Top Fee Generating, Wealth Creating and Destroying ETFs

Documenting the wealth destruction of thematic investing

October 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Market exposure ETFs generated the largest fees and shareholder wealth

- Thematic products destroyed most wealth

- Investors should consider asset-weighted returns when evaluating funds

INTRODUCTION

iShares` MSCI Emerging Markets ETF (EEM) is unusual as it provides almost identical returns to iShares’ Core MSCI Emerging Markets ETF (IEMG), but charges 0.70% per annum compared to a mere 0.09% for IEMG. EEM was launched in 2003 and BlackRock did not want to reduce its fees when cheaper products came to the market, so simply created another version of it at a lower price point.

Although IEMG manages close to $80 billion, EEM still has $17 billion in assets under management, which is odd. Given the high fees and the long fund life, EEM holds the title of the highest fee-generating ETF trading in the U.S. stock market.

SPDR`s S&P 500 ETF Trust (SPY) generated almost the same amount of fees for State Street, and ranks first for the ETF that generated the most dollar gains for its investors. Its counterpart is ARK`s Innovation ETF (ARKK), which destroyed close to $8 billion in shareholder wealth.

In this research article, we will review the top 25 ETFs that generated the most fees for asset managers, as well as the biggest gains and losses for the funds´ shareholders.

TOP 25: HIGHEST FEE GENERATING ETFS

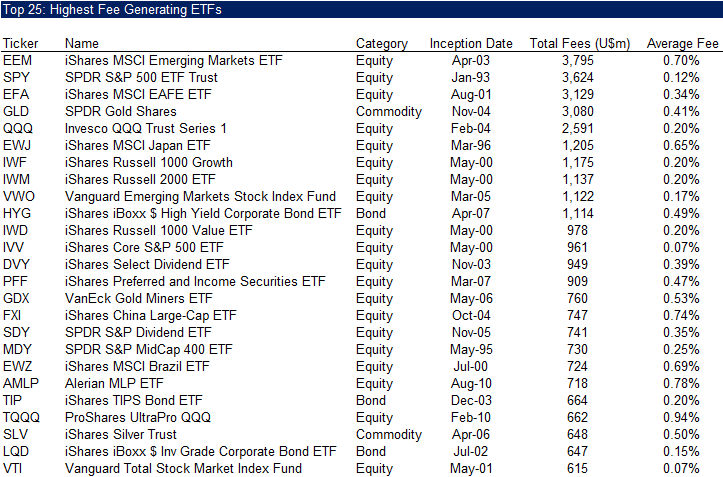

We focus on all ETFs trading in the U.S. stock market and compute the total fees generated for the ETF issuers based on the historical assets under management and fees. All of the top 25 ETFs are passive products that provide access to markets like U.S. equities or high yield bonds. Most of these were launched in the early innings of the ETF industry when fees were higher. iShares dominates with 15 products, followed by SPDR with four and Vanguard with two products.

Source: Finominal

TOP 25 ETFS: GENERATING THE LARGEST DOLLAR GAINS FOR INVESTORS

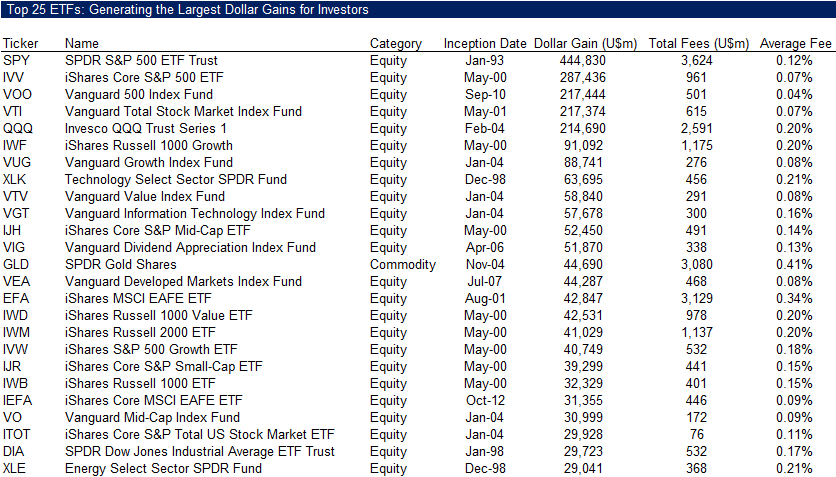

Next, we compute the 25 ETFs that produced the largest dollar gains for their shareholders, which is led by SPDR`s S&P 500 ETF Trust (SPY) which produced $444 billion of gains. The list is mainly comprised of passive products providing market exposures. In contrast to the list of highest fee-generating ETFs, Vanguard claims eight positions.

Source: Finominal

TOP 25 ETFS: GENERATING THE LARGEST DOLLAR LOSSES FOR INVESTORS

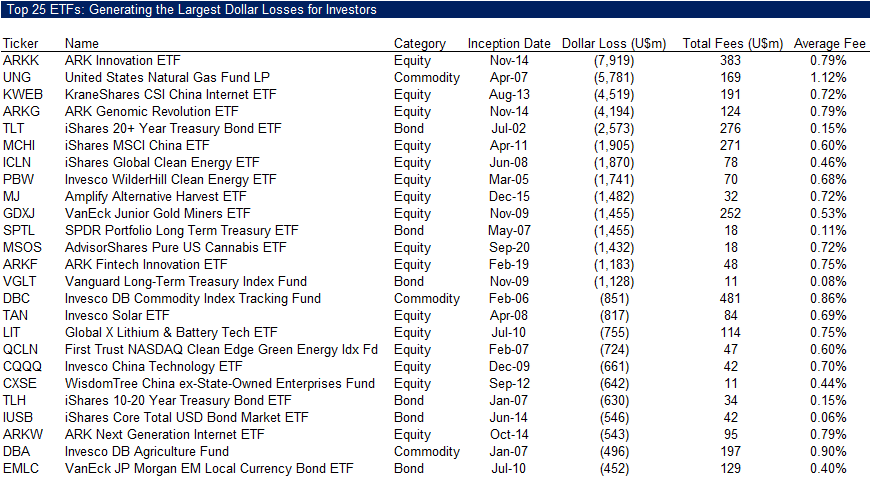

Reviewing the list of the top 25 ETFs that destroyed most shareholder wealth shows ARK`s Innovation ETF (ARKK) on top with an $8 billion loss. ARK Investment Management LP has managed to have an additional three funds on the same list, which is an abysmal accomplishment.

Although this list also includes some ETFs that provide market exposure, e.g. to bonds, more than half are thematic products, which highlights the danger of chasing the best-performing funds.

Source: Finominal

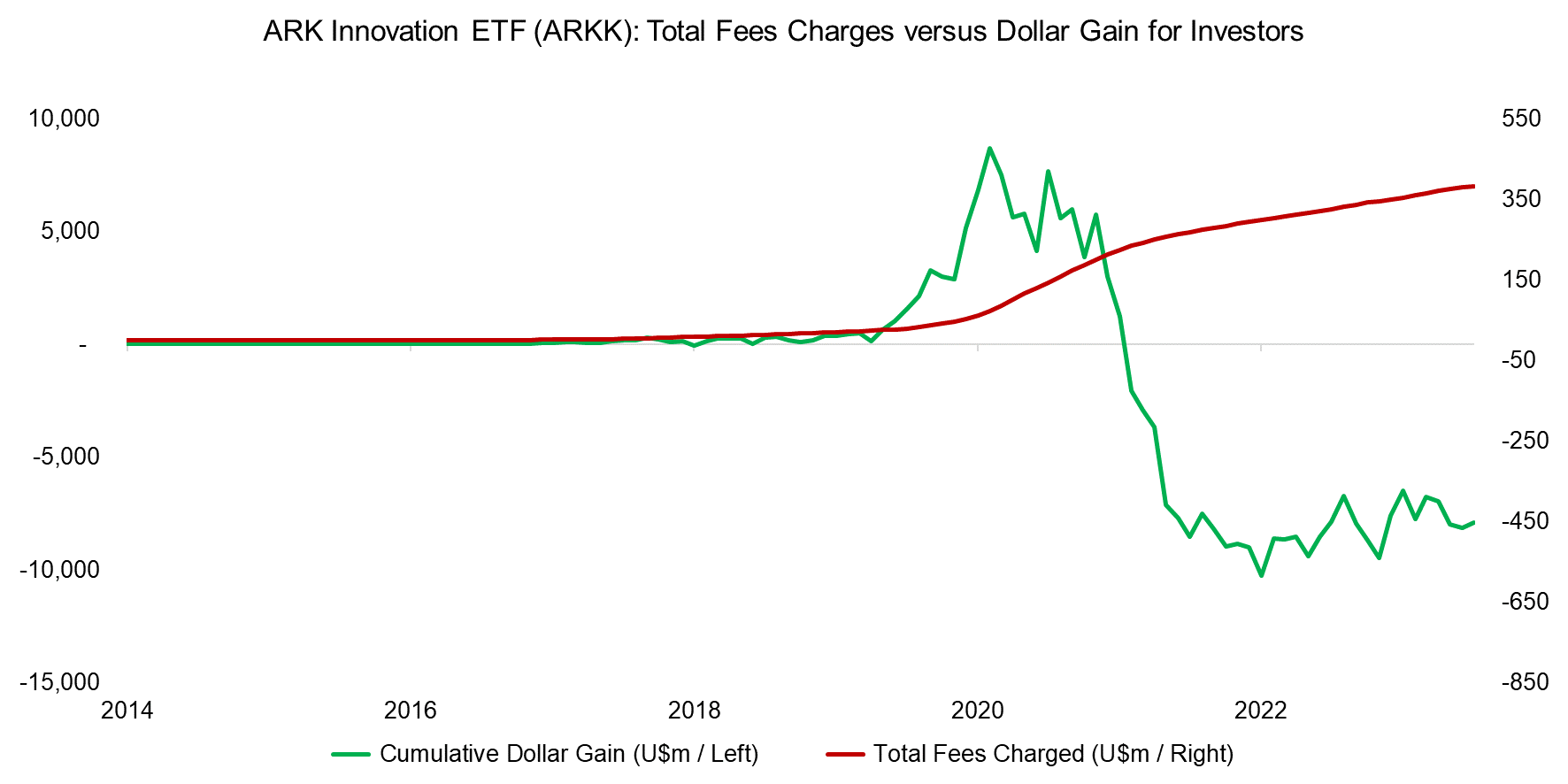

Most investors succumb to performance chasing, and thematic investing is the most dangerous kind as it represents performance chasing with a narrative. Unfortunately, this leads to the majority of investors investing in a theme or specific product at its peak, but then staying invested for too long while hoping for a recovery (read An Anatomy of Thematic Investing and Thematic Indices: Looking at the Past or the Future?).

In the case of ARKK, this meant experiencing an 81% drawdown between 2021 and 2022, from which the fund has not recovered yet. Given that most investors allocated to ARKK at its peak, the management fees continued to rise despite the poor performance.

Source: Finominal

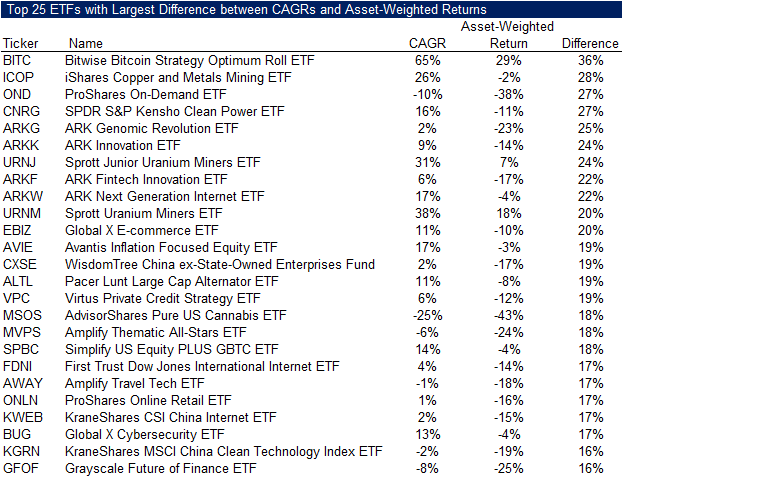

TOP 25 ETFS WITH LARGEST DIFFERENCE BETWEEN CAGRS AND ASSET-WEIGHTED RETURNS

Despite ARKK destroying $8 billion of shareholder wealth, the ETF still produced a positive CAGR since its launch in 2014. However, this is only relevant for the few investors that allocated to ARKK in the early years and not the majority of investors that allocated when performance was at its peak.

Many funds generate impressive performance when small, but then fail to replicate the performance once their assets have grown. This can be explained by smaller funds being able to trade less liquid stocks, and asset managers being more focused on management fees rather than performance as they mature. Given this, it is useful for investors to consider asset-weighted returns when conducting fund diligence.

We calculate the top 25 ETFs that exhibited the biggest difference between these two types of return, which is entirely dominated by thematic products like genomic, cannabis, and uranium mining stocks.

Source: Finominal

FURTHER THOUGHTS

Although we highlight in this analysis that some asset managers like iShares and Vanguard have built great ETF businesses, the ongoing fee war has made the industry less attractive for new entrants. Launching thematic ETFs seems like a good strategy given higher fees, and it only requires launching a few themes to randomly end up with one winner that can then be easily marketed to investors.

Unfortunately, we would expect most investors to continue to fall for thematic investing as we humans are suckers for good stories. Each new generation of investors seems to need to repeat the same mistakes, despite having all the information on the pitfalls of investing easily accessible. As they say, you can bring a horse to the water, but you can’t make it drink.

RELATED RESEARCH

Chasing Mutual Fund Performance

An Anatomy of Thematic Investing

Thematic Indices: Looking at the Past or the Future?

Thematic Investing: Thematically Wrong?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.