What Equity Factor Is Best Combined with Managed Futures?

The one with the lowest correlation to CTAs?

August 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

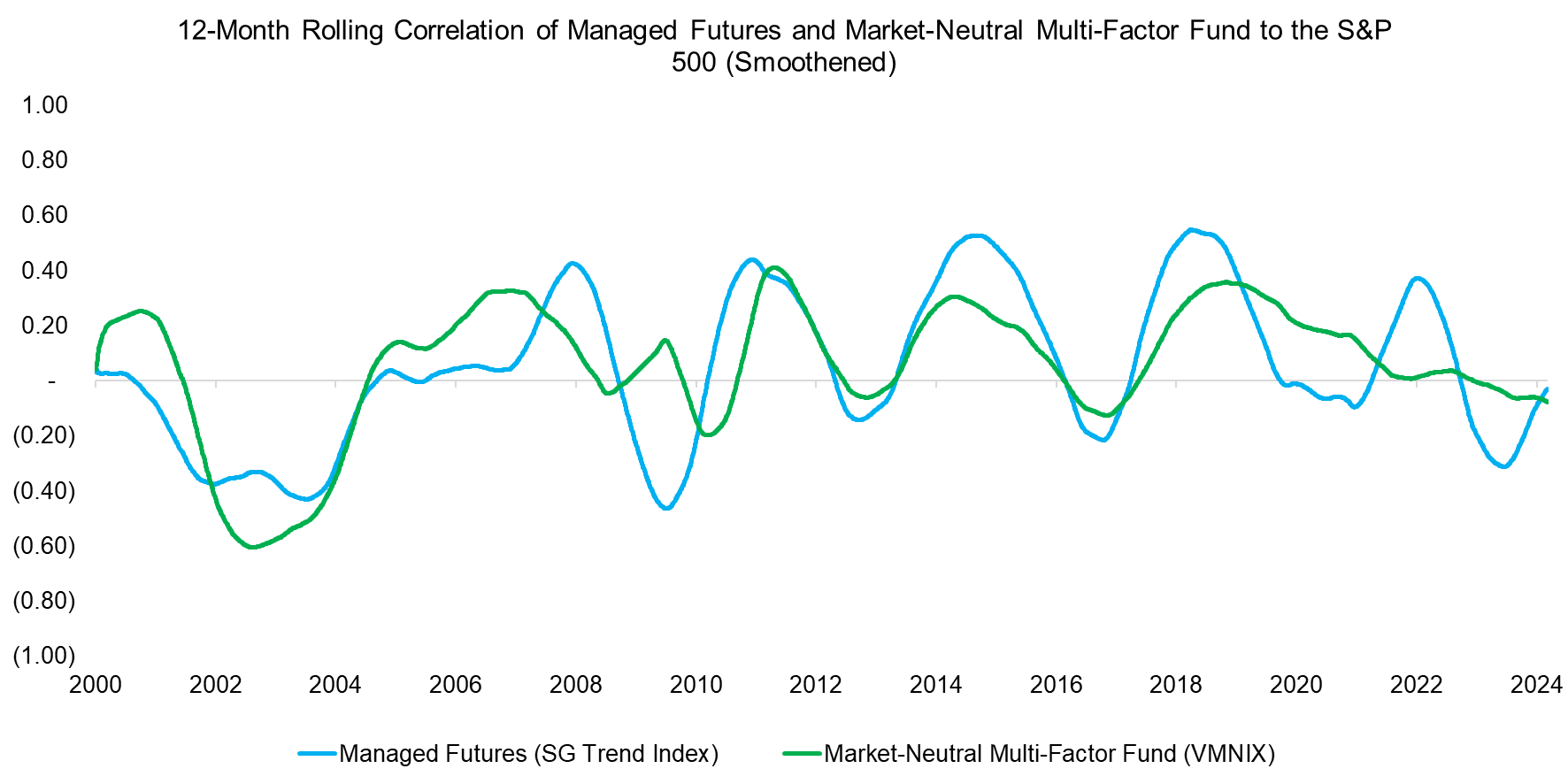

- Managed futures and market-neutral multi-factor portfolios often provided similar risk exposures

- Combining quality, low volatility, or value stocks with CTAs worked best

- Momentum, growth, and size combinations were the worst

INTRODUCTION

In a recent research article (read Managed Futures versus Market-Neutral Multi-Factor Investing), we highlighted that managed futures, also known as CTAs, exhibited similar trends in correlation to the S&P 500 as a market-neutral multi-factor portfolio, where we’ve taken Vanguard’s Market Neutral Fund (VMNIX) as a proxy. Although these two diversifying strategies are uncorrelated to each other on average, they seem to have offered the same risk exposures during certain periods.

Naturally, this begs whether it makes sense to allocate to both strategies or select only one for diversification. Our research highlighted that an allocation to managed futures would have generated higher diversification benefits for an equities portfolio than an allocation to a market-neutral multi-factor portfolio, or an equal-weighted combination of both, from 2000 to 2024.

Source: Finominal

However, the relationship between managed futures and a market-neutral multi-factor portfolio is not clear. A CTA’s portfolio is comprised of long and short positions across asset classes, while a multi-factor portfolio provides exposure to a long and short portfolio of stocks sorted on metrics like valuation, performance, volatility, and quality (read Factor Investing Is Dead, Long Live Factor Investing!).

Intuitively, the only equity factor that might be correlated to managed futures is momentum as both strategies pursue trend following, which might lead to the same exposures, e.g. the CTA might be long oil futures and the momentum factor long oil stocks.

In this research article, we will explore the relationship between single equity factors and managed futures, and how investors best combine them.

CORRELATION ANALYSIS

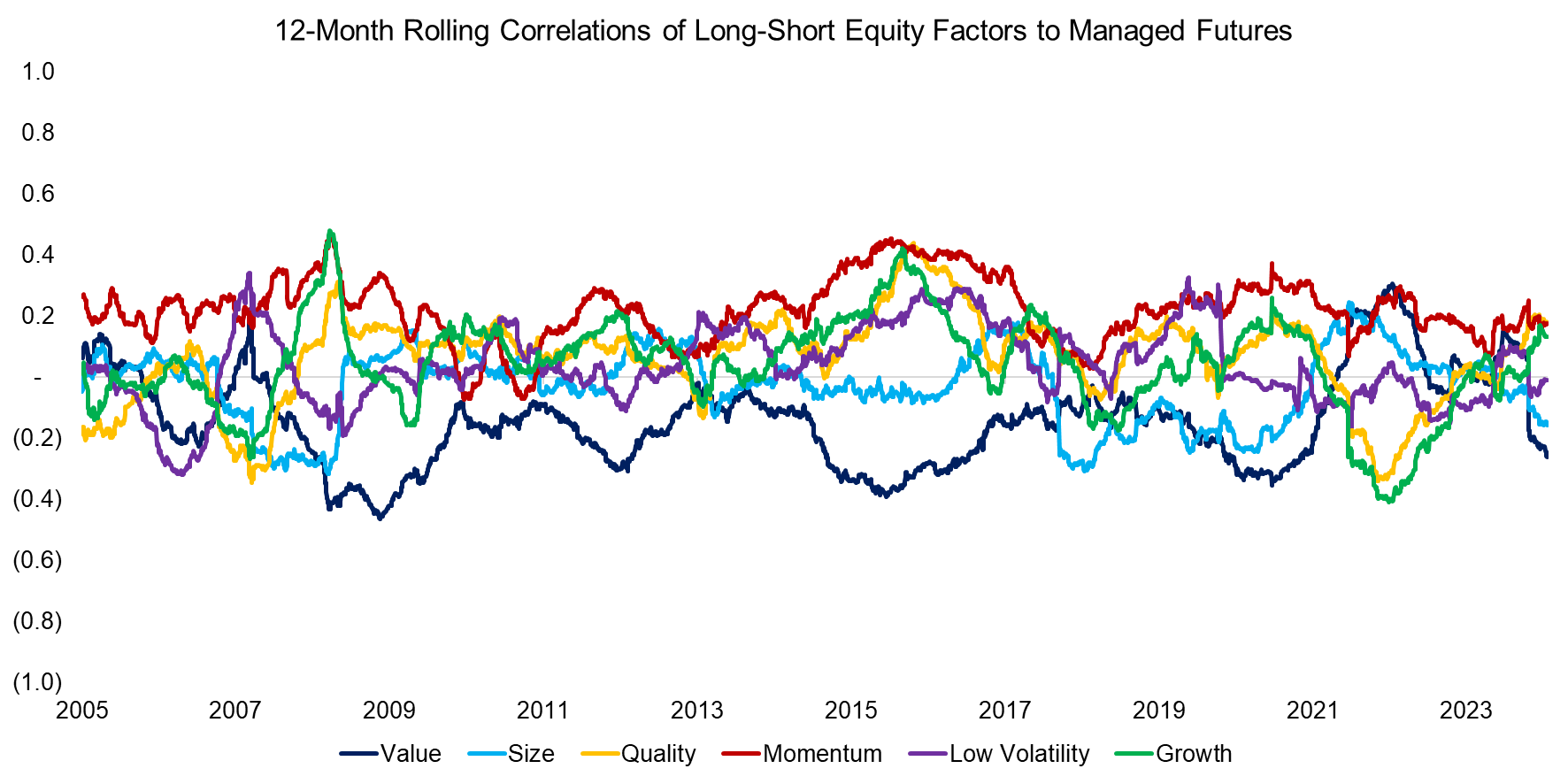

First, we compute the 12-month rolling correlations of long-short equity factors to the SG Trend Index, which is a proxy for the CTA industry. The equity factors are defined using industry-standard definitions and the portfolios are designed beta-neutral selecting the top and bottom 10% ranked stocks trading in the U.S. with a market capitalization larger than $1 billion.

We observe that the correlations of equity factors to managed futures were low on average and ranged between -0.1 to +0.2 in the period from 2005 to 2024. However, we also see that momentum exhibited a consistently positive correlation, and value a consistently negative correlation. The correlations of the size, quality, low volatility, and growth factors were time-varying.

Source: Finominal

COMBINING LONG-SHORT EQUITY FACTORS & MANAGED FUTURES

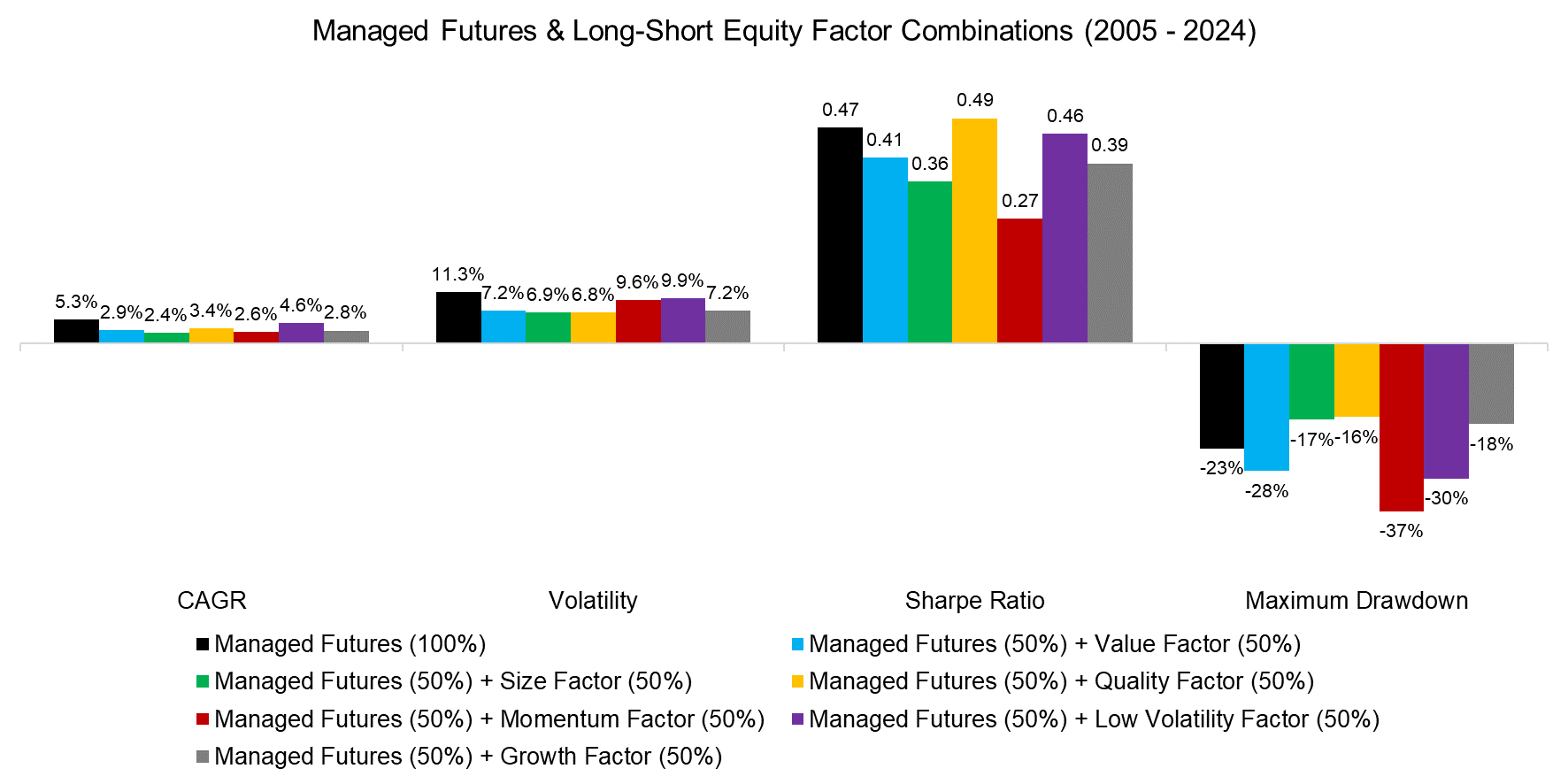

Intuitively, combining the long-short momentum factor with managed futures should be the least attractive as these are positively correlated. At the same time, a combination with value should be most accretive given a negative correlation.

When we compute the Sharpe ratios of combination portfolios comprised of a 50% allocation to managed futures and a 50% allocation to single equity factors, we see that indeed the momentum factor generated the lowest Sharpe ratio. However, the combination with value was not the most attractive as the quality and low volatility factor combinations offered higher Sharpe ratios.

We can explain this by differentiating between risk and return. Factors with low or negative correlations help reduce risk, i.e. volatility, but if they have performed poorly, such as value or size over the recent decade, there is a risk and return reduction. The poor performance of the combination with momentum can partially be attributed to the factor´s crash in 2009.

Source: Finominal

COMBINING STOCKS & MANAGED FUTURES

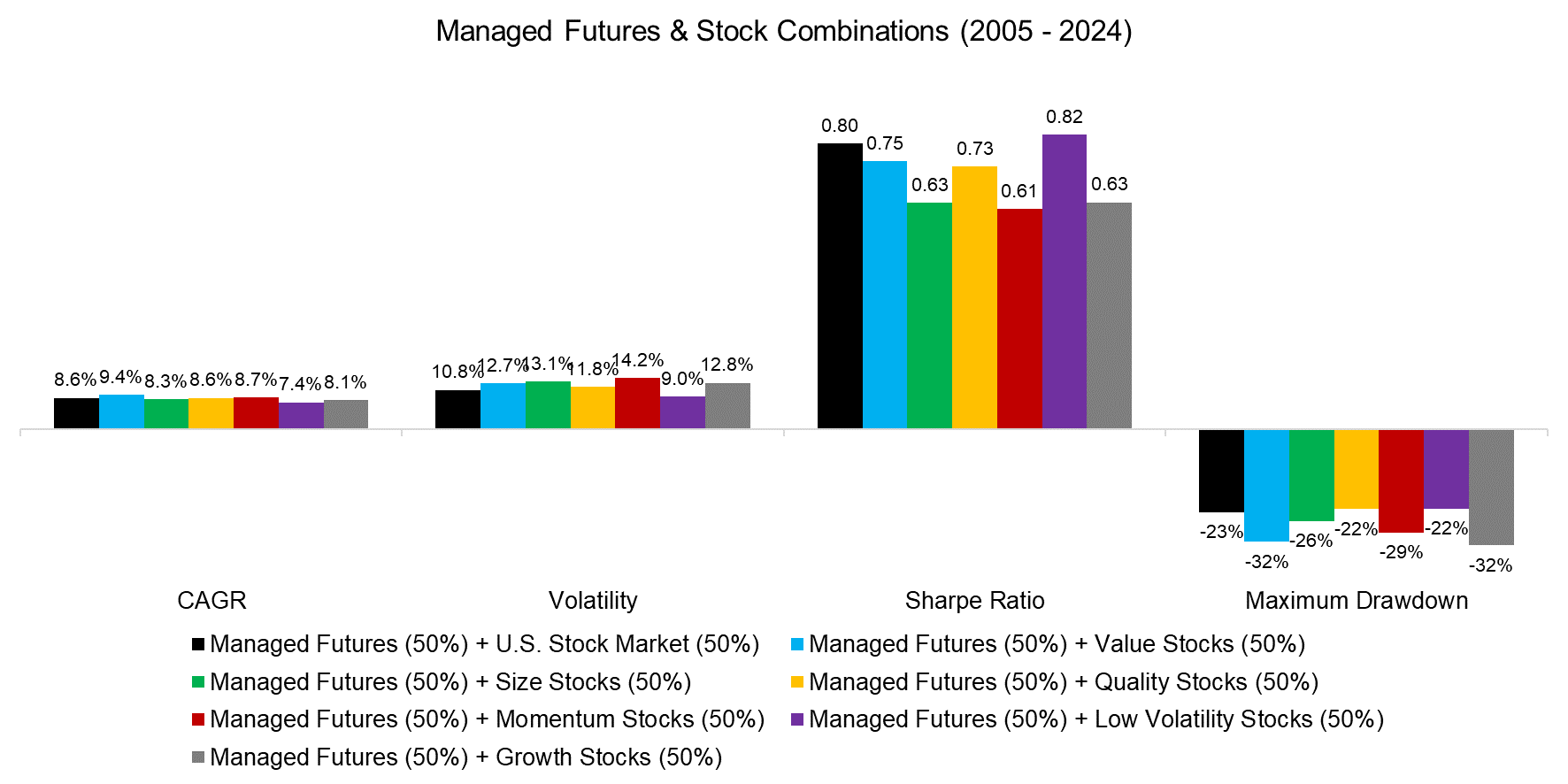

Although it is interesting to evaluate combinations between long-short equity factors and managed futures, this is somewhat theoretical as most investors combine stocks and CTAs (read Smart Beta vs Alpha + Beta).

We rerun the analysis using long-only equities portfolios created from the top 10% of stocks ranked by the various factors, which highlights that combining cheap, high quality, and low volatility stocks with managed futures would have generated the highest Sharpe ratios over the last two decades, while small-cap, high momentum, and growth stocks would have produced lower risk-adjusted returns. It is worth highlighting that combining value stocks with CTAs would have generated the highest return, but also the largest maximum drawdown.

Source: Finominal

FURTHER THOUGHTS

Astute readers will have noticed that 100% allocation to managed futures generated the second highest Sharpe ratio after the combination with the quality factor, and allocating to the broad stock market would have been almost as attractive as a combination with low volatility stocks. Stated differently, the case for combining CTAs and long-short equity factors, or using a smart beta approach with CTAs, is not particularly strong.

RELATED RESEARCH

Managed Futures versus Market-Neutral Multi-Factor Investing

Factor Investing Is Dead, Long Live Factor Investing!

CTAs: With or Without Trend Following in Equities?

Bonds versus CTAs for Diversification

Carry versus Trend Following

Trend Following in Equities

Trend Following in Bear Markets

Replicating a CTA via Factor Exposures

Creating a CTA from Scratch – II

CTAs vs Global Macro Hedge Funds

Managed Futures: The Empire Strikes Back

Managed Futures: Fast & Furious vs Slow & Steady

Hedging via Managed Futures Liquid Alts

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.