Value+Quality or High Quality Value Stocks?

Factor Portfolio Construction: Double-Sorting vs Combination

September 2017. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Investors can either combine single-factors into a portfolio or sort stocks for several factor characteristics

- Double-sorting seems to work better for Value & Quality than for Value & Momentum

- The combination portfolios show the highest risk-return profiles, albeit at lower returns

INTRODUCTION

London recently hosted the World Championships in Athletics where sportsmen competed in a variety of disciplines. Most were specialists, like Usain Bolt in sprinting, but there were also decathletes who aim to be good across 10 different types of track and field events. In factor portfolio construction investors have the choice of selecting specialists and combining these in a portfolio or picking multi-disciplinarian stocks. In this short research note we will consider the difference between selecting single factors and combining them versus double-sorting stocks on different factors.

METHODOLOGY

We’re going to focus on Value in the US and Europe and are going to combine and double-sort once with Quality and once with Momentum. Combining factors will simply be a portfolio of the two single factors with equal allocations and yearly rebalancing. Double-sorting implies sorting stocks on Value and either Quality or Momentum and then look for the stocks in the intersection, i.e. that rank highly for Value and Quality or Momentum. In a combination portfolio we will therefore have twice the amount of stocks compared to a double-sorted portfolio.

The factors are constructed as long-short portfolios by taking the top and bottom 10% of the stock universes in the US and Europe. Value is based on price-to-book ratios, Quality on return-on-equity, and Momentum on the 12 month return excluding the last month. Only companies with a minimum market capitalization of $1bn are considered and 10bps of transaction costs are included.

VALUE & QUALITY US: DOUBLE-SORTING VS COMBINATION

Value investors like Warren Buffett frequently take Quality metrics into account in stock selection, mainly in order to identify hidden gems, i.e. stocks that are cheap but have good balance sheets, decent operating margins, or some other indicators of corporate stability or profitability. Alternatively they could select one Value stock and one Quality stock and combine them in a portfolio, but that approach is rarely seen. However, for factor investors the latter is much easier given an abundance of single-factor smart beta and long-short products (read Value & Quality Factor Valuations).

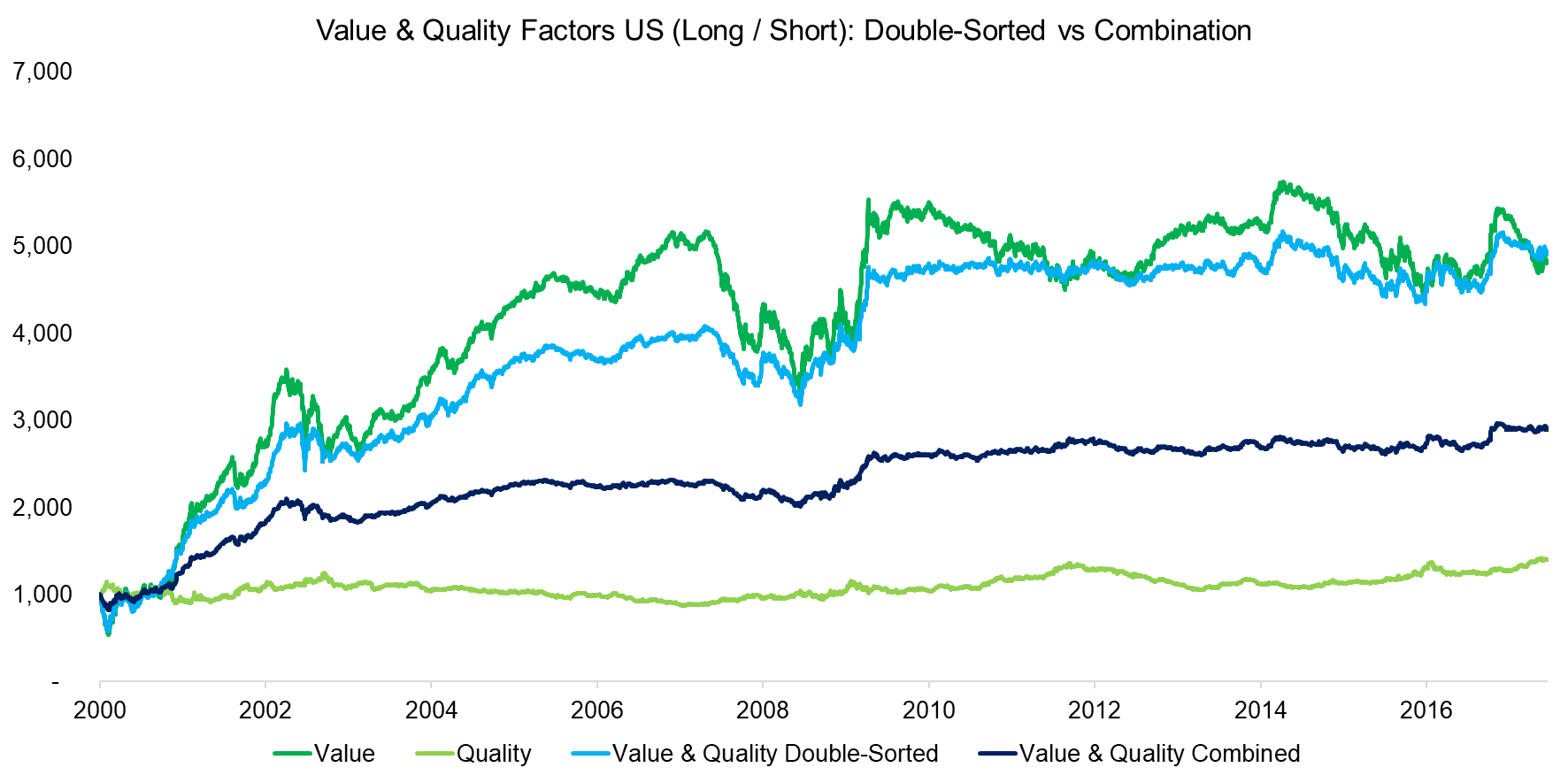

The chart below shows two single factors, Value and Quality, and the combination and double-sorted portfolios from 2000 to 2017. We can observe that the double-sorted portfolio, which contains stocks that rank highly on Value and Quality metrics, looks very similar to the single-factor Value return profile. The combination portfolio looks like the average of Value and Quality, which it represents.

Source: FactorResearch

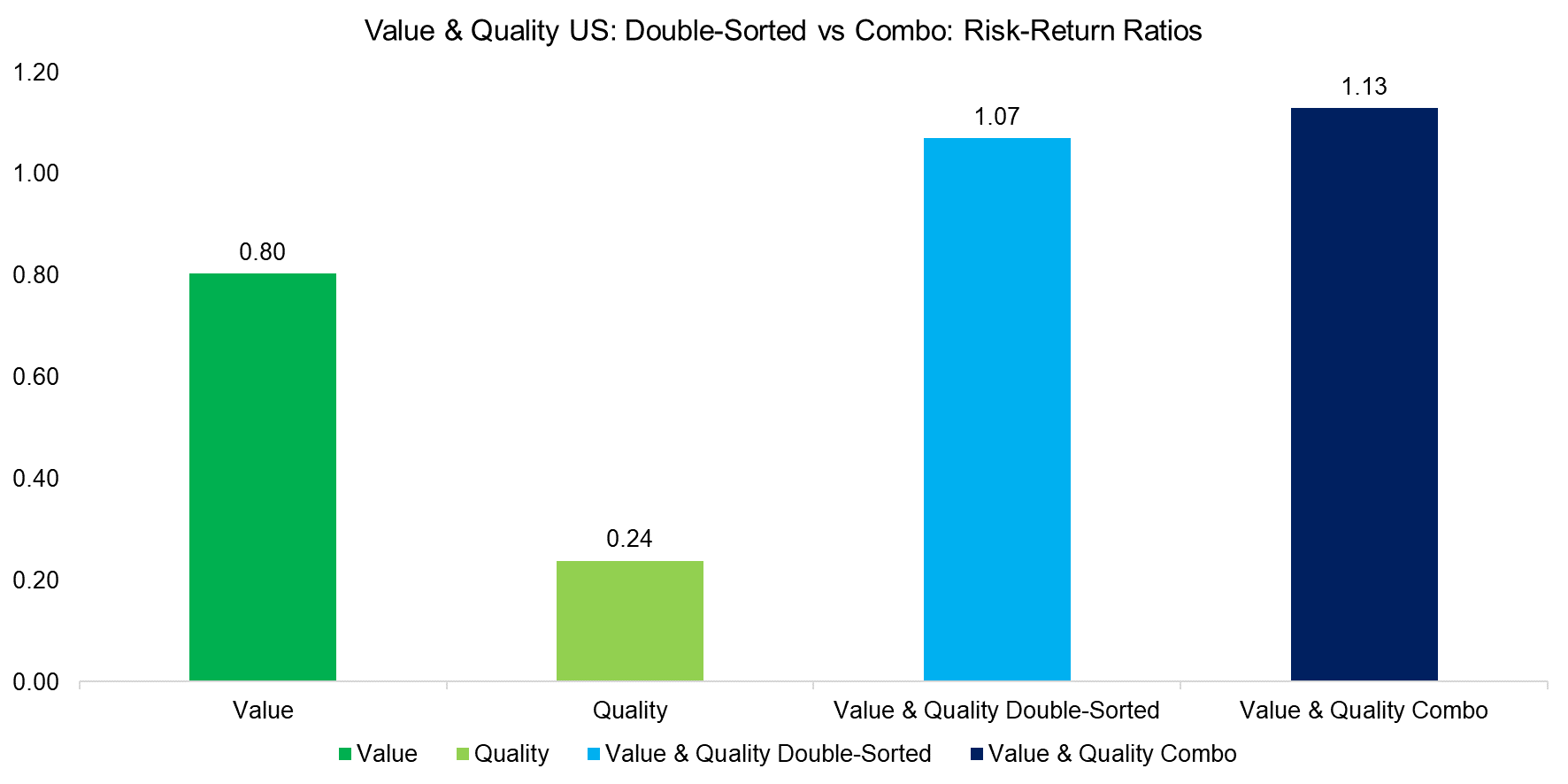

In addition to looking at the performance, it’s also worth analysing the risk-return ratios. We can observe that the double-sorted portfolio, which had a similar total return to Value, has a higher ratio. This would indicate that it might be worthwhile to look for cheap stocks with Quality characteristics. Interestingly the combination shows the highest risk-return ratio, albeit at a much lower total return.

Source: FactorResearch

VALUE & QUALITY EUROPE: DOUBLE-SORTING VS COMBINATION

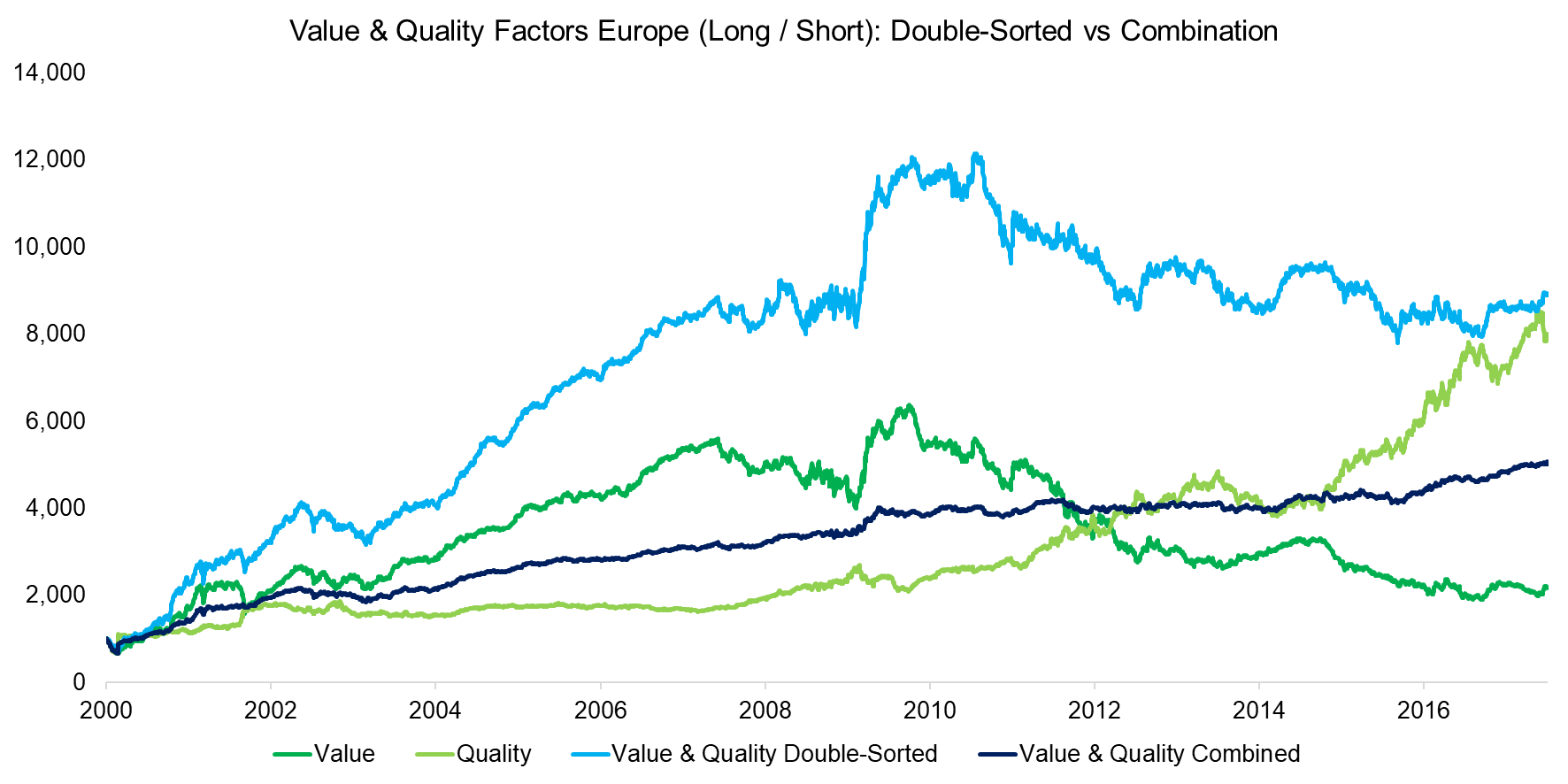

In order to verify the results in the US we can replicate the analysis in Europe, which we can see below. In this region Quality generated strong positive returns over the last 17 years and double-sorting for Value and Quality results in a much better return profile than either factor on its own. Similar to the results in the US, it would indicate that investors can improve the Value stock selection process by incorporating Quality characteristics with limited downside. It looks like a free lunch, which is rare in finance.

Source: FactorResearch

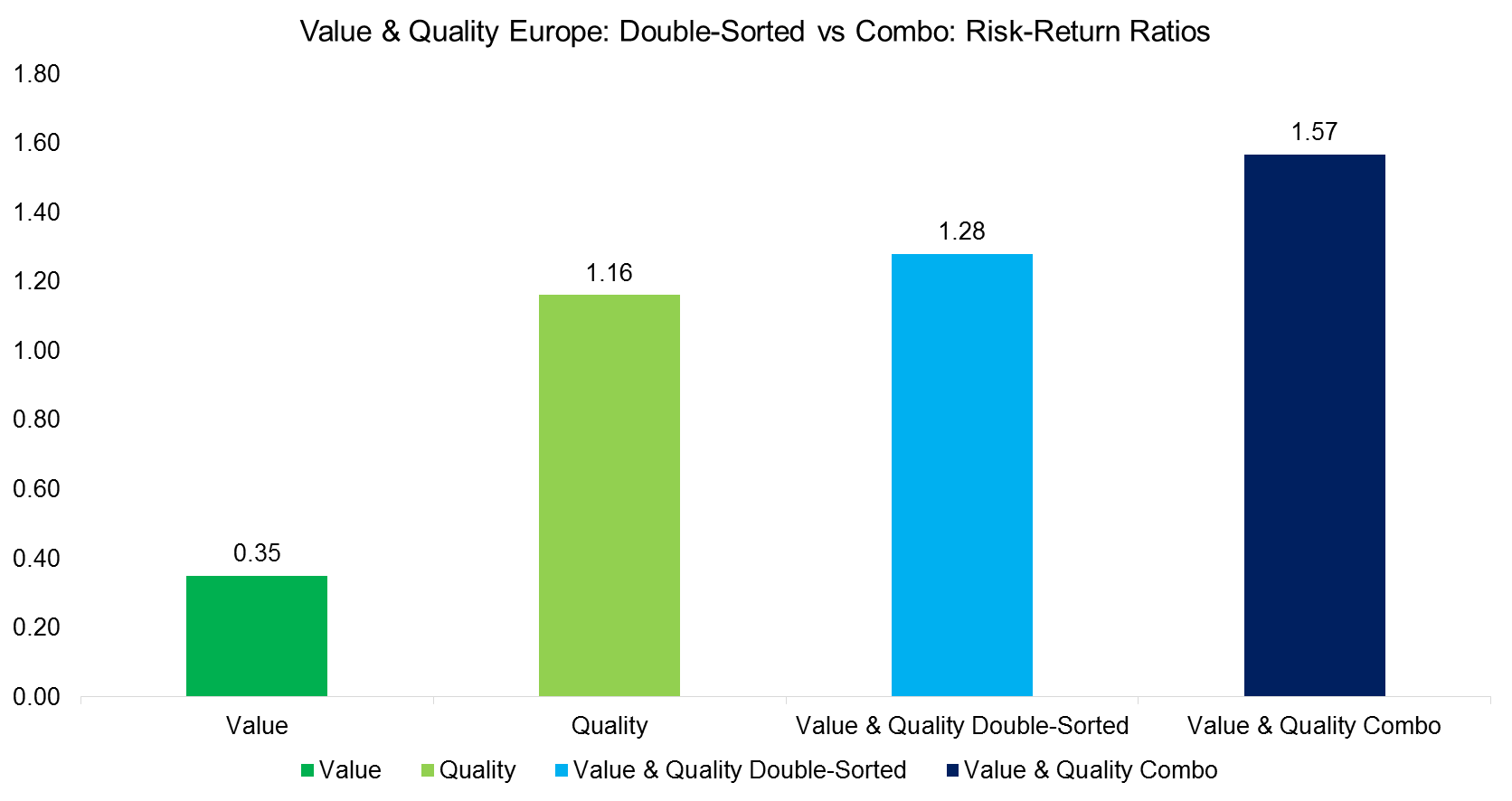

The risk-return ratios in Europe show similar results to the US, the combination has the highest ratio, followed by the double-sorted portfolio.

Source: FactorResearch

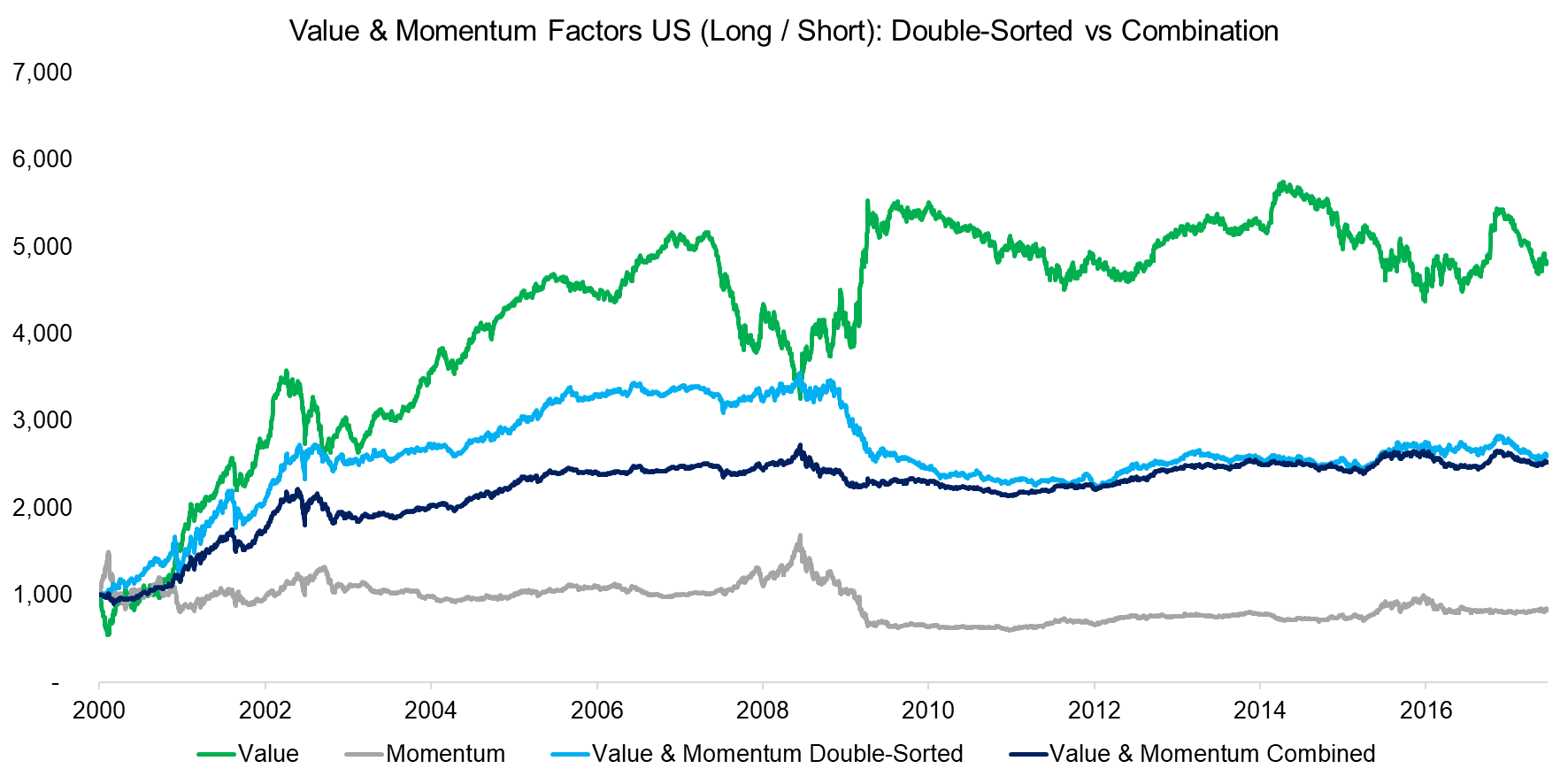

VALUE & MOMENTUM US: DOUBLE-SORTING VS COMBINATION

The nemesis of Value investors are Value traps, i.e. cheap stocks that remain cheap for long periods. One approach for avoiding these would be to consider only cheap stocks that are trading upwards and rank high on Momentum, perhaps indicating improving fundamentals (read Momentum Factor: Intra vs Cross-Sector). The chart below shows this approach, where we can observe that the single factor Value would have done best, while the double-sorted and combination portfolios look quite similar and are impacted by the poor performance of Momentum over the last 17 years.

Source: FactorResearch

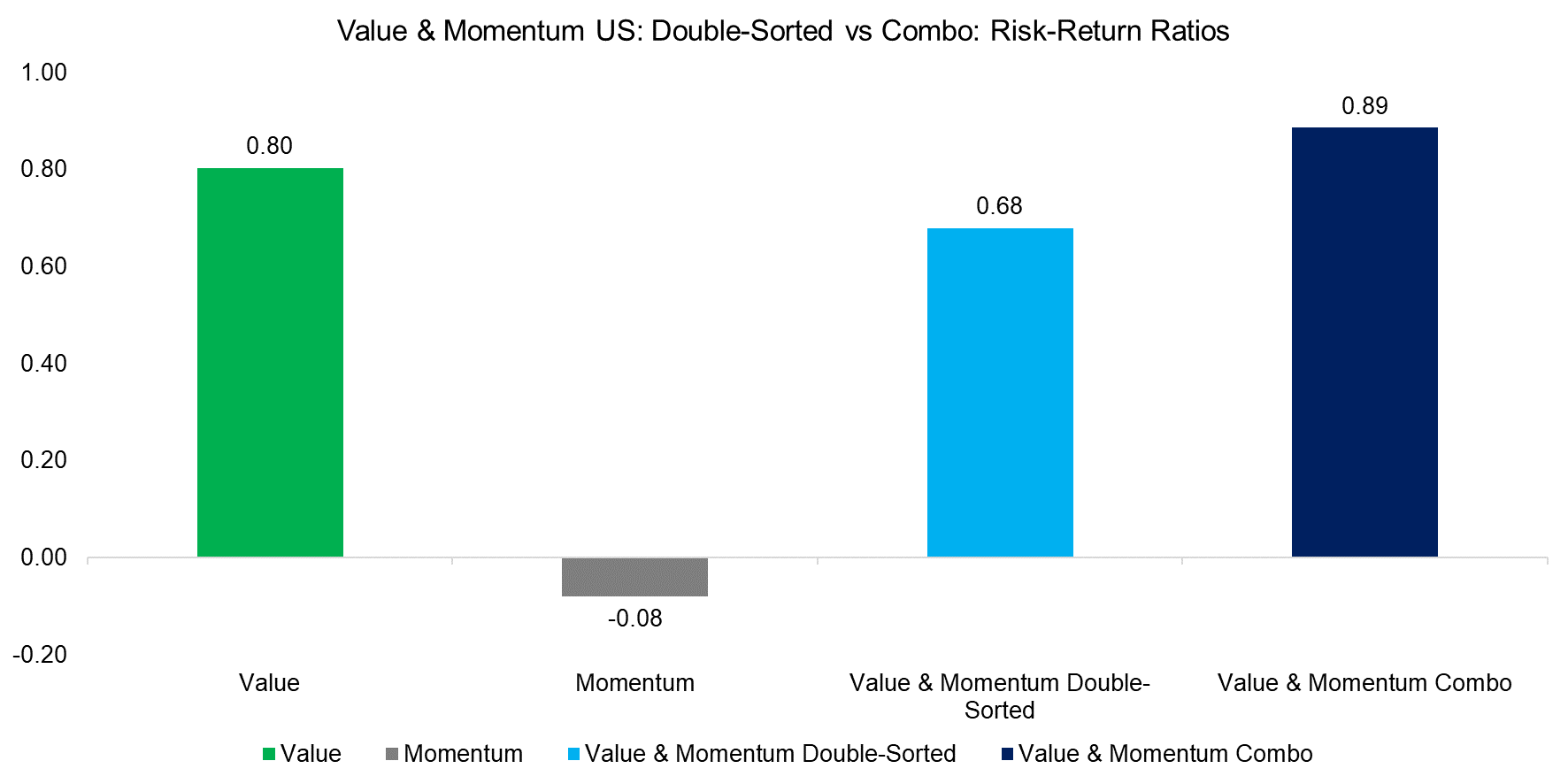

Similar to the results from Value & Quality, the combination shows the highest risk-return ratio. Incorporating Momentum in the stock selection process did not improve the ratio compared to Value on a stand-alone basis.

Source: FactorResearch

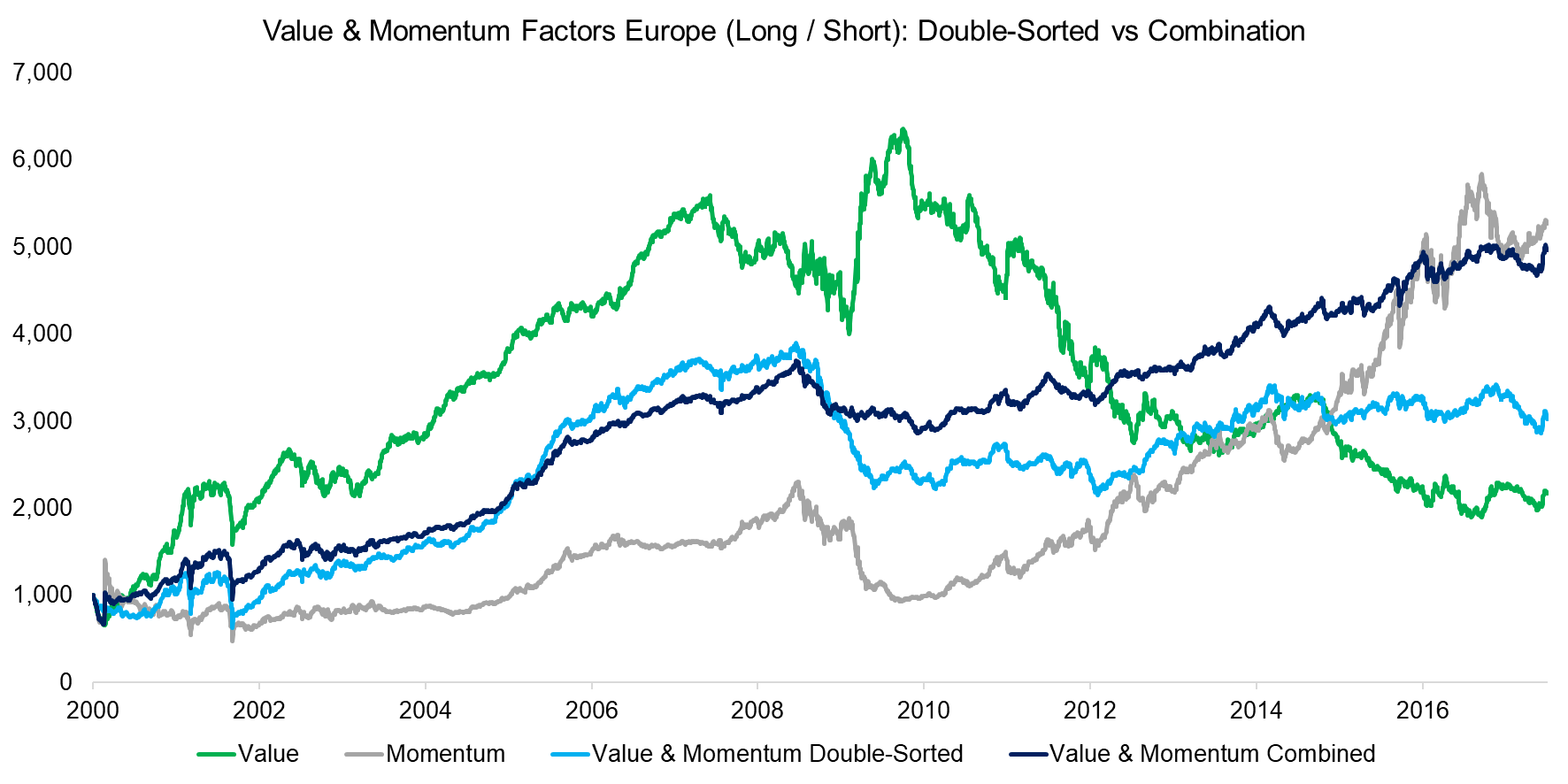

VALUE & MOMENTUM EUROPE: DOUBLE-SORTING VS COMBINATION

In Europe the results of Value and Momentum are somewhat mixed and strongly depend on what point in time we analyse. The combination shows a very consistent profile over time, reflecting the strong performance of Momentum in Europe.

Source: FactorResearch

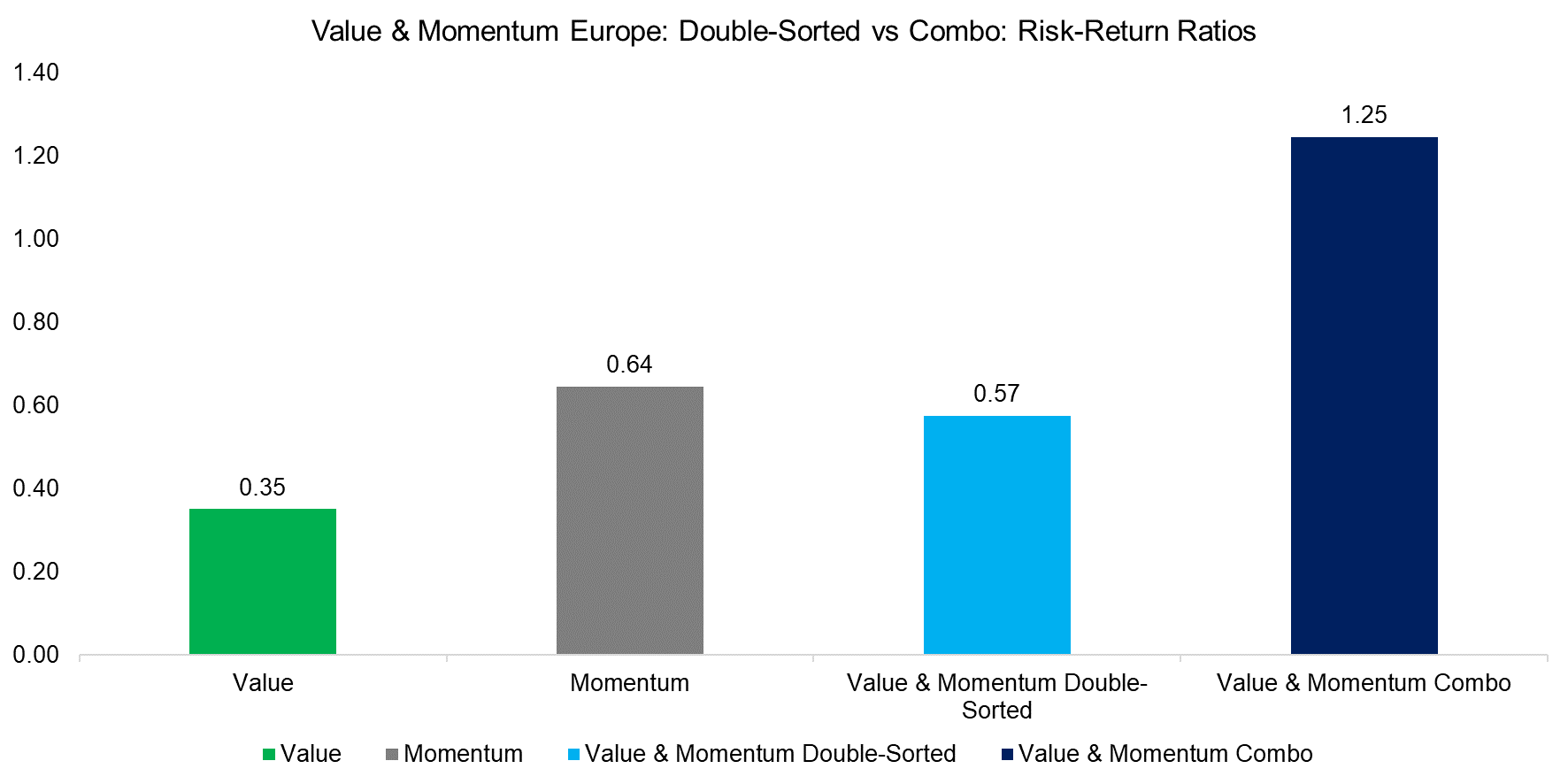

The risk-return ratio analysis shows the same as in all previous results: the combination has the highest ratio.

Source: FactorResearch

FURTHER THOUGHTS

This short research note compares combining single factors in a portfolio versus double-sorting stocks for several factor characteristics. The results are somewhat mixed, double-sorting improves returns and risk-return ratios for Value and Quality, but not for Value and Momentum. The most interesting result was likely the consistency of the combination portfolios, which generated the highest risk-return ratios for all scenarios.

In addition to US and Europe we have replicated the results in other countries and the conclusion remains: double-sorting works better for Value and Quality than for Value and Momentum. Unfortunately we don’t have a good rationale for this and will conduct further research on this topic. Any thoughts or comments are appreciated.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.