What is wrong with Inverse ETFs?

Double-edged swords cut both ways

August 2022. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Inverse ETFs come with significant risk disclosure

- Analyzing the performance of these products justifies the warnings

- There is a significant difference between performance of inverse ETFs & the inverse underlying indices

INTRODUCTION

In May 2022, Allianz, the large German insurance company, agreed to pay $6 billion in damages to investors and have its U.S. asset management arm plead guilty to criminal proceedings due to the collapse of a few investment funds. These were supposed to create alpha regardless of the market conditions, but lost $7 out of $11 billion under management during the COVID-19 crisis.

The case of Allianz highlights the risk of running an asset management company in the U.S., which has become riskier over time as the judicial system allows much larger payouts than in other jurisdictions when legal cases are won. Given this, the risk disclosures in the prospectuses of U.S. investment products keep on increasing in length. Somewhat ironically, the longer the prospectuses become, the less useful they are for investors as they are too time-consuming to read and require more legal acumen.

The risk disclosure also depends on the product and some are more upfront about the investment risks than others. One category that is very explicit about risks is inverse ETFs, which aim to provide the inverse performance of indices like the S&P 500. For example, the website of the ProShares’ Short S&P 500 ETF (SH) is dominated by a large section called “Important Considerations”, which is rather unusual as such risk warnings are typically found at the bottom in a relatively small font size. It seems inverse ETFs are especially risky.

In this research note, we will explore the peculiarities of inverse ETFs.

UNIVERSE OF INVERSE ETFs

We focus on inverse exchange-traded products and funds (ETPs & ETFs) traded in the U.S., which is a universe of close to a 100 products that cumulatively manages approximately $20 billion. Given that the total assets under management of ETFs in the U.S. is more than $7 trillion, it represents a small niche of the ETF market.

The universe of inverse ETFs covers various asset classes such as equities and fixed income, broad indices like the S&P 500, as well as niche sectors like SPACs. The average management fee is 0.95% per annum, which is exceptionally high for ETFs.

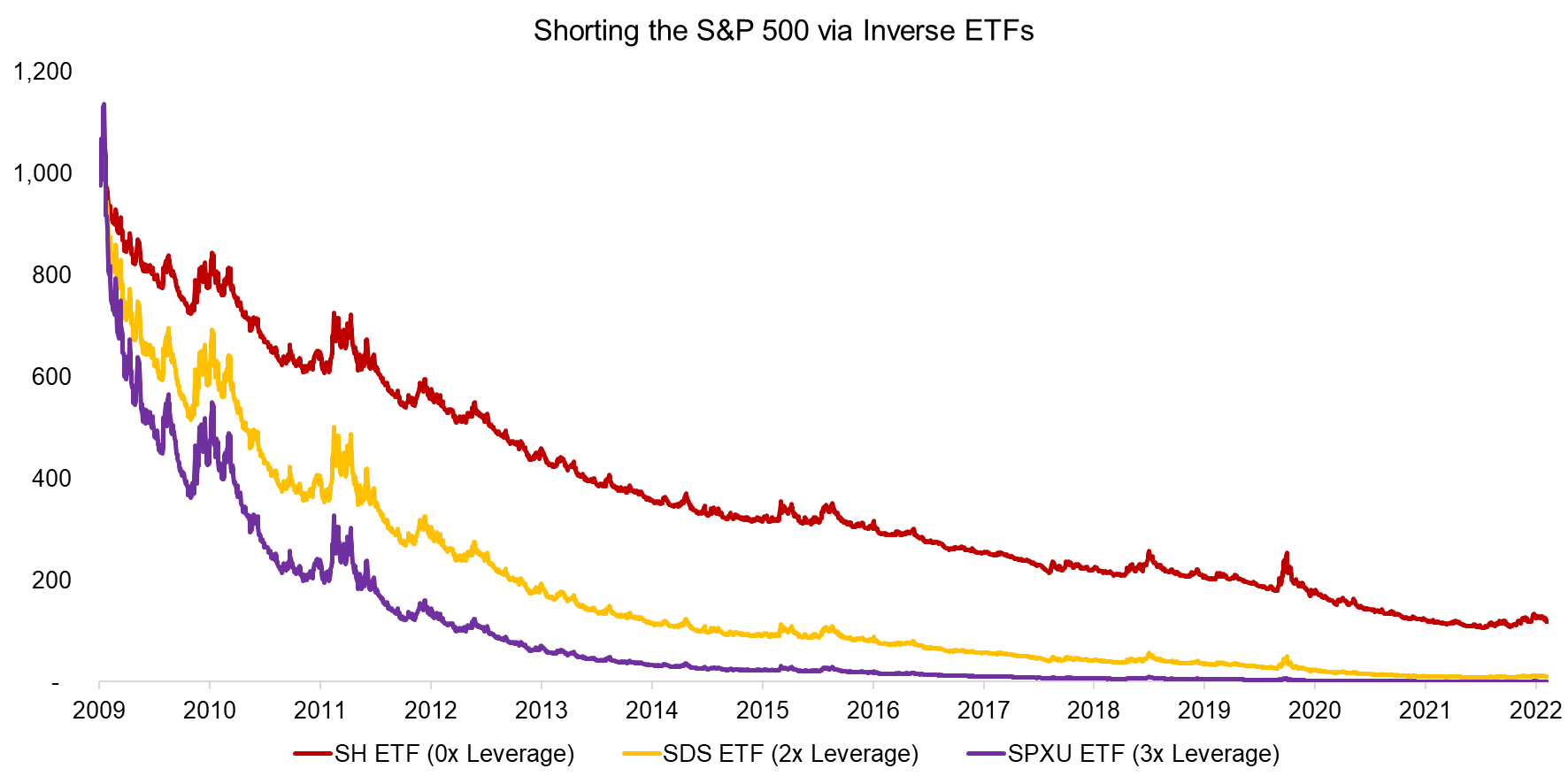

We select three inverse ETFs that provide negative exposure to the S&P 500 with leverage ranging from 0x to 3x for this analysis. These three ETFs have a track record of more than 10 years and manage more than $5 billion of assets.

We observe that investing $1,000 in 2009 would have wiped out the investment capital for both of the leveraged inverse ETFs and resulted in a 80% drawdown for the unleveraged one. The S&P 500 has mostly been in a bull market since the global financial crisis and shorting the stock market has not worked well.

Source: FactorResearch

INVERSE S&P 500 VS INVERSE S&P 500 ETF INDEX

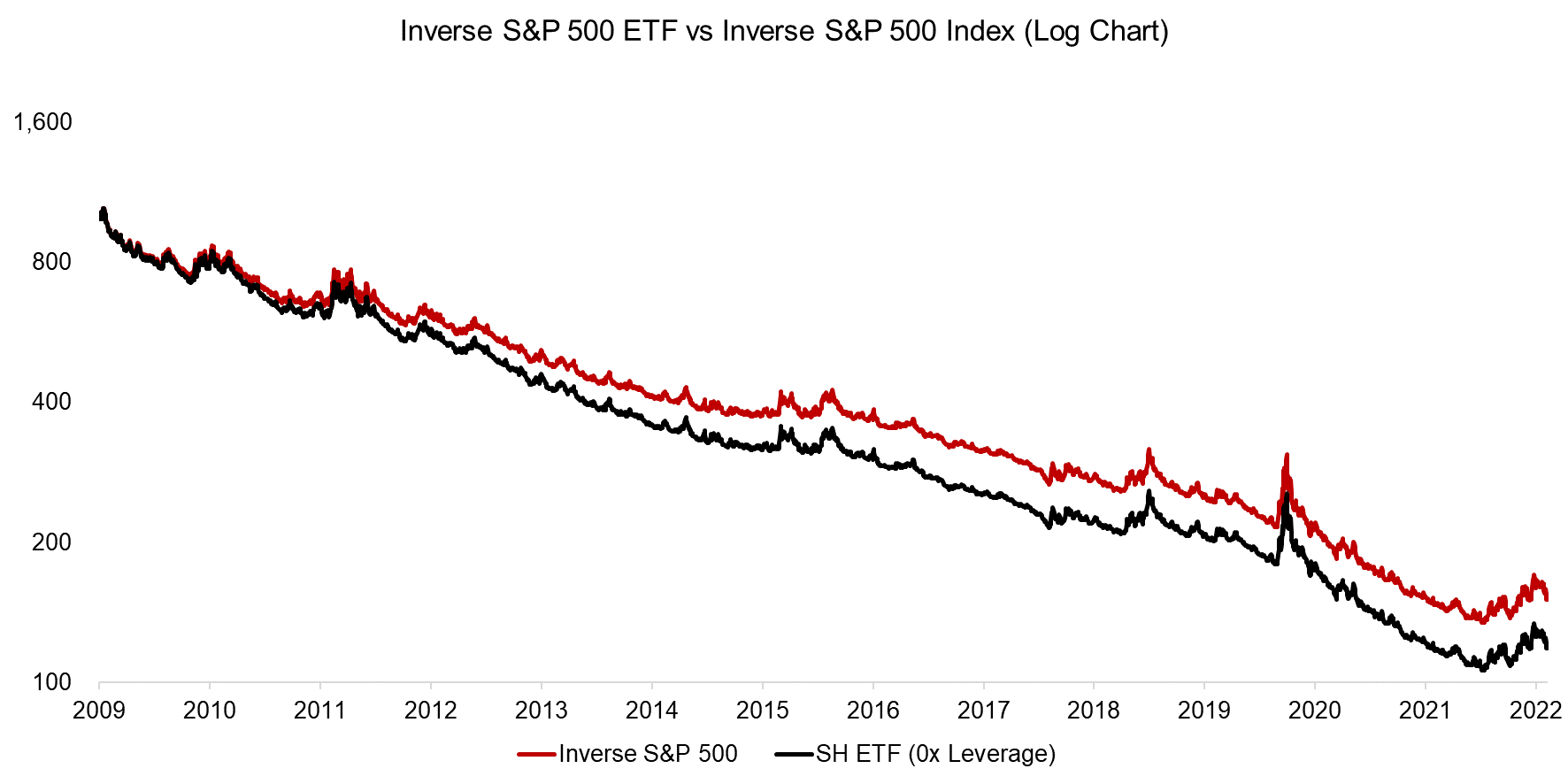

The risk disclosures of inverse ETFs highlight that the performance of an inverse ETF does not necessarily mirror that of the inverse performance of the underlying index.

We can analyze this by contrasting the performance of the ProShares S&P 500 Inverse ETF (SH) and the inverse S&P 500 total return index. The correlation in the period between 2009 and 2022 was one and the trends were identical, but the ETF generated a slightly worse return. Furthermore, the difference in performance has been increasing consistently over time.

Source: FactorResearch.

EXPECTATIONS VERSUS REALITY

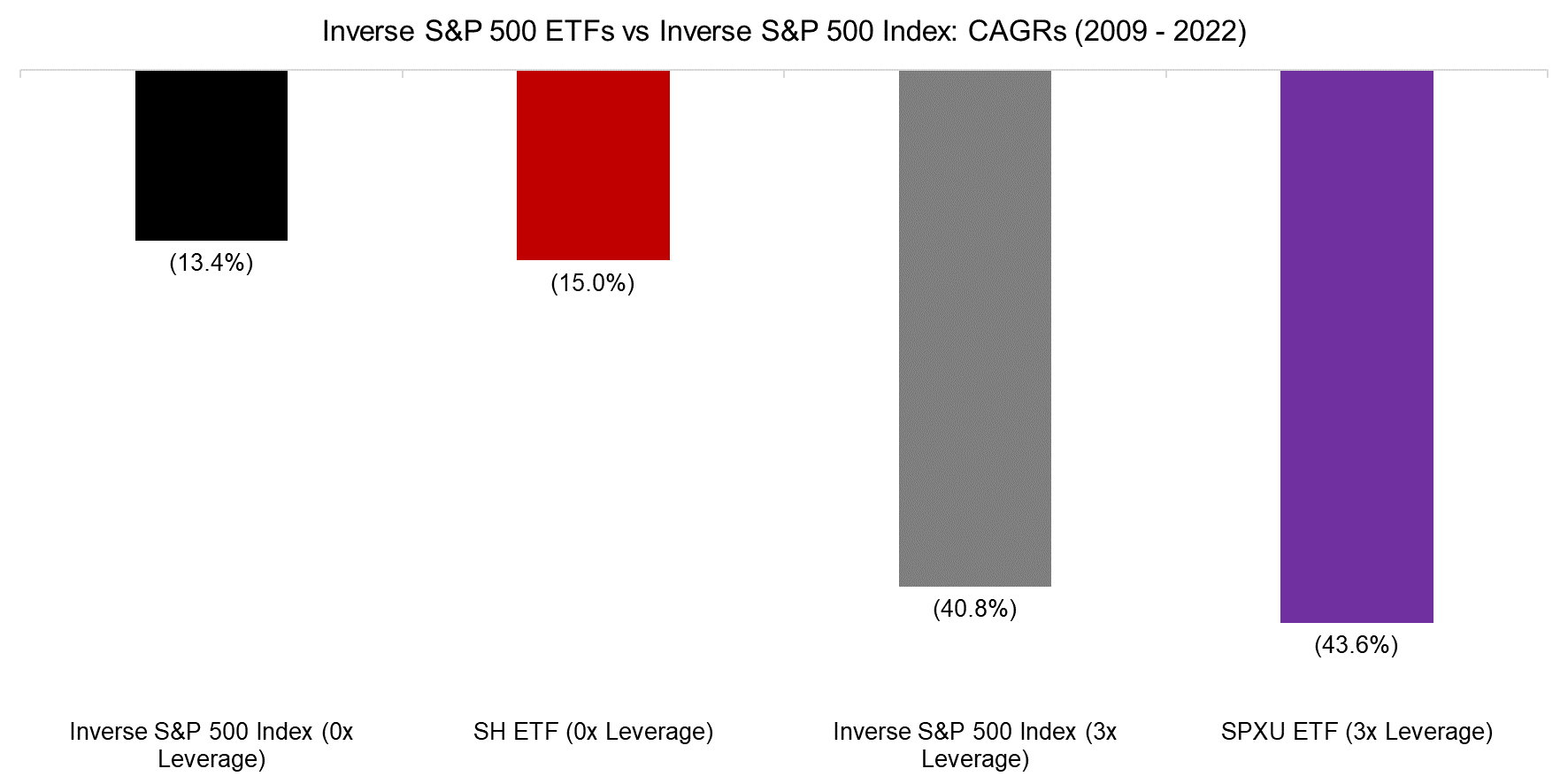

The difference in performance between inverse ETFs and their underlying indices is explained by these ETFs aiming to replicate the return on a daily basis, which impacts the performance due to compounding, especially when volatility is high. Furthermore, some of these ETFs use futures in portfolio construction that incur trading costs. Finally, high management fees also detract from performance over time.

We can measure this difference for SH (0x leverage) and SPXU (3x leverage), where the CAGRs were 1.6% and 2.9%, respectively, lower per annum in the period from 2009 to 2022, compared to the inverse performance of the S&P 500.

Stated differently, investors are buying products that generate returns significantly worse than the negative performance of the underlying index, which justifies the risk disclosure for these products. WYSINWYG – what you see is not what you get.

Source: FactorResearch

INVERSE ETFS FOR SHORTING

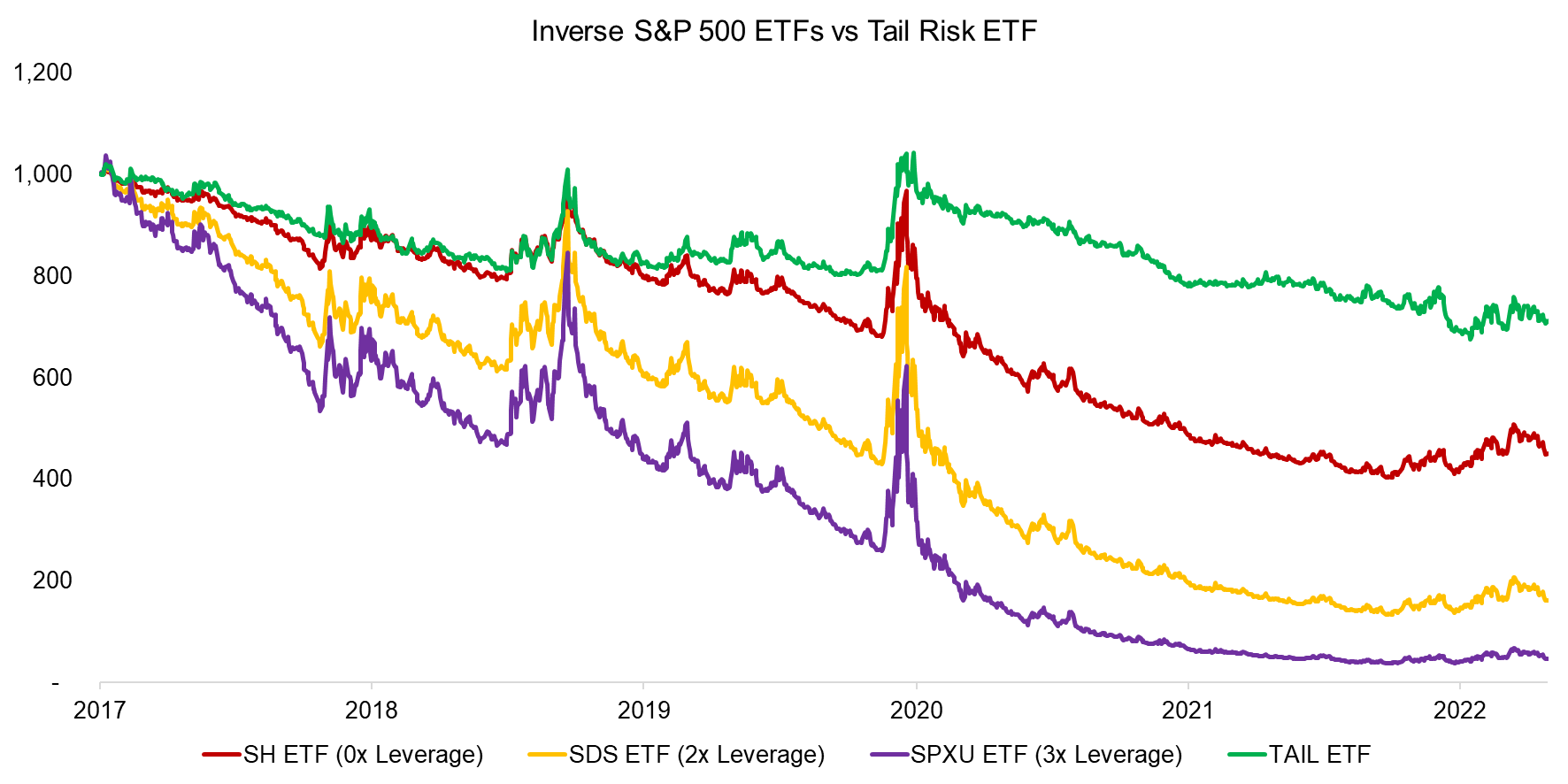

Finally, it is interesting to compare inverse ETFs with tail risk strategies, which have become available as ETFs, eg the Cambria Tail Risk ETF (TAIL). Comparing the performance of TAIL, which buys puts on the S&P 500, versus the inverse ETFs highlights a somewhat milder decline in the period between 2017 and 2022, but identical trends (read Tail Risk Hedge Funds).

Source: FactorResearch

FURTHER THOUGHTS

Are inverse ETFs a useful addition to the universe of ETFs?

Probably not. As per their risk disclosure and this analysis they are unsuitable for long-term short positions on the stock market, eg when constructing an equity market neutral strategy. Shorting futures or stocks directly is more complicated than buying an ETF, but these instruments have better characteristics for portfolio construction.

This leaves short-term speculation as the primary purpose of inverse ETF, but there is little empirical evidence that investors are able to generate consistent profits with day trading as markets have become highly efficient (read Short-Term Momentum in Stocks, Commodities, and Cryptos).

As often in capital markets, the (asset management) house wins.

RELATED RESEARCH

Risk-Managed Equity Exposure II

Market Timing vs Risk Management

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.