Trend Following in Equities

The trend is my friend, right?

May 2023 Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Long-only trend following in equities was more effective than long-short trend following in the US

- Same for European and Asian stock markets

- Perhaps explained by the negative skewness of stock markets

INTRODUCTION

Imagine a world where economic growth is anemic. Governments and central banks do everything to stimulate growth, but their powers have weakened over time to the extent that even the most extreme fiscal and monetary policies have only a short-lived impact.

Although such a scenario sounds utterly depressing, it is difficult not to see that we are on its trajectory. Economic growth is a function of productivity and the working-age population. Despite all the technological innovation, productivity has not increased in most developed countries over the last decade. And demographics are poor across developed and emerging markets, eg China is expected to lose 400 million people over the next 80 years (read Aging & Equities: Selling Stocks for the Long-Term).

How do you invest in such a world?

Real estate, aside from nursing homes, will be unattractive given large vacancies. Governments won’t be able to repay debt as their taxable populations are shrinking and they have to deal with exploding healthcare and pension costs. The demand for commodities will be reduced as there is less construction and industrial activity happening. Traditional diversification will fail to provide the desired benefits as they all represent bets on positive economic growth.

How about equities, or equity proxies like private equity or venture capital?

Well, corporations will still aim to generate a profit for their shareholders, although this will be more difficult when economic growth is low or negative. Stocks might simply go up as investors do not like the alternatives, but an elderly population does also not like to take too much risk. The long-term outlook for equities is unclear.

Instead of the traditional buy-and-hold approach to stocks, investors may consider applying a trend following strategy to equities, which we explore in this article.

TREND FOLLOWING IN EQUITIES

Trend following funds, which are also known as CTAs or managed futures funds, have had a comeback recently given strong performance in 2022 (read Managed Futures: The Empire Strikes Back). The basic strategy is to buy asset classes that are trending upwards, and short ones that are performing poorly. The resulting portfolio is typically diversified across all asset classes and frequently changes its positions.

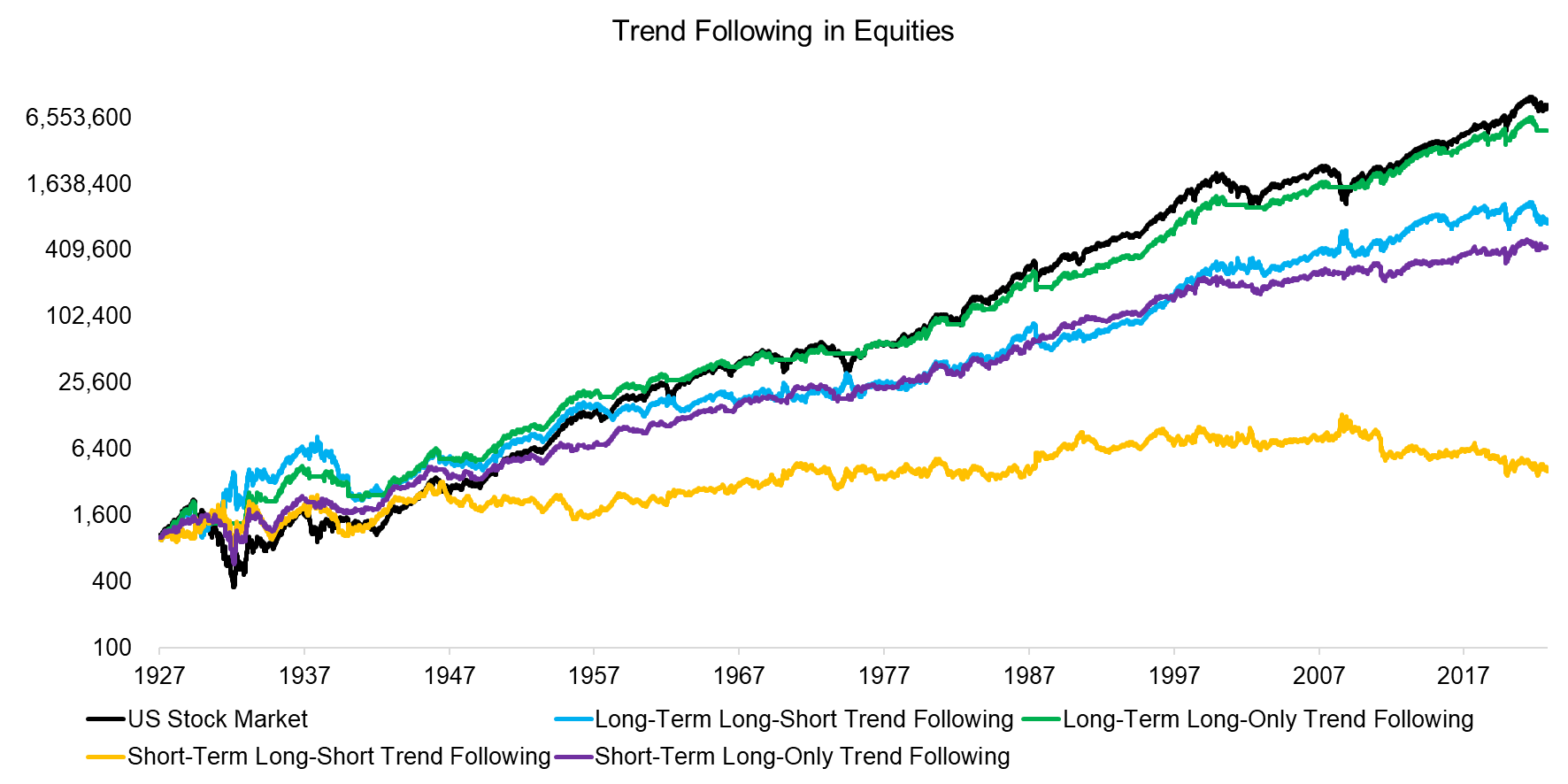

We will focus on the US stock market and apply four simple trend following strategies. Each portfolio is rebalanced monthly and performance is evaluated with a one-day delay so that implementation is realistic. Trading costs are ignored, but the portfolios do not change frequently within one year (read Creating a CTA from Scratch – II).

- Long-term long-short trend following: Long equities if the 12-month performance is positive, short equities otherwise

- Long-term long-only trend following: Long equities if the 12-month performance is positive, hold cash otherwise

- Short-term long-short trend following: Long equities if the 1-month performance is positive, short equities otherwise

- Short-term long-only trend following: Long equities if the 1-month performance is positive, hold cash otherwise

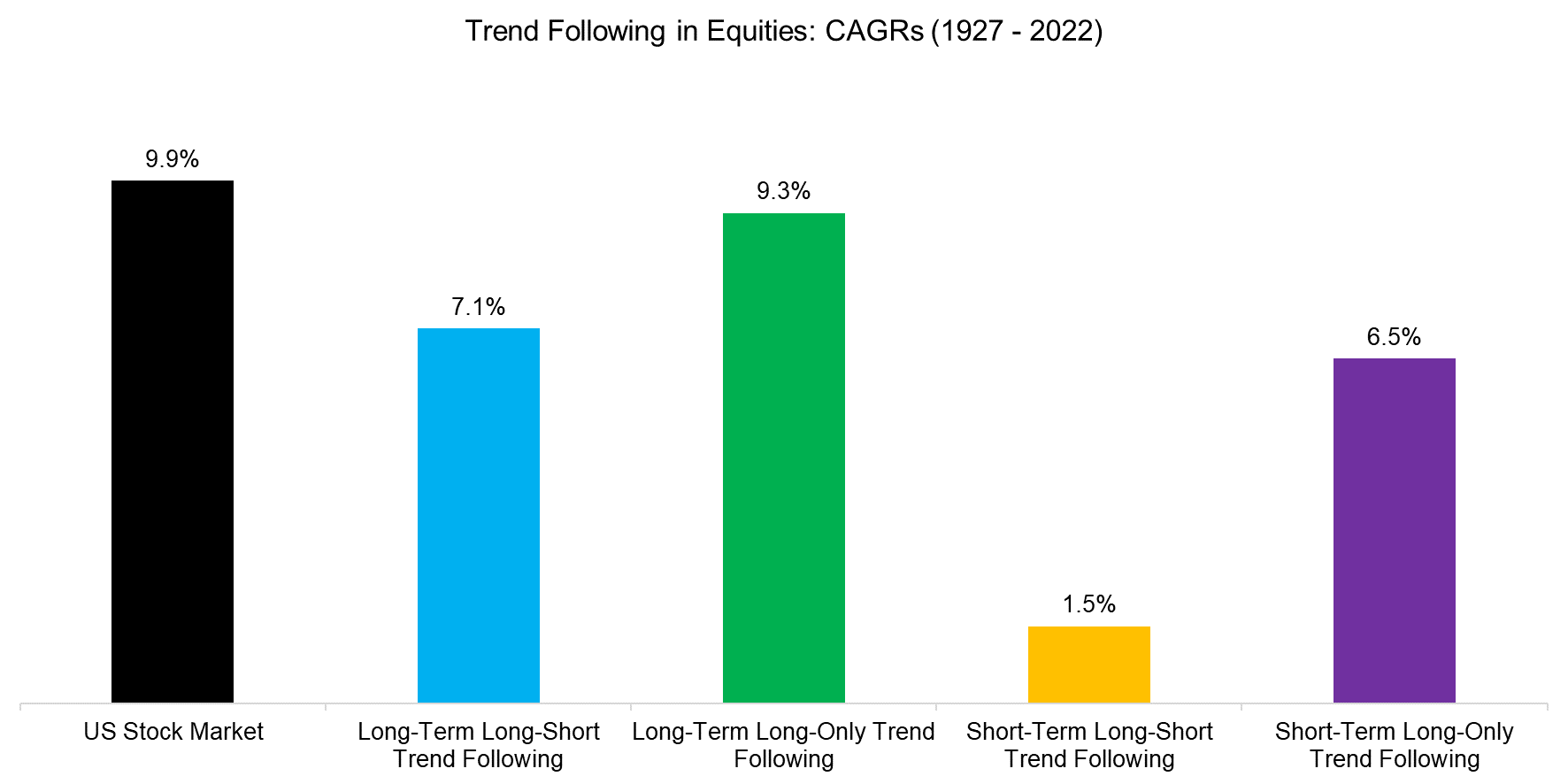

We observe that none of the four trend following strategies outperformed the US stock market in the period between 1927 and 2023. However, long-term long-only almost achieved the same return, while short-term long-short performed worst.

Source: Finominal, Kenneth R. French Data Library

Pursuing trend following in equities can be challenged as bull markets tend to be long and bear markets short, which makes it difficult to exploit trends with the same model assumptions. In contrast, other asset classes like commodities feature bull and bear markets that are more similar in duration. Stated differently, stock market returns are negatively skewed, which perhaps makes them sub-optimal for applying trend following strategies.

The analysis highlights that long-term trend following in equities generated higher returns than short-term trend following, which broadly reflects the approach of the CTA industry. Although there are some CTAs that focus on short-term trends, even intra-day time frames, most use lookbacks of up to a year for evaluating the performance of asset classes (read Managed Futures: Fast & Furious vs Slow & Steady).

Source: Finominal

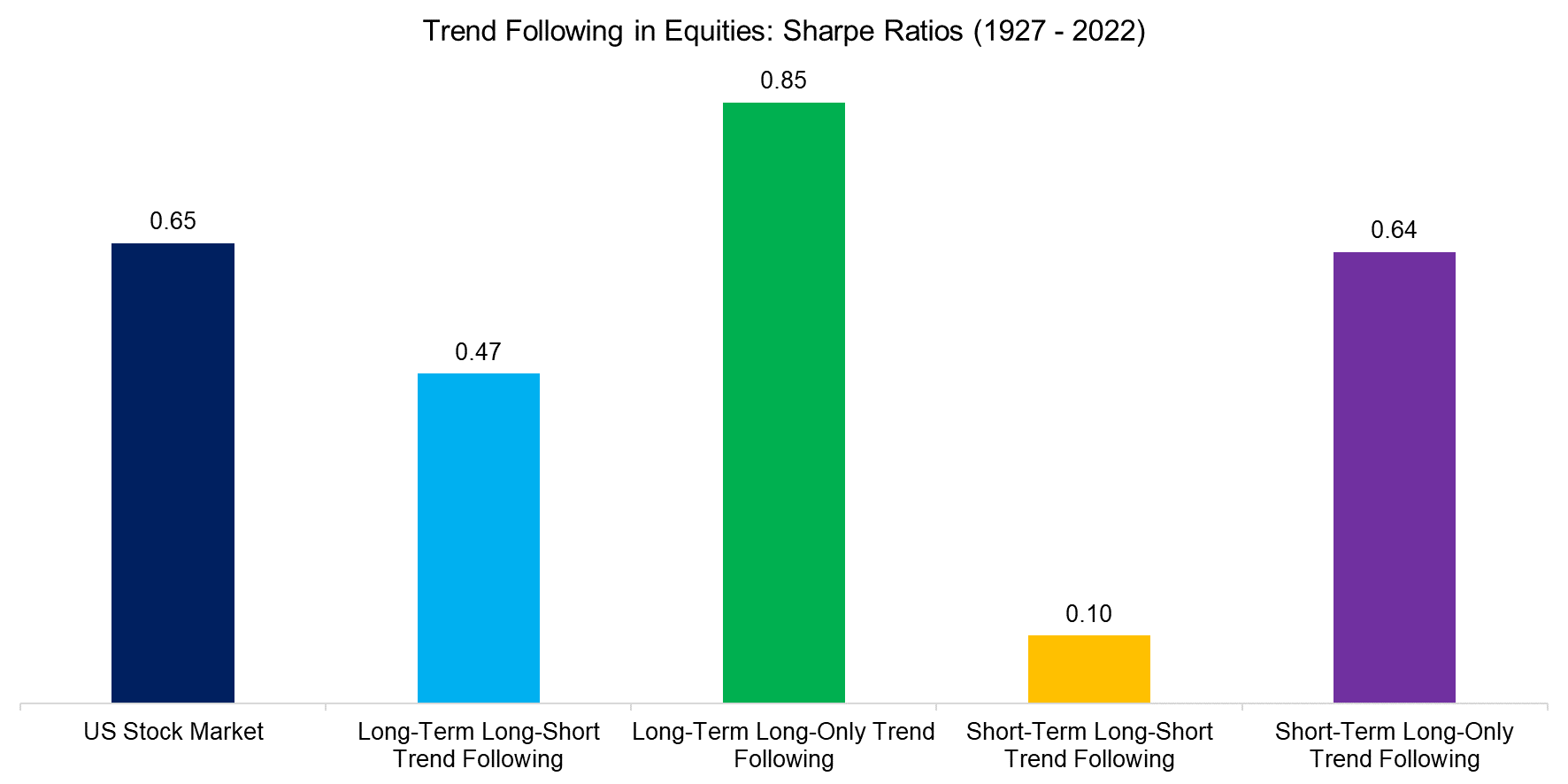

SHARPE RATIOS

Analyzing the Sharpe ratios of the four trend following strategies highlights that the long-only ones generated attractive risk-adjusted returns. Although we have ignored transaction costs, which decrease returns, we have also ignored reinvesting cash into interest-bearing bonds, which would have increased returns.

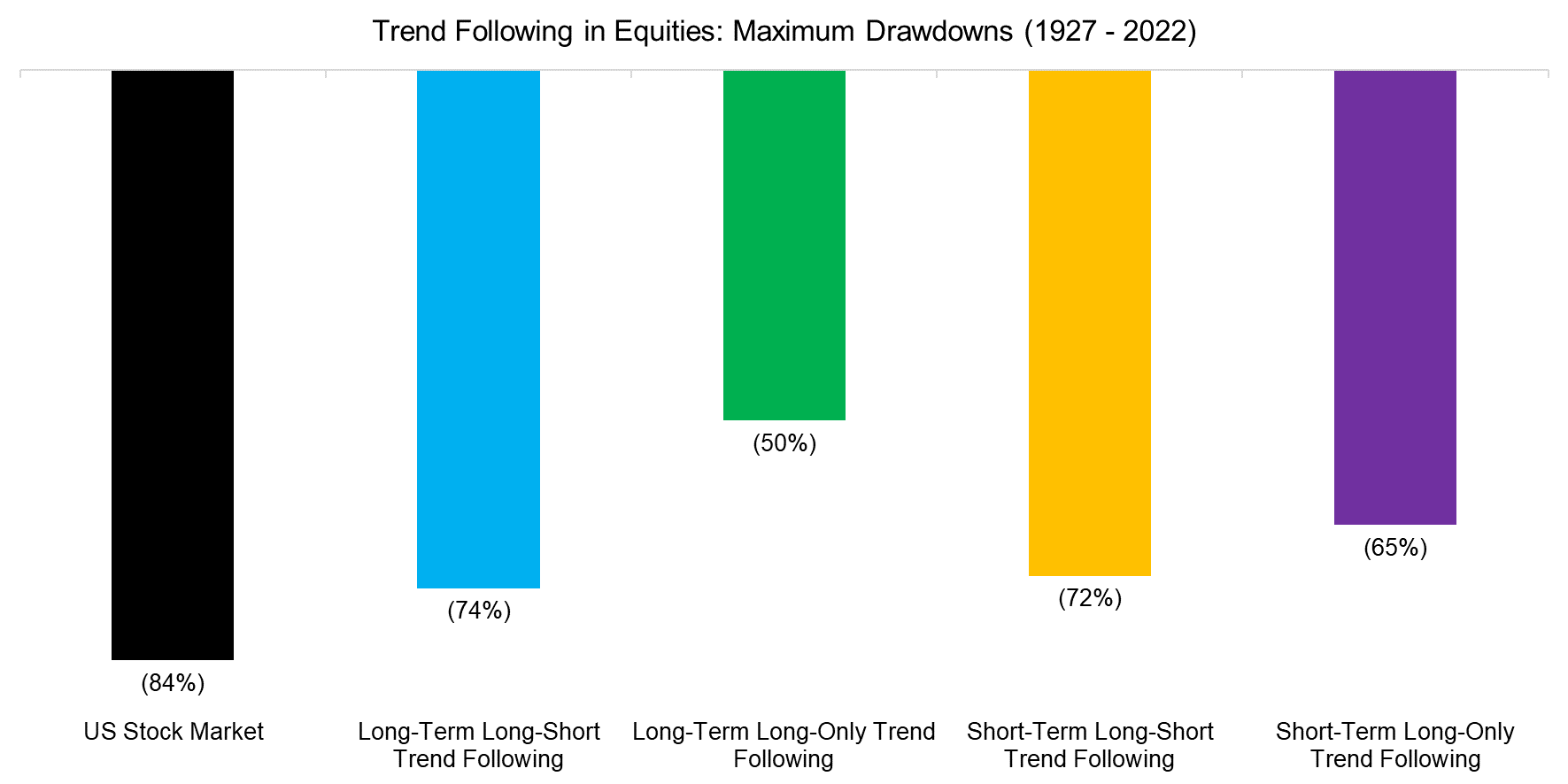

Source: Finominal

The relatively high Sharpe ratio of the long-term long-only trend following strategy can be explained by this broadly participating in the major bull markets of the US stock market, but reducing the exposure to equities during bear markets. We observe that the maximum drawdown was below 50%, compared to 84% for the stock market in the period from 1927 to 2023.

It is worth highlighting that trend following does not protect against stock market crashes like in 1987 as it takes time for these strategies to switch from long to short or into cash. Investors need to consider tail risk or long volatility strategies for hedging stock market crashes (read Tail Risk Hedge Funds & Long Volatility Strategies versus Tactical Asset Allocation).

Source: Finominal

INTERNATIONAL EVIDENCE

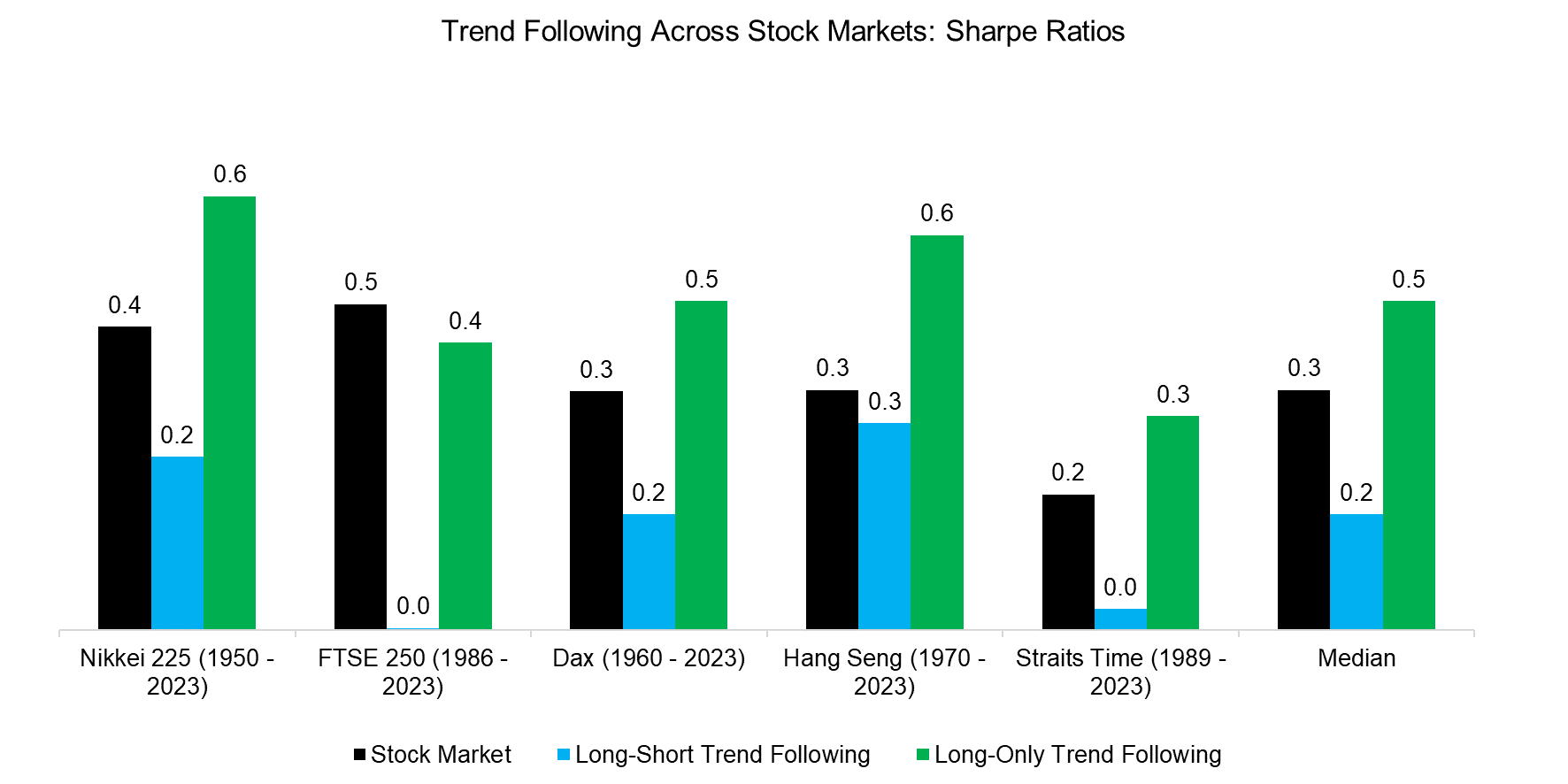

Finally, we evaluate the performance of the long-term trend following strategies across five European and Asian stock markets, where the starting point of the data ranges from 1950 to 1989.

We observe that long-short trend following strategies generated significantly lower Sharpe ratios than long-only trend following strategies, whose returns were even better than from buy-and-hold stock market exposure.

Source: Finominal

FURTHER THOUGHTS

Given the poor long-term outlook for investing, would trend following help?

Japan can be used as a case study as it is ahead of the rest of the world in terms of a declining population. Economic growth has been anemic and its stock market features a long bear market between 1989 and 2010. The results from this analysis do not highlight that long-short trend following was effective when applied to the Nikkei 225, although long-only trend following generated attractive risk-adjusted returns.

Long-only trend following in equities combined with long-short trend following in other asset classes may be an attractive combination (read Building a Diversified Portfolio for the Long-Term – Part II). After all, there is a difference between betting on the decline of copper or a currency like the Japanese Yen versus betting against the ingenuity of highly incentivized CEOs and entrepreneurs.

RELATED RESEARCH

Risk-Managed Equities II

Replicating a CTA via Factor Exposures

Creating a CTA from Scratch – I

Creating a CTA from Scratch – II

Managed Futures: The Empire Strikes Back

Managed Futures: Fast & Furious vs Slow & Steady

Hedging via Managed Futures Liquid Alts

60/40 Portfolios Without Bonds

Trend Following & Factor Investing – Unexpected Cousins?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.