Trend Following in Bear Markets

Does it work?

- Short-only trend following in stocks generated consistent losses across markets

- However, combining the strategy with an equities portfolio generated diversification benefits

- Like other hedging strategies it would be difficult to execute this strategy over the long-term

INTRODUCTION

Trend following is likely the most researched investment strategy. The folks at AQR have backtested the framework across various asset classes for more than a century starting in 1880, while researchers at Capital Fund Management managed to go back even further to 1800.

Although no asset management firm has a track record spanning such a long period, Campbell & Company’s first trend following product was launched in 1972 and has therefore reached an impressive half a century of realized returns. The origin of the trend following industry is found in commodities, where the aim was to systematically exploit the various bull and bear markets across the diverse set of instruments, which explains why such fund managers are also called commodity trading advisors (CTAs) (read Replicating a CTA via Factor Exposures and Creating a CTA from Scratch – II).

Their third name, aka managed futures, can be attributed to portfolios being constructed via future contracts. As other asset classes like fixed income became tradable via futures, some trend following expanded their universes while others stuck to commodities.

However, whether to include equities within a trend following product is likely the most challenging question. First, all investors have substantial exposure to the stock market, and increasing this further via managed futures does not generate any diversification benefits. Second, equities are different from other asset classes as stock markets tend to have long bull and short bear markets, which might make it difficult to exploit trends systematically.

We previously explored trend following in equities (read Trend Following in Equities) and found that a long-only approach performed better than long-short trend following. In this article, we will investigate short-only trend following in equities.

SHORT-ONLY TREND FOLLOWING IN U.S. EQUITIES

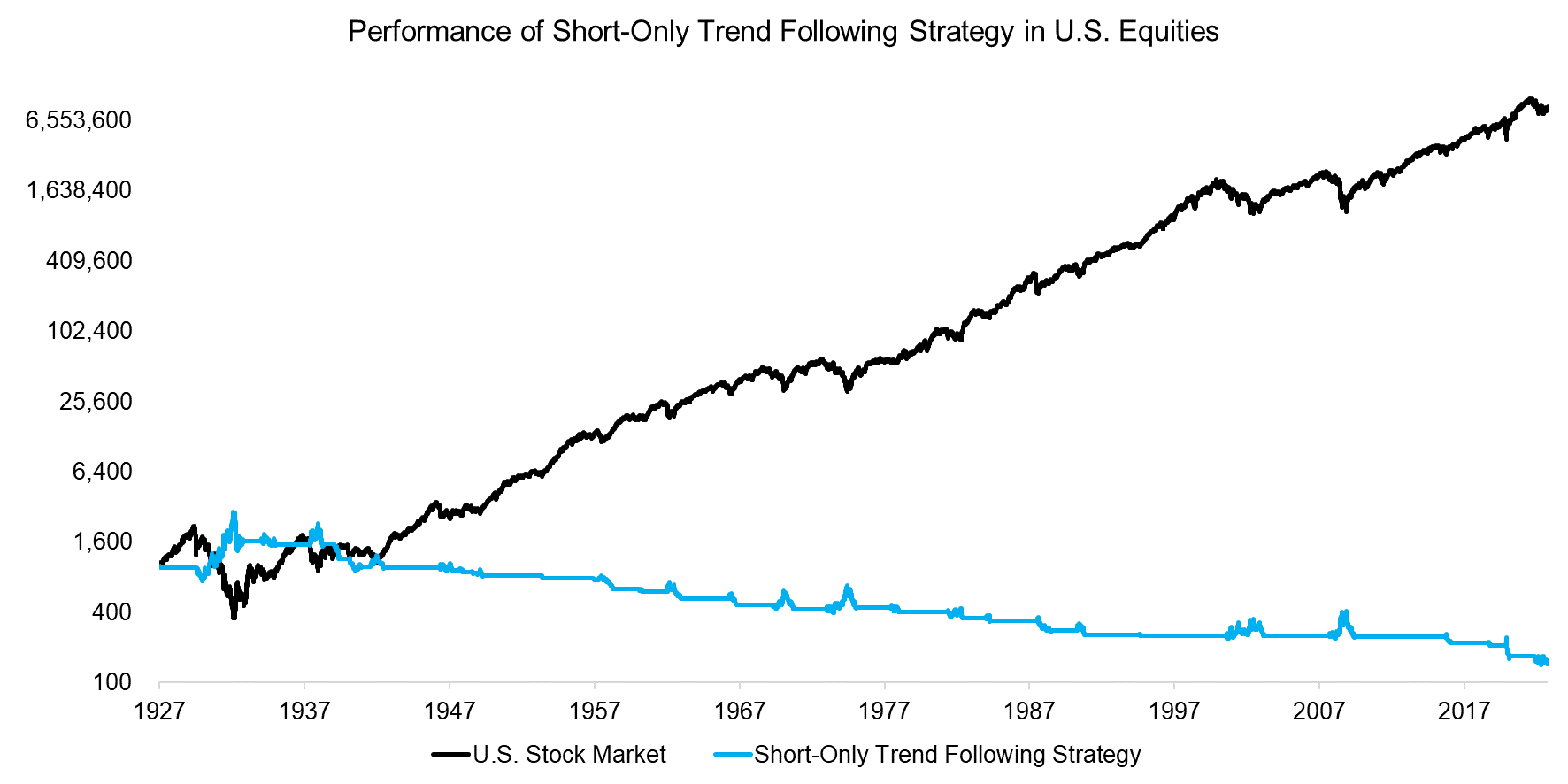

We create a simple trend following model based on the 12-month performance of the U.S. stock market. If the performance is negative, then short the stock market, otherwise hold zero-interest cash. We measure the performance with a day of delay to simulate a realistic implementation and rebalance monthly, but exclude transaction costs. However, these would have had a negligible impact on returns as there were only two transactions per annum on average.

We observe that short-only trend following was a consistently losing strategy in the U.S. equities in the period from 1927 to 2022. The biggest gain was during the Great Depression in the 1930s, while the global financial crisis in 2009 and the COVID-19 crisis in 2020 seem to have been less meaningful. Perhaps this is explained by the bear market during the Great Depression being the most severe with stocks declining steadily for three years between 1929 and 1932.

Source: Finominal

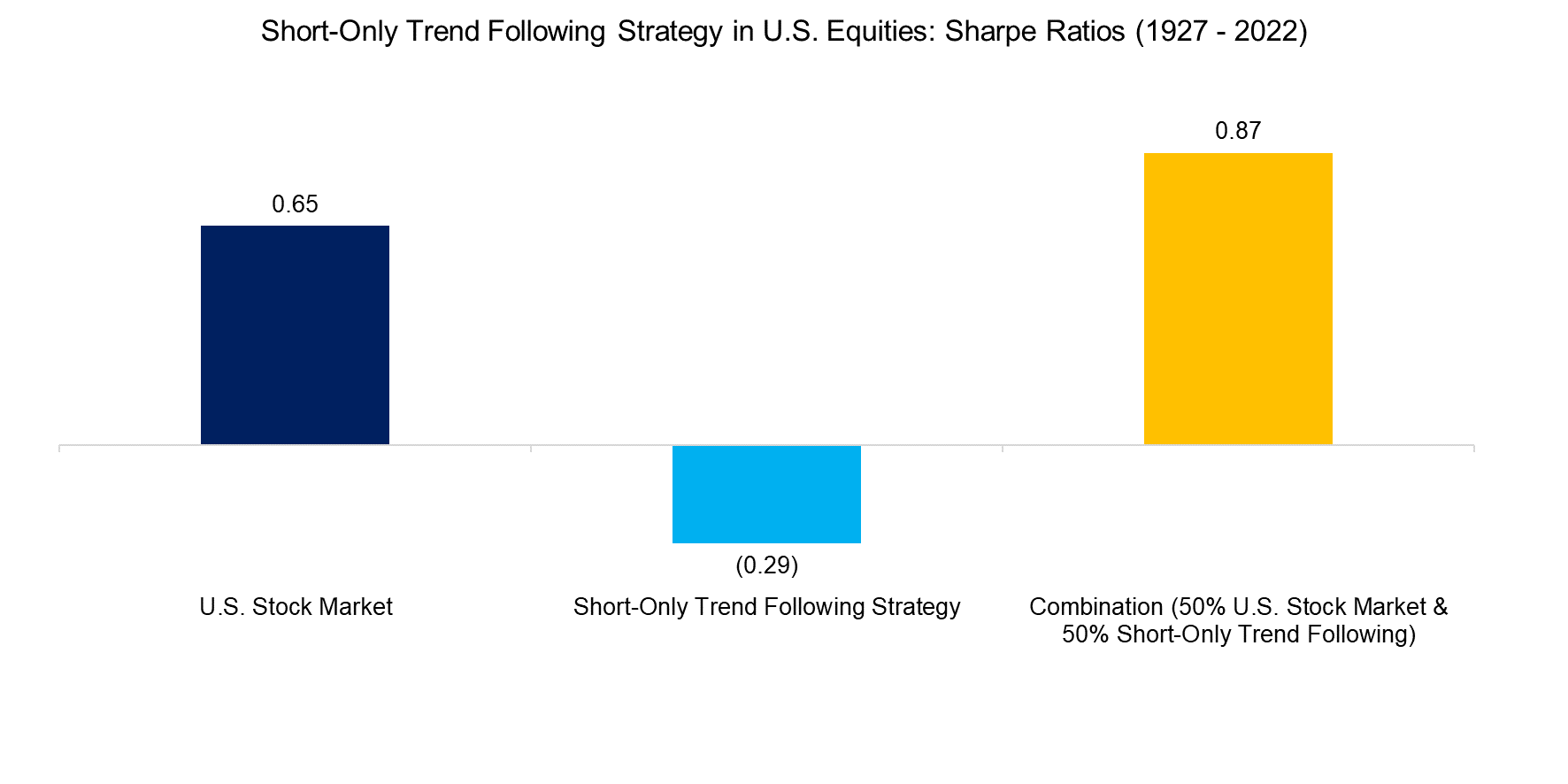

Although the performance of the short-only trend following strategy was poor, adding this to an equities portfolio would have generated diversification benefits. The Sharpe ratio of a portfolio allocated exclusively to U.S. equities was 0.65 in the period between 1927 and 2022, but increased to 0.87 with a 50% allocation to the short-only trend following strategy. The CAGR has reduced from 9.9% to 4.9%, but so has volatility with a decrease from 15.1% to 5.6% per annum. The maximum drawdown improved from -89% to -28%.

Source: Finominal

SHORT-ONLY TREND FOLLOWING ACROSS STOCK MARKETS

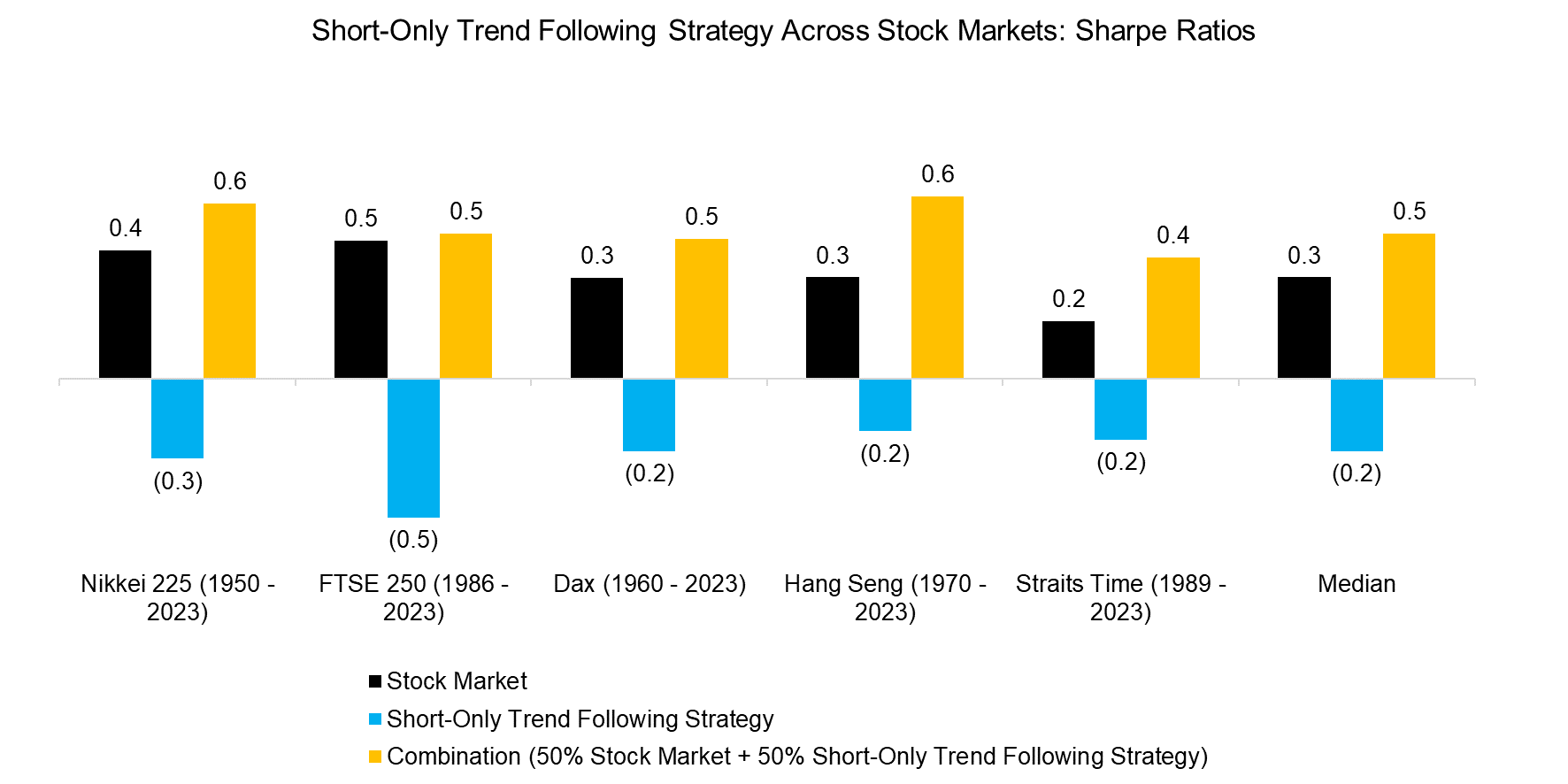

Next, we evaluate short-only trend following across other stock markets namely Japan, the UK, Germany, Hong Kong, and Singapore. Although the lookback periods vary, we observe that the Sharpe ratios were positive for all five stock markets, while the Sharpe ratios for short-only trend following were consistently negative.

However, similar to the U.S. stock market, combining a 50% allocation to the stock market and 50% allocation to the short-only trend following strategy generated diversified portfolios that feature higher Sharpe ratios than long-only equity exposure.

Source: Finominal

Short-only trend following should be most interesting for investors that have a negative outlook on the medium to long-term returns for stocks.

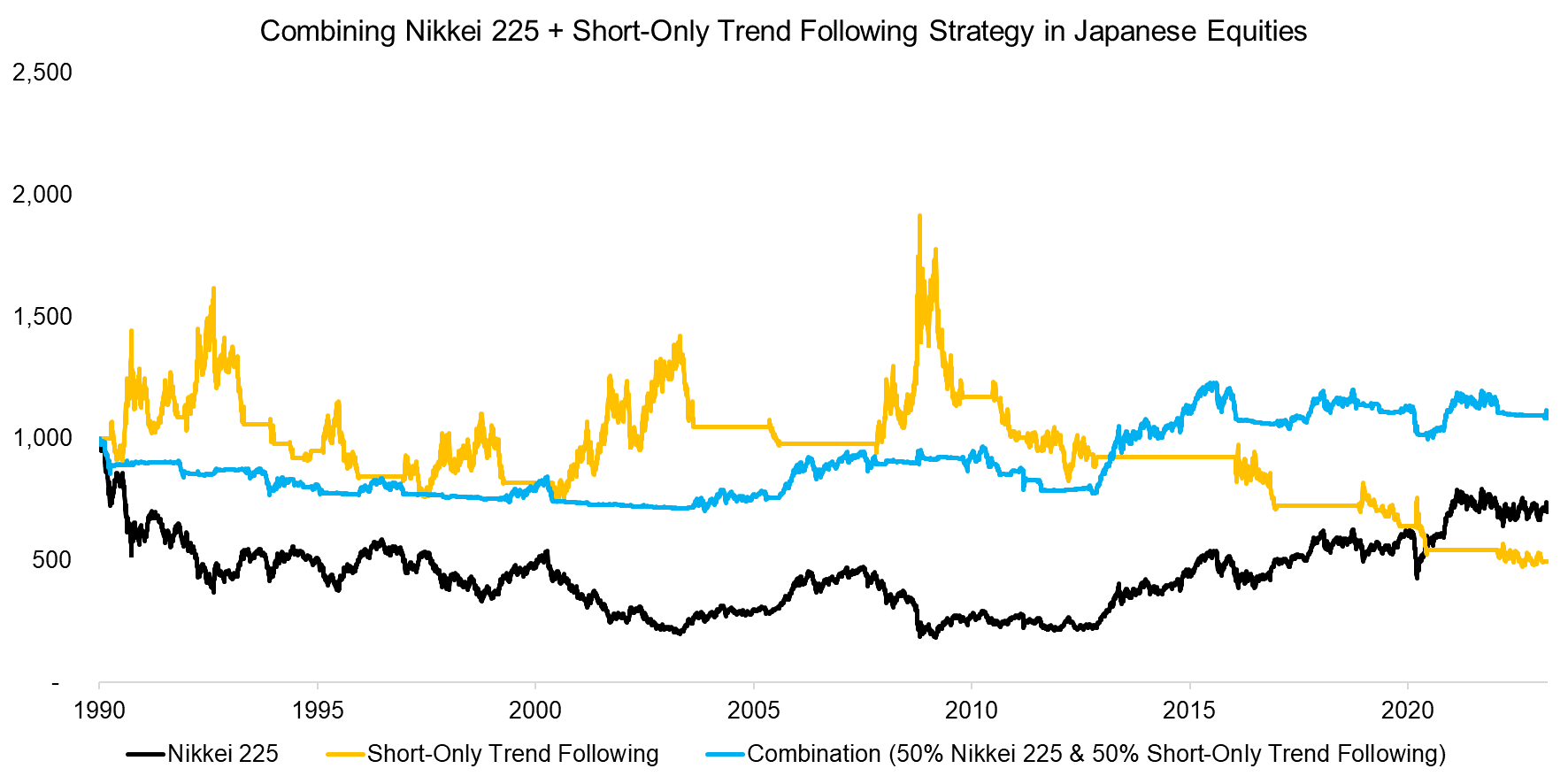

We can evaluate this scenario by taking Japan as a case study from 1990 onwards, which represents the peak of the Japanese economic and stock market bubbles. From then stocks declined for more than 20 years before staging a recovery in 2012, when the former Prime Minister Shinzo Abe implemented a comprehensive policy to revive the Japanese economy.

We observe that the short-only trend following strategy generated approximately a flat return while the Nikkei 225 was declining, but then lost when Japanese stocks were recovering.

A portfolio comprised of a 50% allocation to the Nikkei 225 and a 50% allocation to short-only trend following strategy has not produced an attractive absolute return over the 24 years, but a higher one than the Japanese stock market on a stand-alone basis. Naturally, this is from the peak of the Japanese stock market bubble, so needs to be taken with a grain of salt.

Source: Finominal

FURTHER THOUGHTS

The short-only trend following strategy is unattractive on a stand-alone basis, but generated significant diversification benefits when combined with an equities portfolio. The correlation between the stock market and the strategy in the U.S. was -0.7 in the period from 1927 to 2022, so this should be regarded as a hedging rather than diversifying strategy (read Diversification versus Hedging).

Given the increase in Sharpe ratios and significant reductions of maximum drawdown across stock markets, what is not to like?

Like many hedging and diversifying strategies, there is clear support for the long term, but it is difficult to execute the strategy in the short to medium term. For example, the short-only trend following strategy would have lost approximately 50% of its value over the last 10 years in Japan when the Nikkei 225 represented a bull market, which few investors would have been able to endure.

RELATED RESEARCH

Trend Following in Equities

Diversification versus Hedging

Hedging Market Crashes with Factor Exposure

Hedging via Managed Futures Liquid Alts

Replicating a CTA via Factor Exposures

Creating a CTA from Scratch – II

Market Timing with Multiples, Momentum & Volatility

REFERENCED RESEARCH

A Century of Evidence on Trend-Following Investing, AQR, 2017

Two Centuries of Trend Following, Capital Fund Management, 2014

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.