U.S. versus International Quality Stocks

Why should investors get compensated for holding high-quality stocks?

August 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- U.S. quality stocks have not outperformed or provided less risk than the market

- International quality stocks have done so, but that has slowed down considerably in recent years

- Quality is best used in combination with other factors rather than on its own

INTRODUCTION

The posts of social media influencers focused on personal finance are full of formulas that help investors select high-quality stocks, where low debt-over-equity, high return-on-equity, and high interest rate coverage ratios are some of the favorite metrics. Typically these posts are supplemented by leaning on heavy-weight investors like Warren Buffett who supposedly use the same ratios in their stock selection processes.

Unfortunately, it is not only retail but also professional investors who frequently fall for high-quality stocks. Everyone loves companies that feature low leverage and high profitability, but that leads to such stocks being perfectly priced, or overpriced.

We previously highlighted the lack of outperformance of quality stocks (read Quality versus Low Volatility ETFs and Oh, Quality, Where Art Thou?), but our research was focused on U.S. stocks.

In this research article, we will compare the performance of U.S. versus international quality stocks.

LONG-TERM FACTOR PERFORMANCE

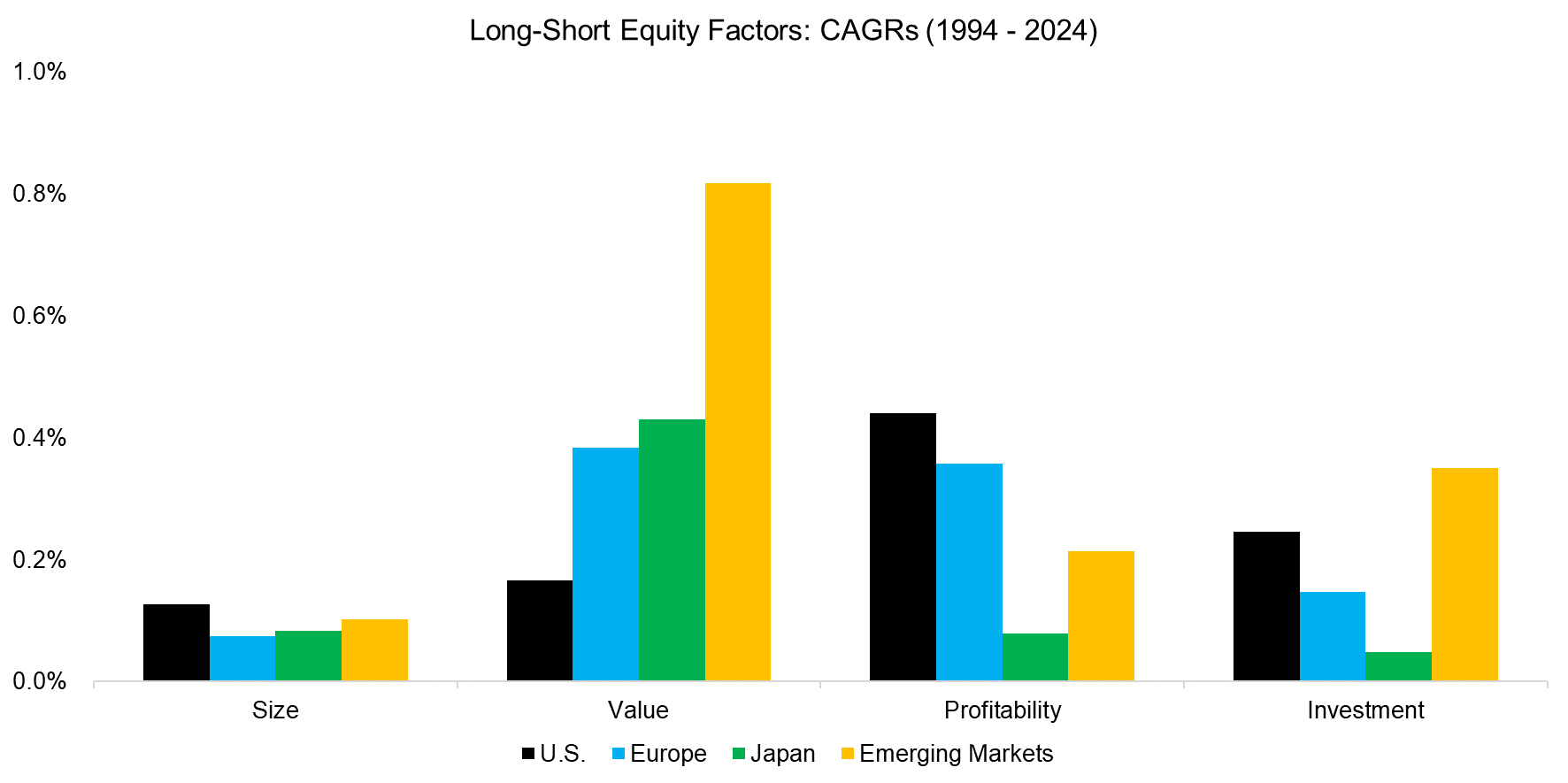

First, we review the excess returns of the four factors from the Fama-French model using data for the U.S., Europe, Japan, and Emerging Markets from 1994 to 2024. We observe that all factors generated positive excess returns over the last 30 years, with size producing the lowest and value the highest returns on average.

Profitability, which is one of the core pillars of measuring quality, was strongest in the U.S. and lowest in Japan. However, the magnitude of excess returns was very low and this data includes micro-caps stocks and excludes transaction costs, i.e. the real excess returns would be close to zero or negative.

Source: Kenneth R. French Data Library, Finominal

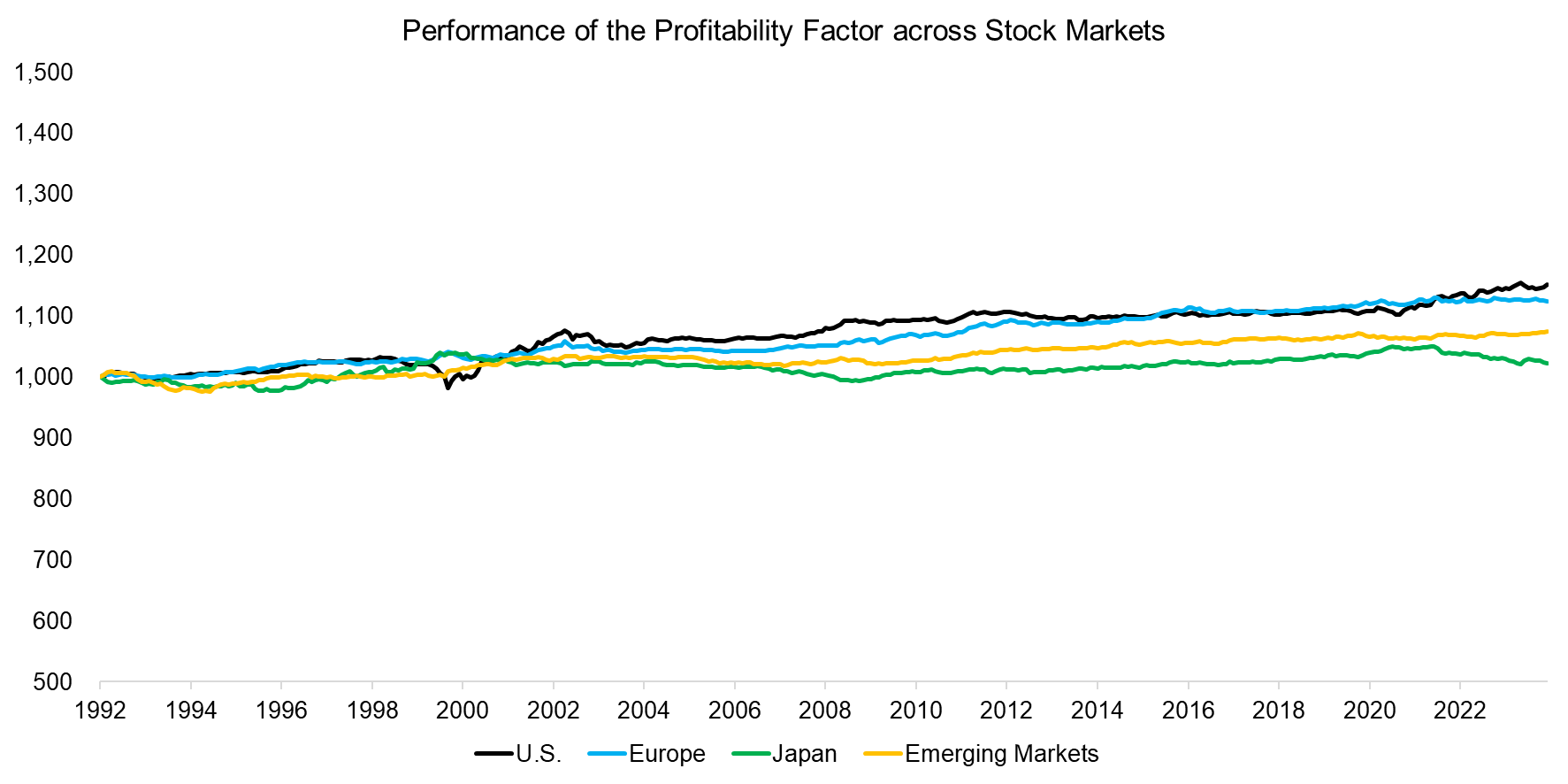

Factors tend to behave similarly across geographies and even asset classes, but the correlations of the profitability factor were close to zero across stock markets (read The Odd Factors: Profitability & Investment).

We observe a significant divergence of the U.S. profitability factor between 1998 and 2000 as well as between 2019 and 2020, when unprofitable technology stocks vastly outperformed profitable ones in the U.S. stock market. It seems that investors in other stock markets did not exhibit the same preferences for such stocks, which also may be a function of the technology sector being much larger in the U.S. market.

Source: Kenneth R. French Data Library, Finominal

PERFORMANCE OF U.S. QUALITY STOCKS

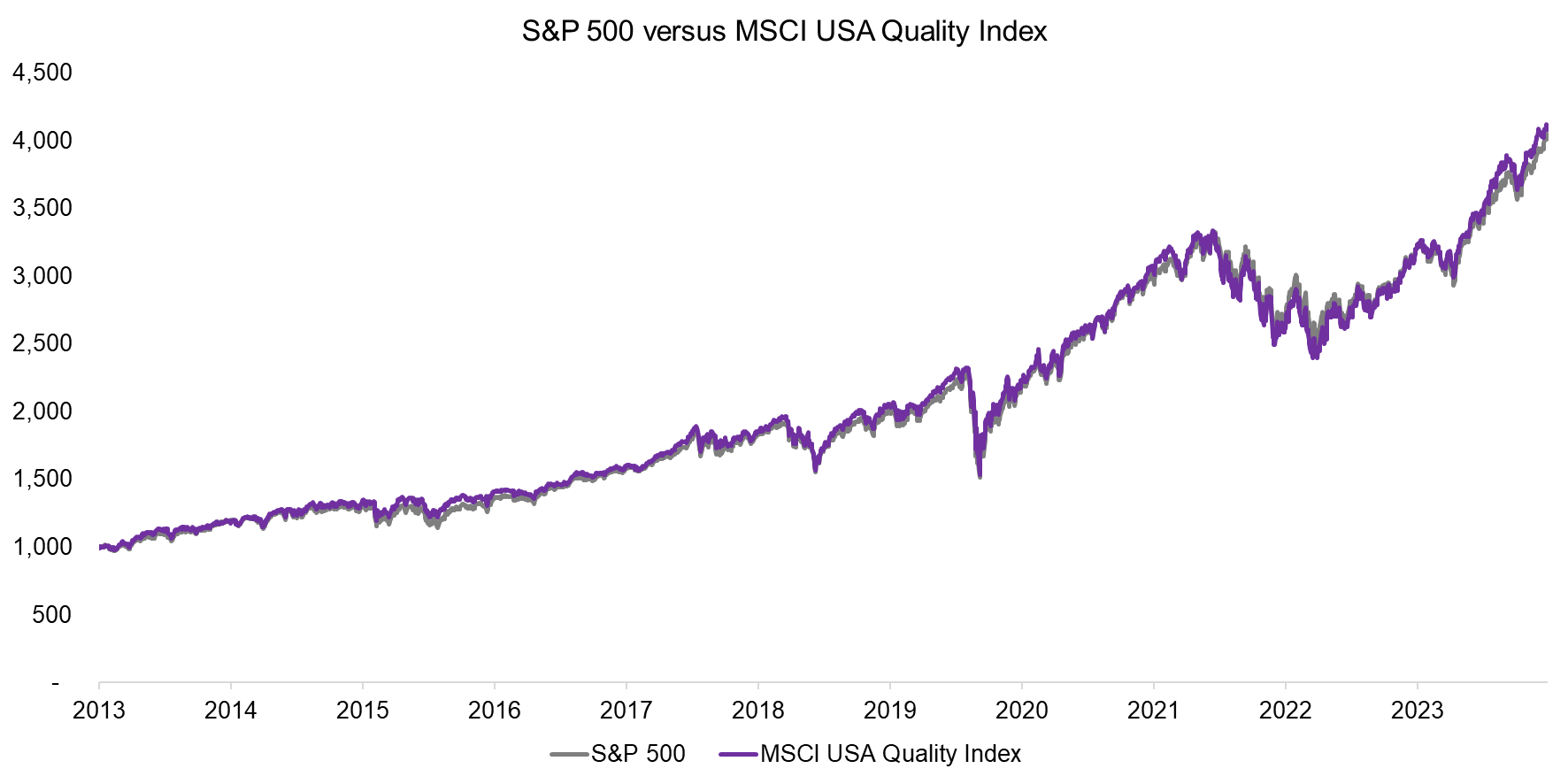

Although the profitability factor generated positive excess returns in the U.S. between 1994 and 2024, we can not observe this premium in the stock market when taking the MSCI USA Quality Index as a proxy as its performance was almost identical to that of the S&P 500 over the last decade.

Some investors make the point that quality stocks are not supposed to outperform the market, but rather produce a higher Sharpe ratio by being less volatile and offering low drawdowns when stocks crash. However, U.S. quality stocks were more volatile (17.5% versus 17.0%) and generated a slightly higher drawdown than the S&P 500 (-33.7% versus -34.1%).

Source: Finominal

PERFORMANCE OF INTERNATIONAL QUALITY STOCKS

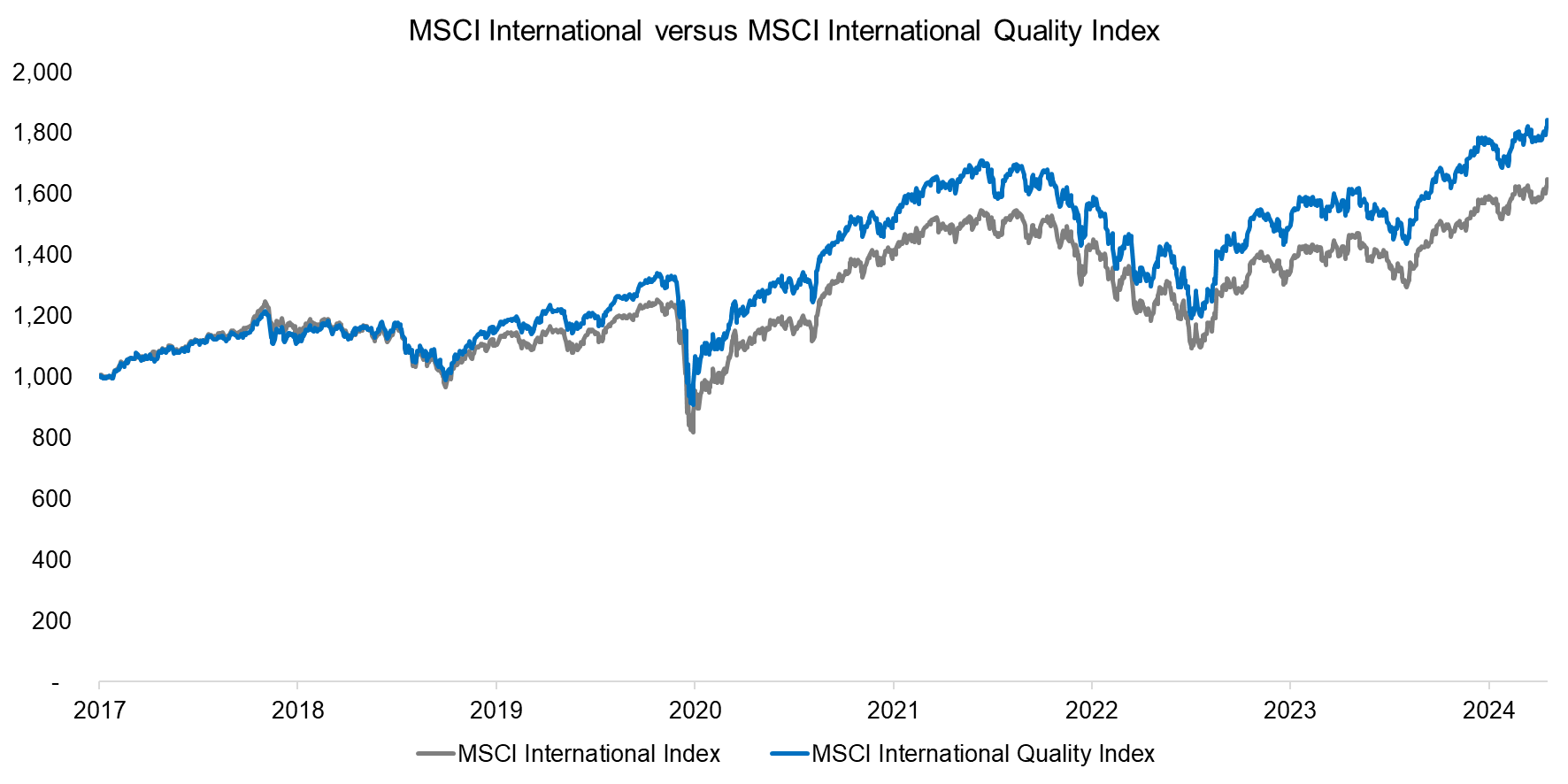

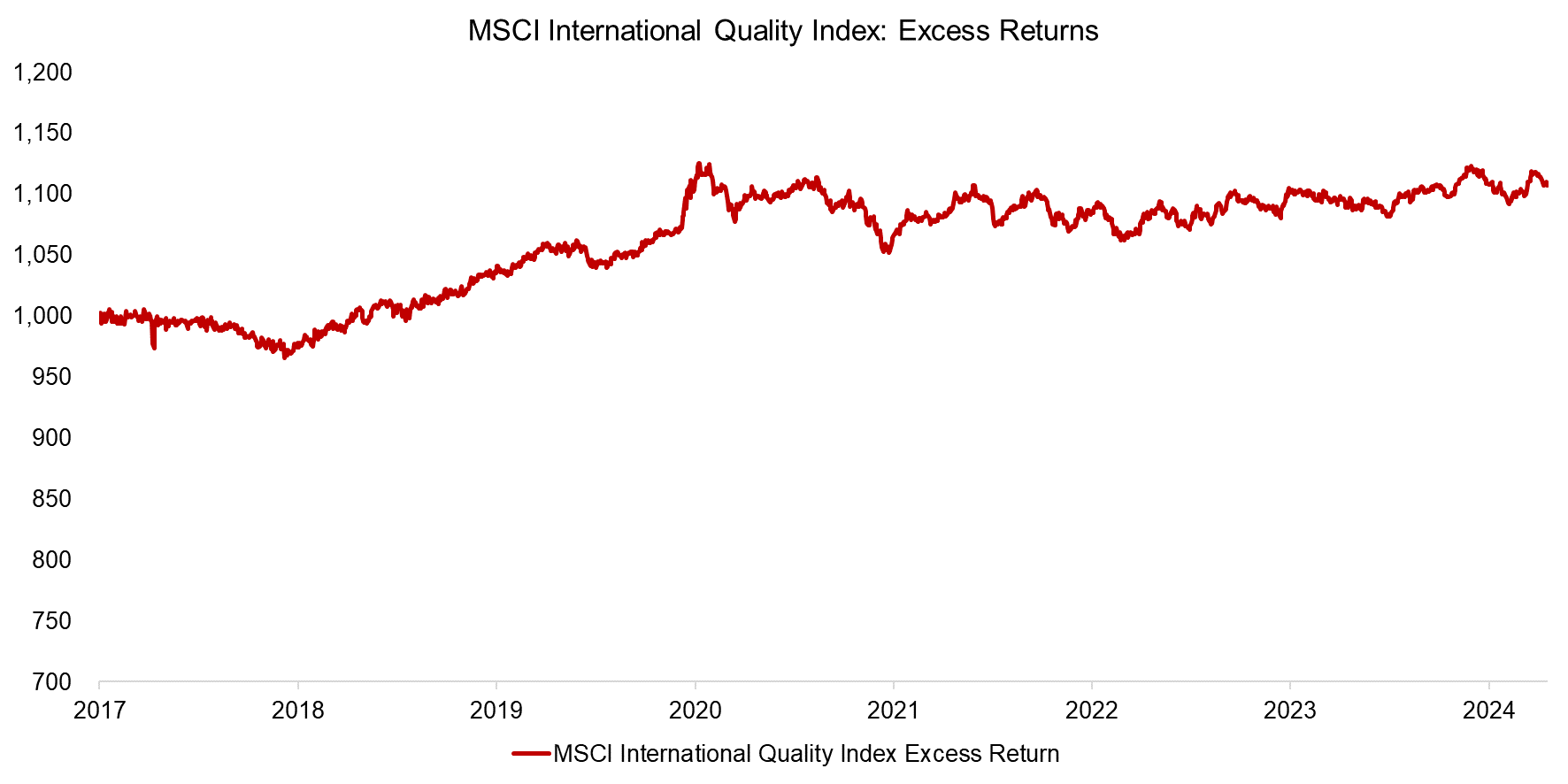

Next, we move on to international quality stocks, where we take the MSCI International Quality Index as a proxy, which outperformed the MSCI International Index since 2017.

The quality portfolio is well diversified with 323 stocks, but less than the stock market index with over 2000 holdings, so the latter is slightly less volatile. However, given the higher return of the quality portfolio, its Sharpe ratio was significantly more attractive at 0.48 versus 0.37 for the overall market.

Source: Finominal

Although the quality stocks outperformed in international markets, it is worth highlighting that the excess return has been close to zero since the low point of the COVID-19 crisis in March 2020. Naturally, this questions if quality stocks in international markets will follow their brethren in the U.S., whose excess return has been zero over the last decade.

Source: Finominal

FURTHER THOUGHTS

Although almost every asset manager has a small-cap product, the academic research community has largely concluded that there is no premium associated with small caps. In only three out of 21 stock markets the size factor generated positive excess returns in the three decades between 1990 and 2023 (read The Illusion of the Small-Cap Premium).

Perhaps practitioners and researchers will also conclude that there is no premium associated with buying high-quality stocks in a few years, despite previous research indicating so. In the case of small caps, there was at least the somewhat logical argument that small caps are riskier, but why should investors get compensated for holding stocks with low leverage and high profitability?

Size and quality are like salt and pepper, best for flavoring a dish rather than being the main ingredient of a meal.

RELATED RESEARCH

Quality versus Low Volatility ETFs

Oh, Quality, Where Art Thou?

Picking Profitable Companies Can Be Unprofitable

Quality Factor: Zero Alpha for Most Investors

Building a Stock Portfolio for a Debt-Averse World

The Odd Factors: Profitability & Investment

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.