There is Value in the Value Factor

Equity Factors & Fundamental Factor Valuations

September 2017. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Equity factors can be valued using fundamental metrics

- Value and Size are cheap while Low Volatility and Growth are expensive

- Likely more meaningful for medium- to long-term than short-term investors

INTRODUCTION

The term “Factor Investing” reached an all-time high this year according to Google Trends, which is mirrored by an abundance of smart beta and risk premia products being issued by fund management companies and investment banks. The natural question when considering a factor product is its outlook as factors, like equity markets, can have significant, multi-year drawdowns. The likelihood of successful factor timing, again like market timing in equity markets, is probably low. However, investors still somehow need to form an opinion if the current environment is supportive for the factor outlook. In this short research note we will analyse the valuations of factors using fundamental metrics and contrast current valuations to historical averages, which is one way of determining factor attractiveness.

METHODOLOGY

We will analyse six well-known factors – Value, Size, Low Volatility, Momentum, Quality, and Growth – and use definitions close to the academic standards like Fama-French. Readers can view the precise definitions in our public user guide on our website. Factor data is available for most developed countries, but we will focus on the US, Europe and Japan as these have the largest stock universes, which make the results more meaningful. The long and short portfolios are constructed by taking the top and bottom 10% of the stock universes.

HISTORICAL FUNDAMENTAL VALUATION TRENDS

In this analysis, we will use the difference in book value multiples between the long and short portfolios to determine how cheap or expensive a factor is. This approach is equivalent of valuing stocks based on their book value multiple or other fundamental metrics. With regards to factors, the more negative the spread, the cheaper the factor as it implies that the long portfolio is trading at a lower multiple than the short portfolio, e.g. a spread of -5.0x could be derived from the long portfolio being valued at 1.0x (cheap) versus the short portfolio at 6.0x (expensive).

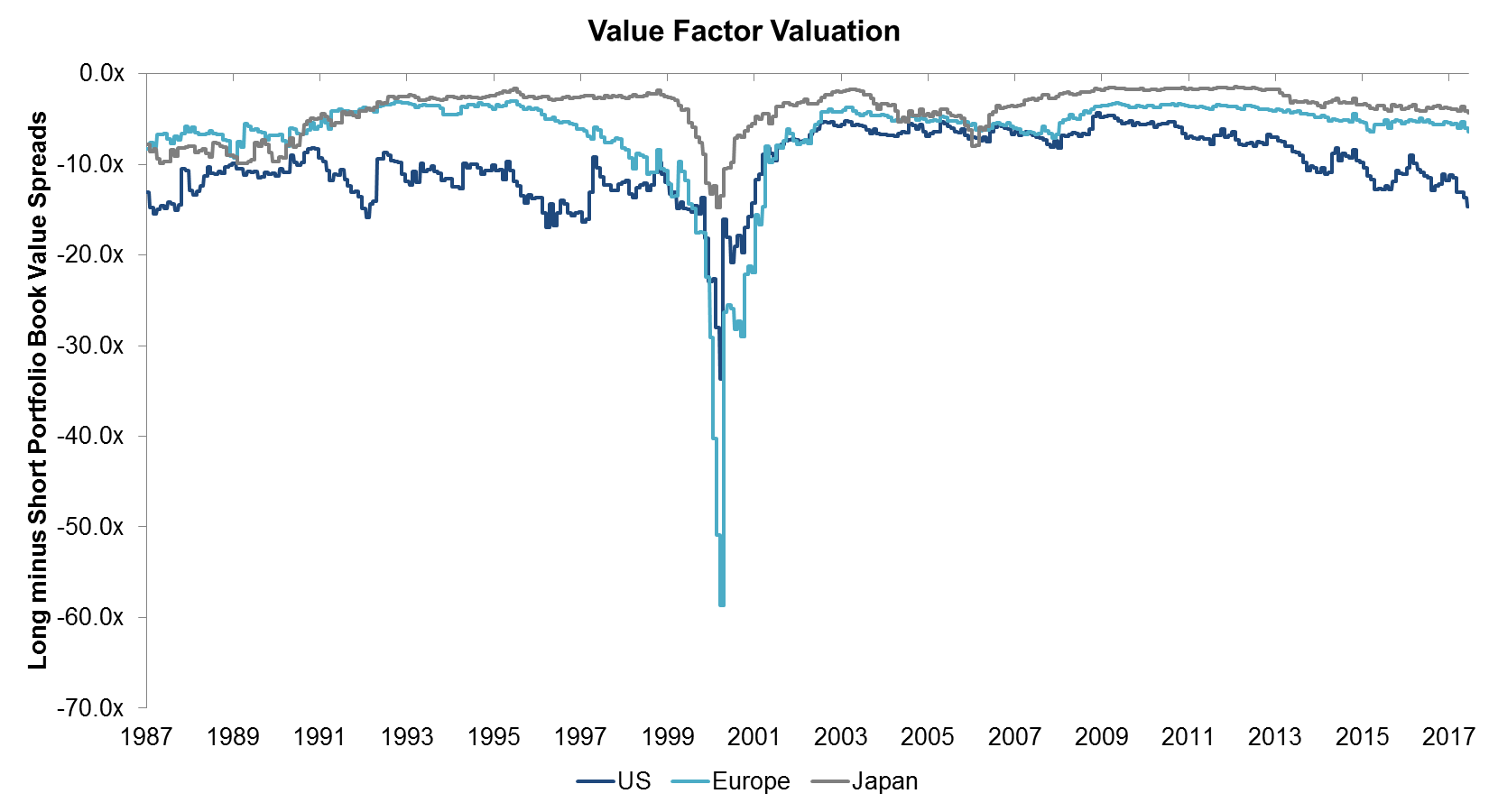

The chart below shows the book value spread for the Value factor for the period from 1986 to 2017 and is significantly influenced by the Tech bubble, where the Value factor experienced significant drawdowns as Tech stocks traded to levels that were far from fundamentals. In general, we can observe that the Value factor trades at a negative spread, which is intuitive given that the long portfolio is always cheaper than the short portfolio (read Value & Quality Factor Valuations).

Source: FactorResearch

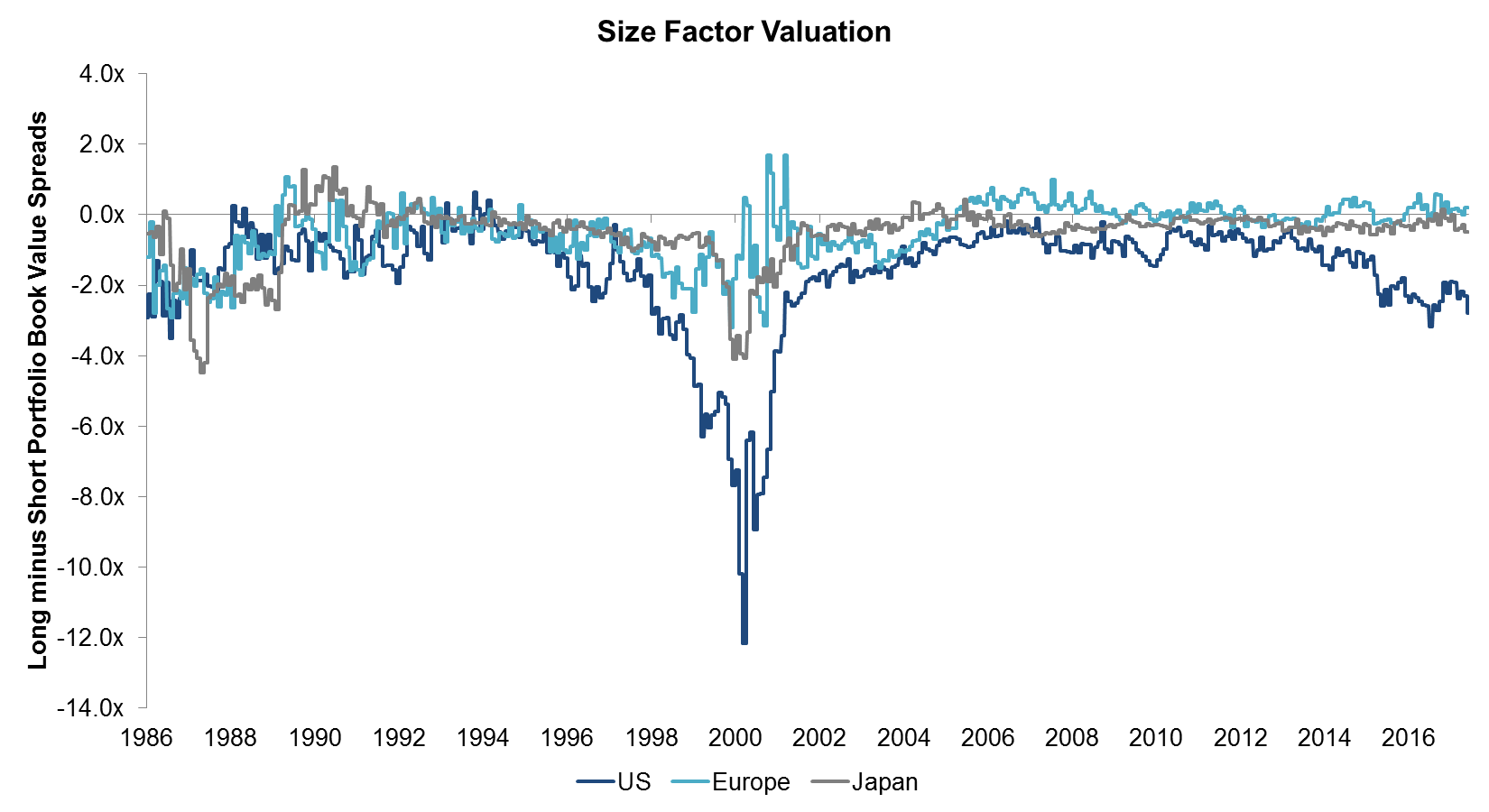

We can also observe the impact of the Tech bubble on the valuation spreads of the Size factor, which goes long companies with low market capitalizations and short companies with large market capitalizations. The average spread excluding the Tech bubble is close to zero, indicating that the long and short portfolios are valued similarly from a book value perspective.

Source: FactorResearch

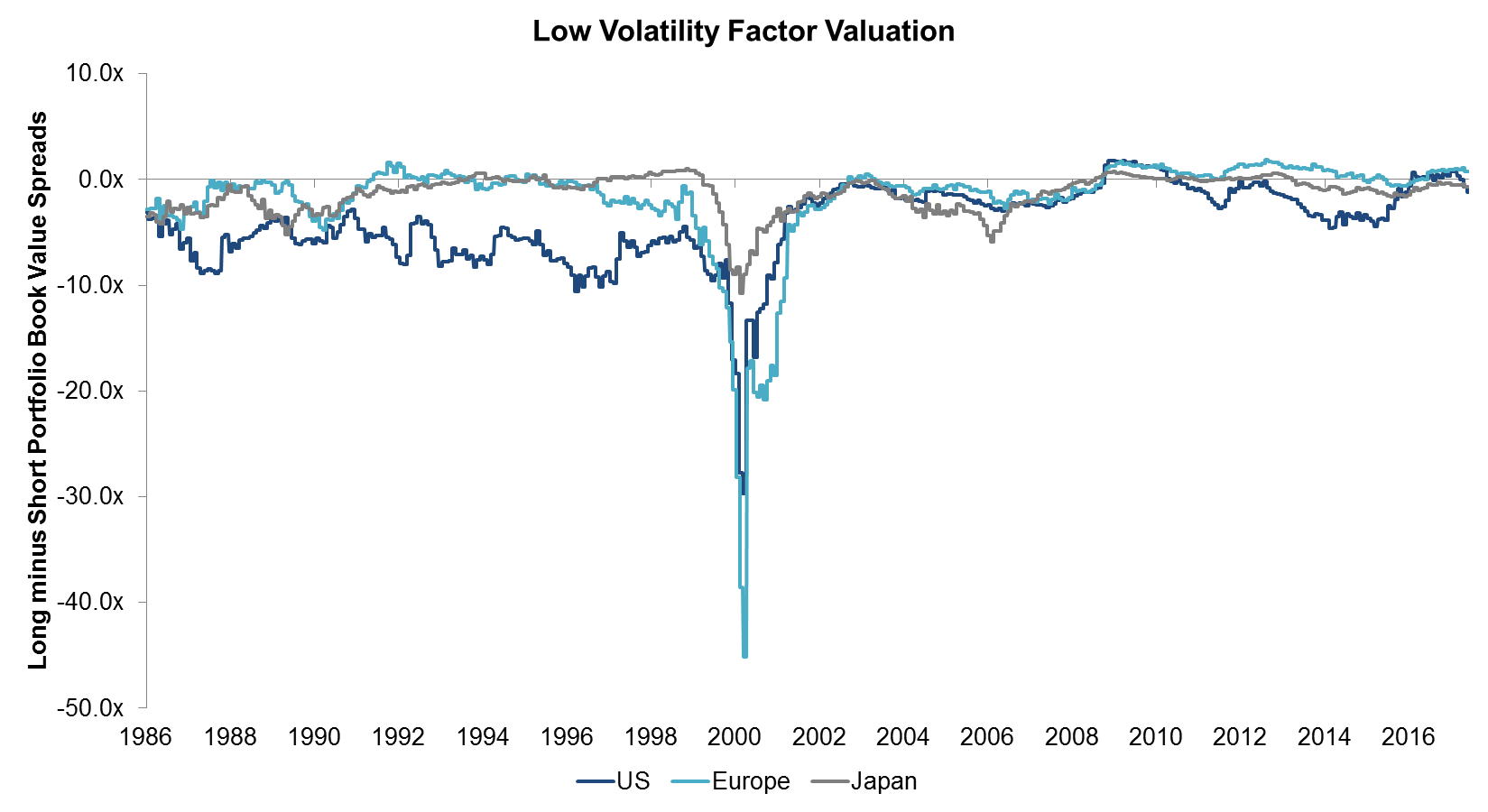

The Low Volatility factor has negative spreads on average, which can be explained by the long portfolio containing stocks with low volatility or beta, which are often unexciting and cheap stocks, while the short portfolio includes stocks with high volatility, which tend to be expensive, e.g. Tesla.

Source: FactorResearch

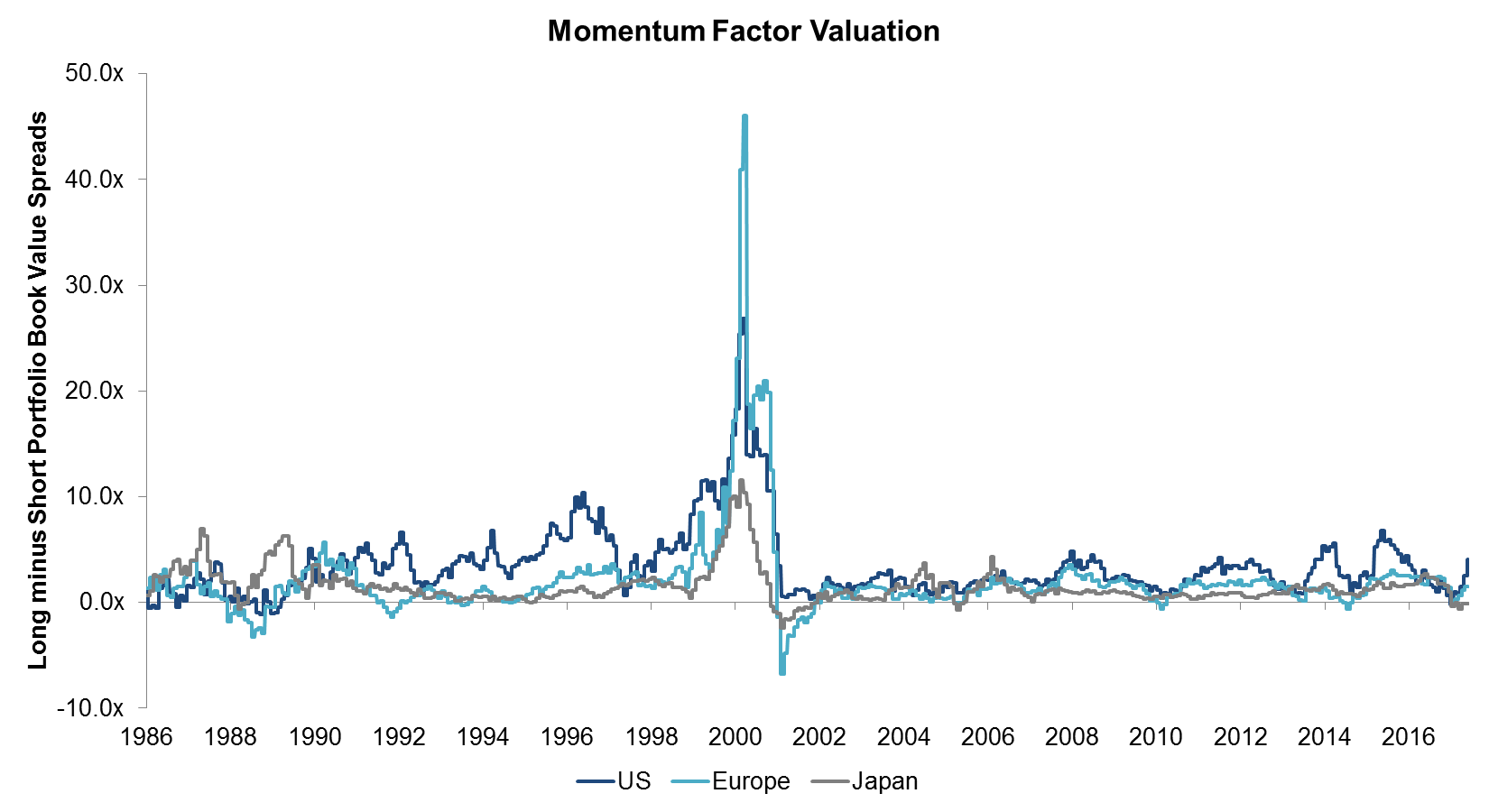

The Momentum factor shows a different picture as the valuation spread is positive on average, highlighting that stocks in the long portfolio are typically more expensive than stocks in the short portfolio. Given that the long portfolio contains winners and the short portfolio losers, this is to be expected.

Source: FactorResearch

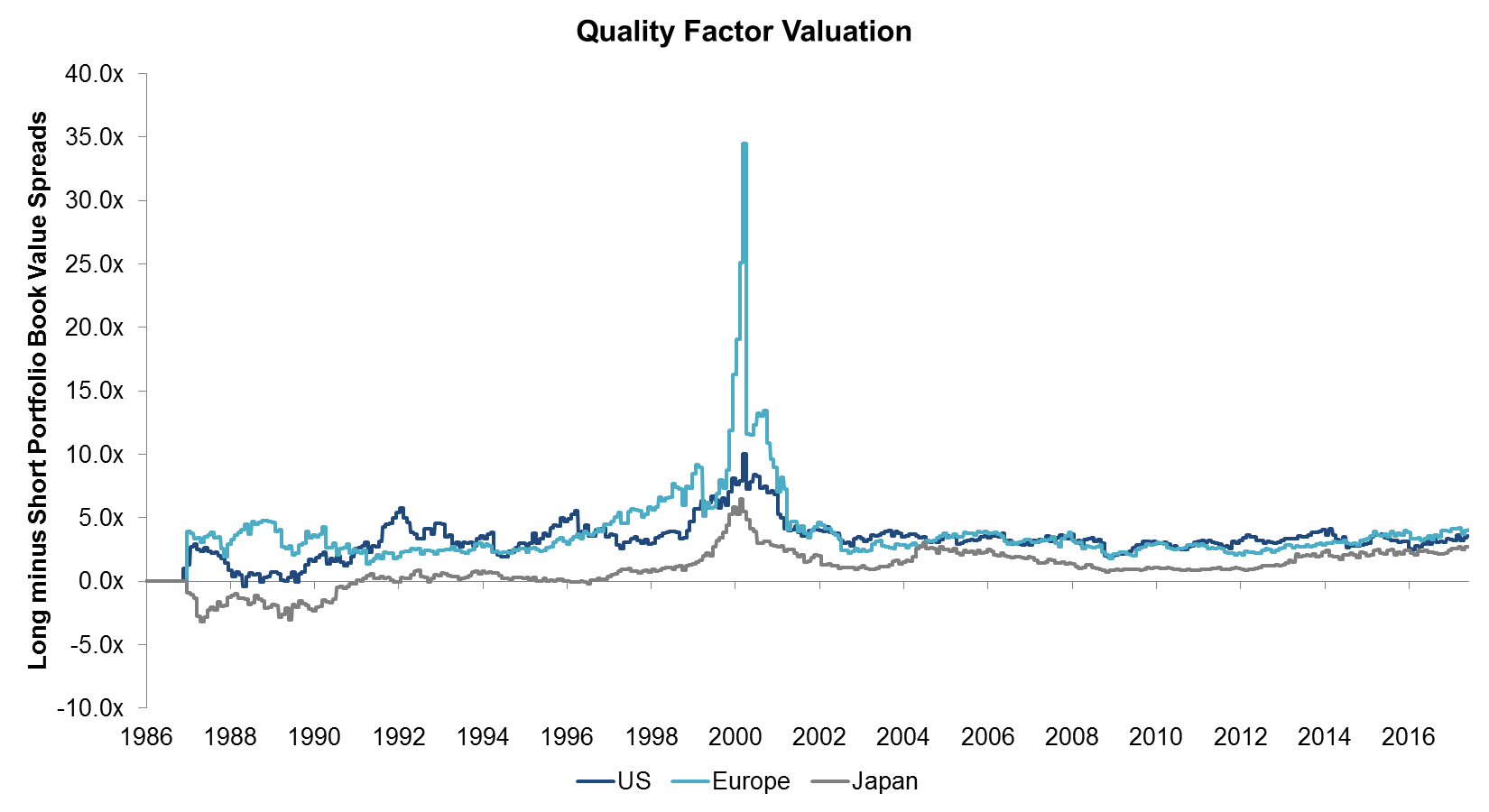

The Quality factor, which to a degree is the opposite of Value, reflects this in the valuation spreads that are positive on average as stocks with high quality characteristics tend to be more expensive from a fundamental perspective than stocks with low quality (read Quality Factor: How To Define It?).

Source: FactorResearch

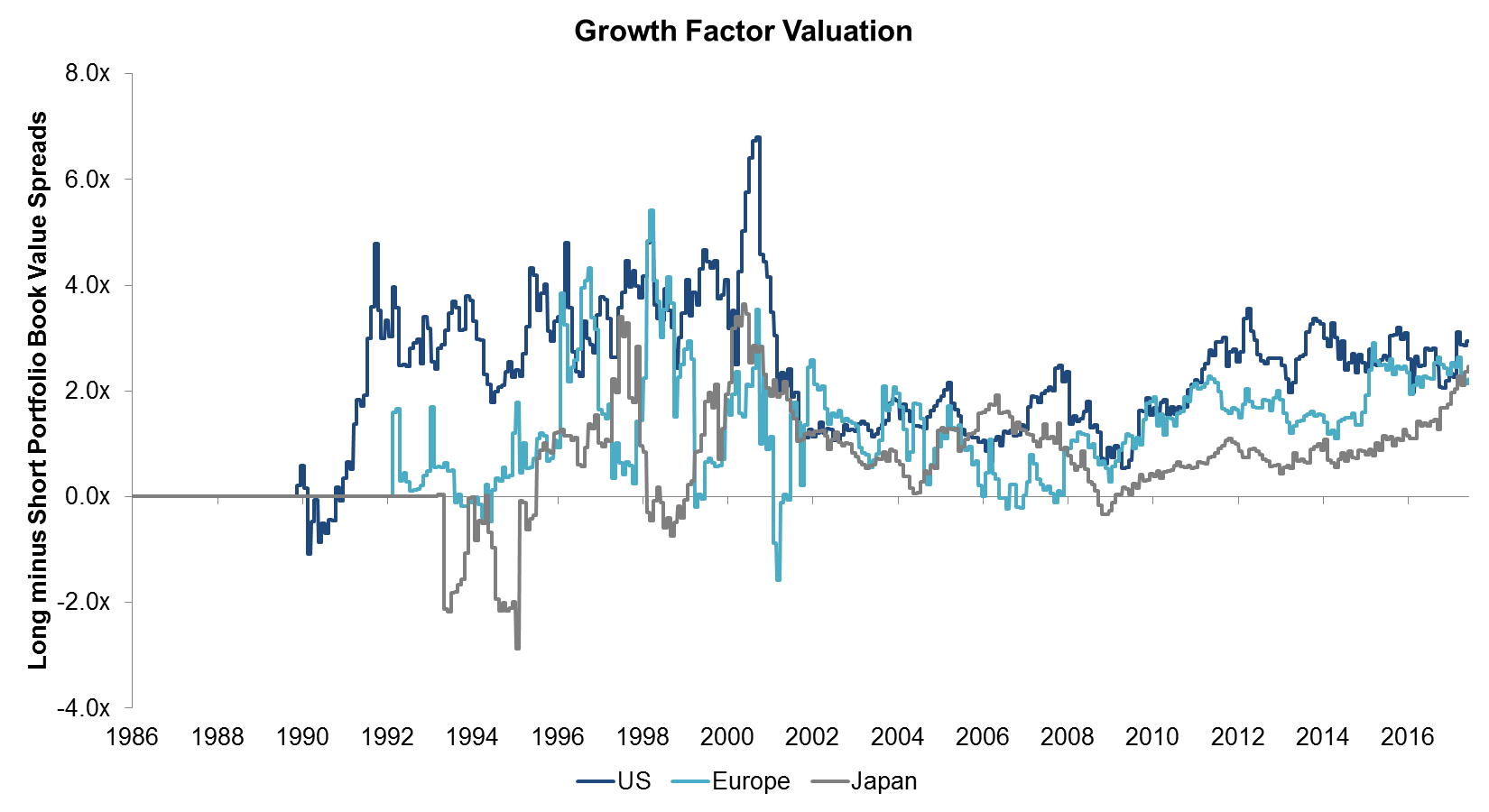

The last factor, Growth, shows positive spreads on average, which is intuitive given that companies with high growth tend to be expensive while companies with low or negative growth are usually cheap.

Source: FactorResearch

CURRENT VS HISTORICAL FACTOR VALUATION

Observing the valuation spreads over a 30-year period shows that there have not been any meaningful structural shifts in the valuation spreads over time, e.g. the current spread of the Value factor today is almost identical to the one in 1987. The spreads seem to indicate strong mean-reversion features, which might be taken advantage of in terms assessing the factor attractiveness. However, all the valuation spreads were influenced significantly by the Tech bubble, which distort the historical averages. Naturally it’s correct to include the Tech bubble in the calculation, like including the Global Financial Crises when looking at multiples or time series, but it should be done with caution as it’s unlikely to repeat itself too frequently.

The table below shows the current valuation spreads compared the historical averages, once since 1986 and once since 2002, excluding the Tech bubble. The factors with significant over- and undervaluation are shaded in green and red. The analysis highlights the following:

- Value: Cheap on average, especially in the US

- Size: Cheap on average

- Low Volatility: Expensive across regions

- Momentum: Expensive in the US, cheap in Japan

- Quality: Expensive in Japan

- Growth: Expensive across regions

Source: FactorResearch

FURTHER THOUGHTS

This short research note shows the current factors valuations using book value spreads compared to historical averages. Naturally this methodology can be criticized easily as there is little evidence that expensive valuations matter for short-term factor performance. Reflecting the valuations of stocks, valuation spreads can go to extremes. However, for an investor with a medium- to long-term horizon, where starting valuations do tend to impact expected returns, cheap factors should be preferable to expensive factors.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.