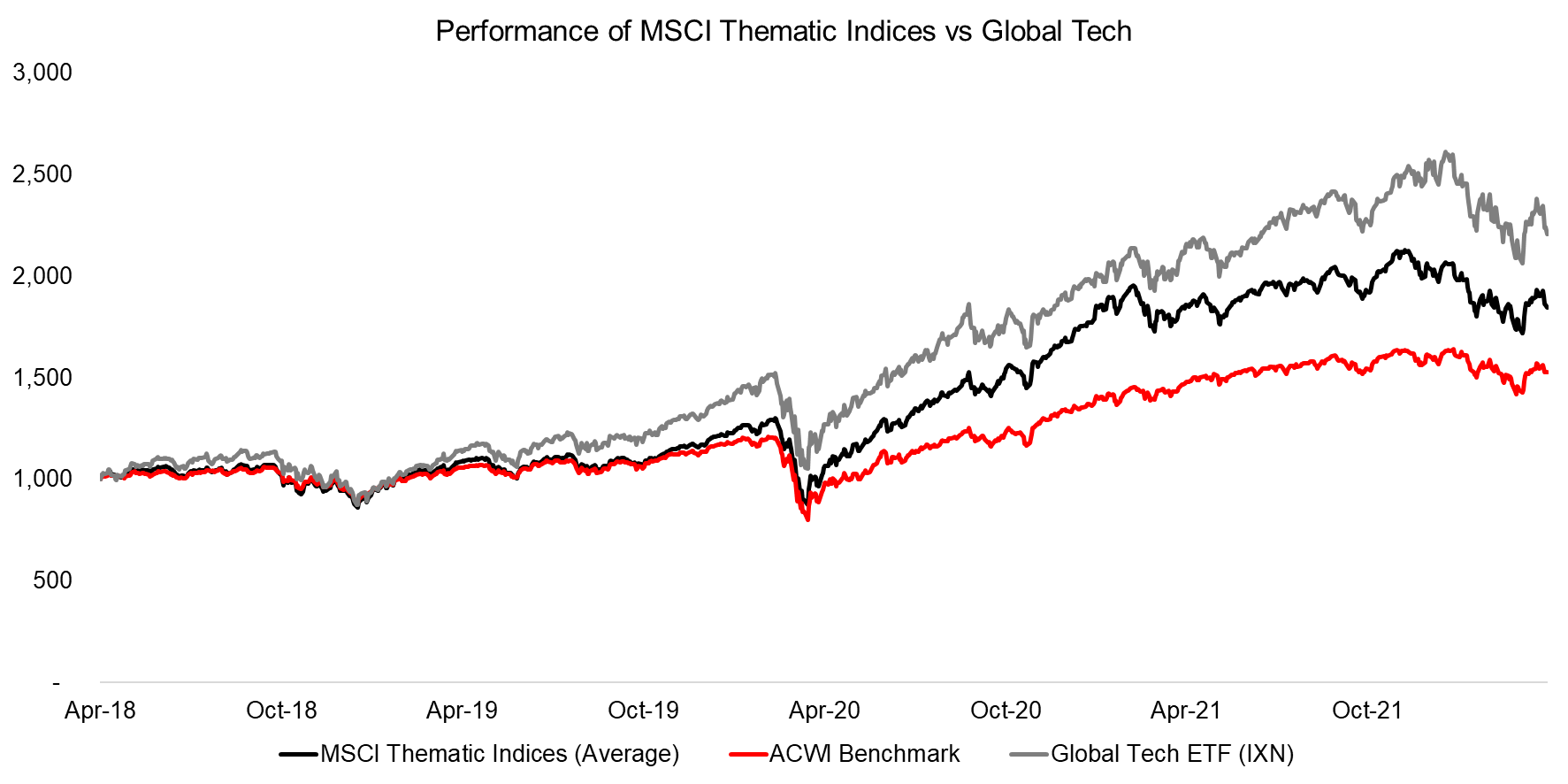

MSCI launched nine thematic indices in 2018, so these have approximately four years of track record. Stocks are selected from the ACWI universe, which is comprised of more than 90,000 stocks from developed and emerging markets. The stocks are chosen based on their market capitalization and their relevance score that measures the importance of a theme to the company’s business.

We observe that in the period from April 2018 to March 2022, eight of the thematic indices outperformed the benchmark ACWI index. The theme that has not aged well is the one dedicated to the ageing society (pun intended).

Source: MSCI, FactorResearch

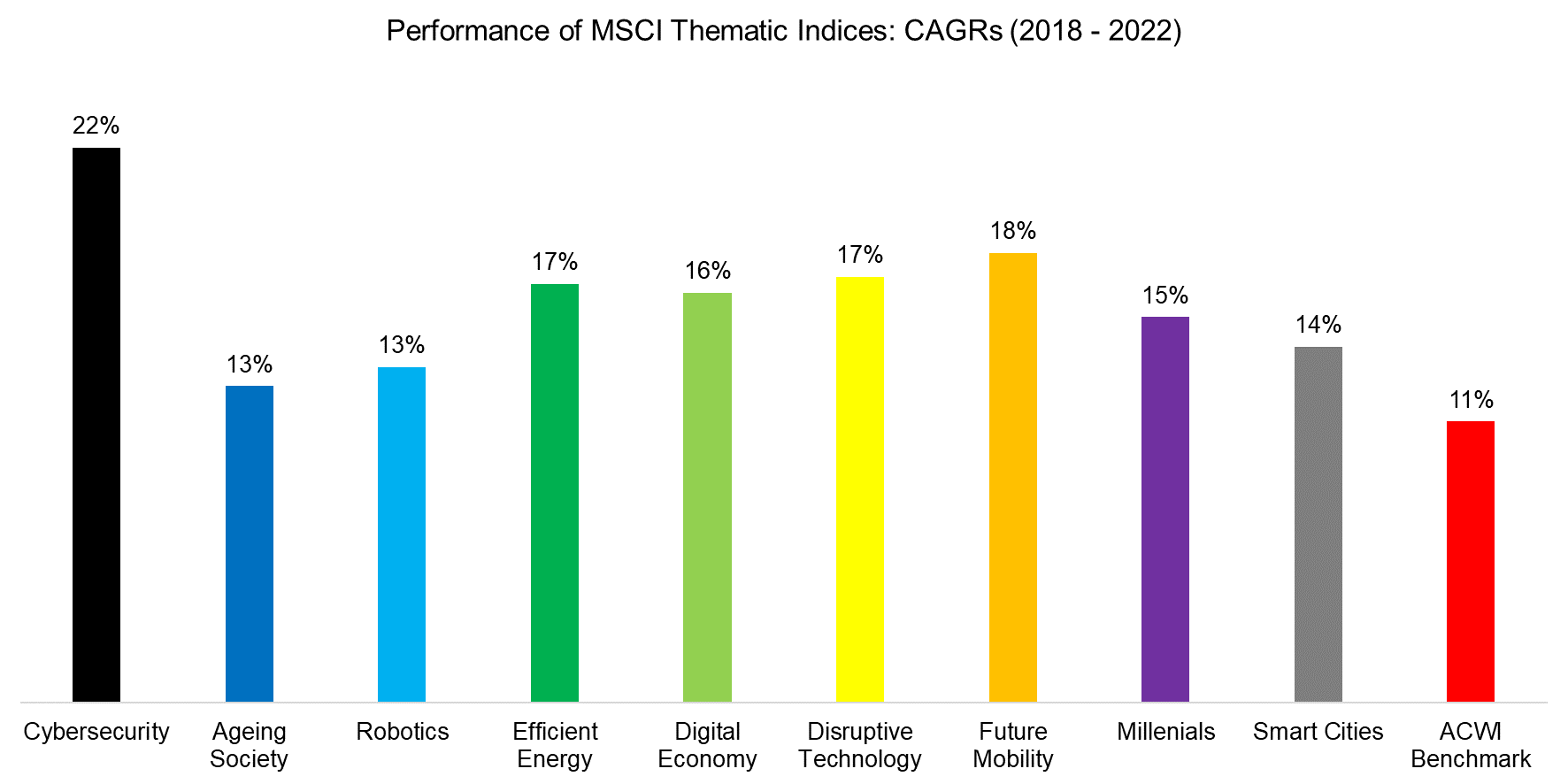

If we calculate the CAGRs for the four-year period, then the outperformance of these thematic indices becomes even clearer. Cybersecurity stocks have generated double the return of the ACWI benchmark index. Betting on these themes has been a great call from today’s perspective.

Source: MSCI, FactorResearch

FACTOR EXPOSURE ANALYSIS OF THEMATIC INDICES

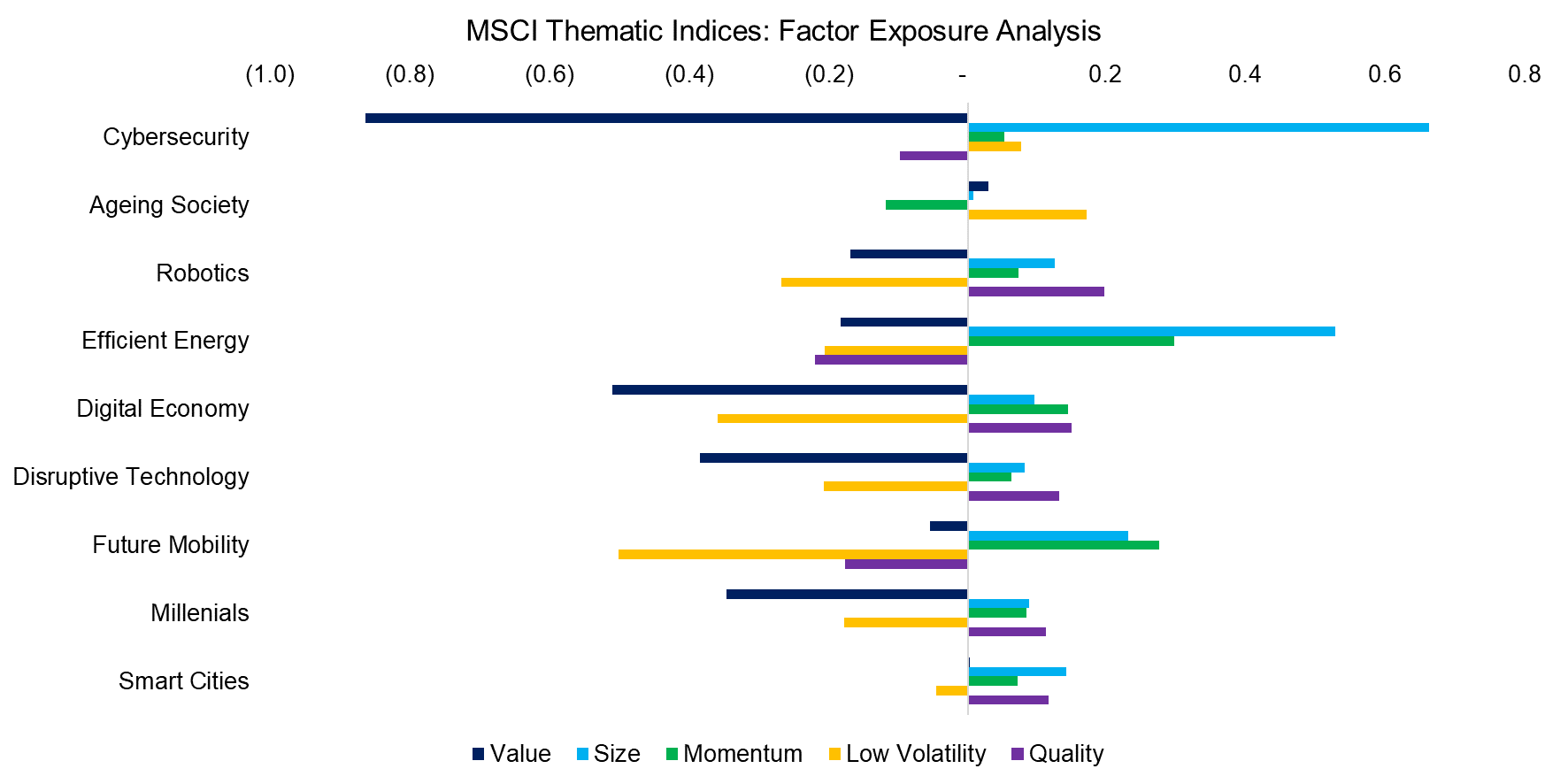

Given the impressive outperformance of the thematic indices, it is interesting to explore what has been driving this alpha generation. Running a factor exposure analysis using common equity factors highlights that most of these indices provided similar exposures. Namely, they had negative exposure to the value and low volatility factors, while offering positive exposure to the size and momentum factors.

Stated differently, these indices primarily consisted of expensive small-cap stocks that were highly volatile but also outperforming. The factor exposure explains most of the outperformance, so it is alternative beta rather than alpha.

Source: MSCI, FactorResearch

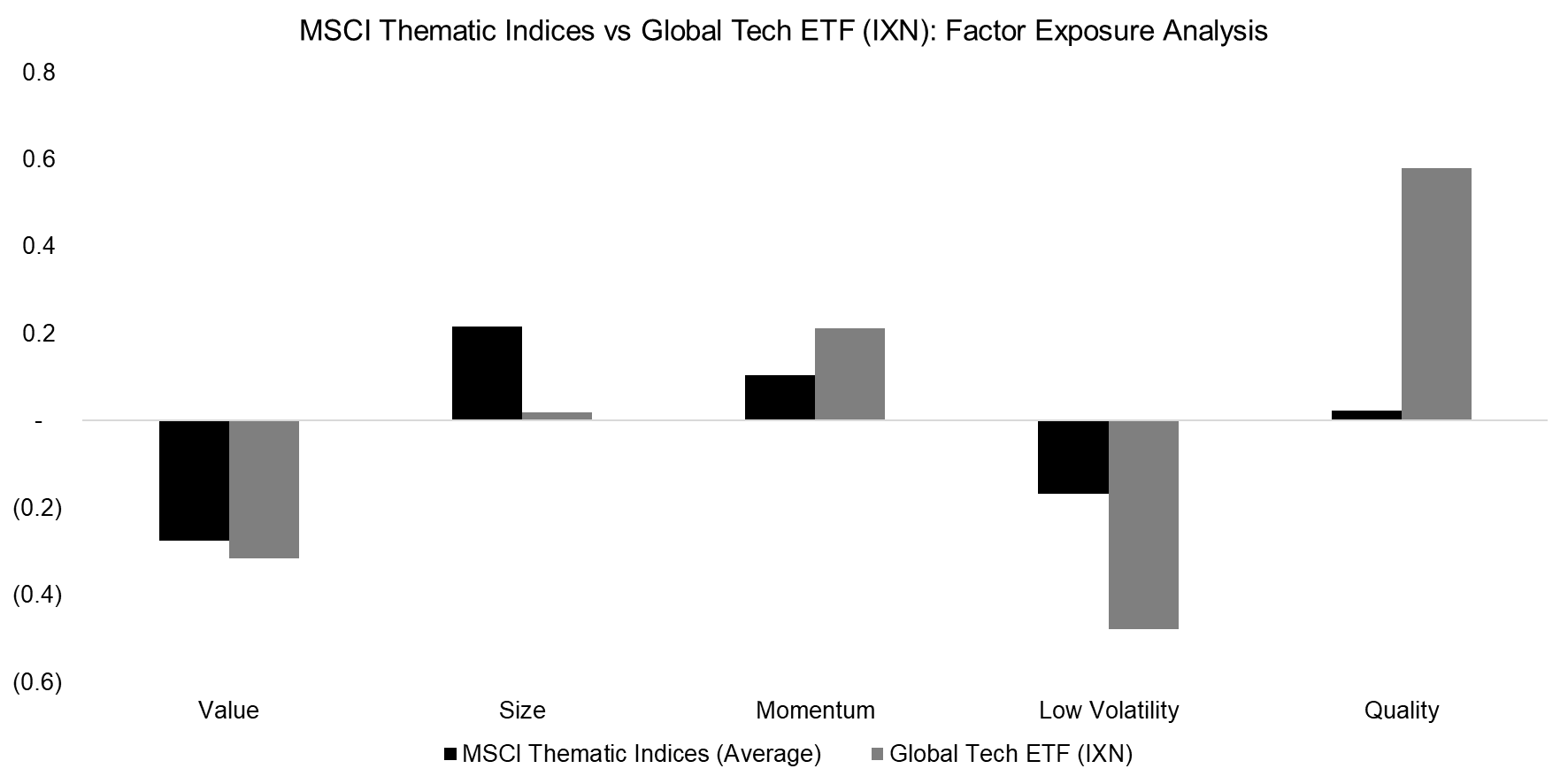

Due to the focus on themes like disruptive technologies and robotics, these indices have a large bias towards technology stocks. Given this, we compare the average factor exposure of the nine thematic indices to the exposure of a proxy for global technology stocks – the iShares Global Tech ETF (IXN), which has close to $5 billion of asset under management.

This analysis highlights that the factor exposure of the thematic indices is not particularly attractive for investors with a long-term horizon, which is exactly what is required for thematic investing given the uncertainty of when a theme will start working. The positive exposure of the thematic indices to the size and momentum factors is not large and does not compensate for the negative exposure to the value factor, which is strongly supported by academic research (read Mapping My Mind: Value Factor).

The global tech ETF does also not have a particularly attractive mix of factors, given negative exposure to value and low volatility, but at least it offers larger positive exposures to the momentum and quality factors.

Source: MSCI, FactorResearch

PERFORMANCE OF TREND FOLLOWING & MULTI-FACTOR INVESTING

The performance of the thematic indices is impressive when compared to their benchmark ACWI index. However, the global tech ETF outperformed both since 2018 and has a more favorable factor exposure. In addition, the average fee for a thematic ETF in the US is 0.63%, compared to 0.43% for IXN.

Source: FactorResearch

FURTHER THOUGHTS

An investor could challenge that the unattractive factor mix does not matter given that the thematic indices outperformed their benchmark, but in the medium to long-term it does.

These unfavorable multi-factor exposures are not limited to the thematic indices from MSCI, but David Blitz from Robeco found similar results when analyzing the ones from Dow Jones using the Fama-French factors.

The unfortunate nature of thematic investing is that investors have zero interest in themes unless accompanied by strong performance. Stated differently, thematic investing is performance chasing with a narrative. Naturally, this forces index providers to identify portfolios that generated outperformance historically, and hope these continue to do so, even if it means ignoring decades of research.

RELATED RESEARCH

Smart Money, Crowd Intelligence, and AI

AI, What Have You Done for Me Lately?

Tactical ETFs: Tactfully No, Thank You?

Myth-Busting: ETFs Are Eating the World

REFERENCED RESEARCH

Betting Against Quant: Examining the Factor Exposures of Thematic Indices, David Blitz, 2021

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.