Why Pension Funds & Millennials Should Avoid ESG

Plain and Hidden Costs of ESG Investing

December 2019. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- ESG ETFs underperformed the stock market since 2005

- Likely explained by higher fees, a constrained stock universe, and sector bets

- Financially-impaired investors like public pension funds and Millennials should avoid ESG investing

INTRODUCTION

If investors would be looking for the ETF flavor of the year, then it would likely be ESG as highlighted by the large number of product launches in 2019. In the US, six ESG-focused ETFs have grown to more than $1 billion of assets under management, which is an important milestone that only approximately 400 other ETFs have reached, out of a global universe of close to 7,000.

However, the total assets under management in ESG-focused ETFs is only approximately $25 billion, which is less than one percent of total assets in the ETF industry, according to data from ETFGI. Given that most equity and fixed income investment products can be structured to be ESG-compliant, there is plenty of further room to grow. Blackrock, the world’s largest asset manager, expects $400 billion in assets under management by 2028.

Two investor types that are particularly keen on ESG investing are public pension funds and Millennials, essentially representing the old and the young. However, there is a case to be made that neither of these should consider ESG investing, which we will outline in this short research note (read ESG Investing: Too Good to be True?).

101 OF ESG INVESTING

ESG investing basically means separating good from bad corporate citizens as measured on environmental, social, and governance metrics. Investors evaluating ESG strategies should carefully consider the following:

- Additional costs: Investing in ESG requires additional resources from investors, either directly or indirectly, if investing is outsourced to a fund manager. Money needs to be spent on buying ESG ratings from data providers like MSCI or FTSE. Furthermore, staff needs to be hired to evaluate the data, which typically requires expensive data scientists given large and complex data sets.

- Data issues: There are many providers that sell ESG ratings for stocks and no ultimate authority. Unfortunately, in many cases, the same company ranks high on ESG metrics in one data set while low in another. This typically happens with complex firms like Exxon Mobile, which does pollute the environment through its core business, but also has a strong focus on treating its employees well and investing in its local communities.

- Higher fees: ESG products charge higher management fees than plain beta ETFs, which have become almost zero-cost.

- Stakeholder approach: Companies that rank high on ESG pursue a stakeholder, not a shareholder approach. Naturally this implies that resources that could have been distributed to shareholders via dividends or share buybacks are allocated elsewhere.

- Reduced investment universe: Avoiding companies that rank low on ESG reduces the universe of investible companies and opportunity set for investors. A surprisingly small number of stocks tend to be responsible for most stock market returns.

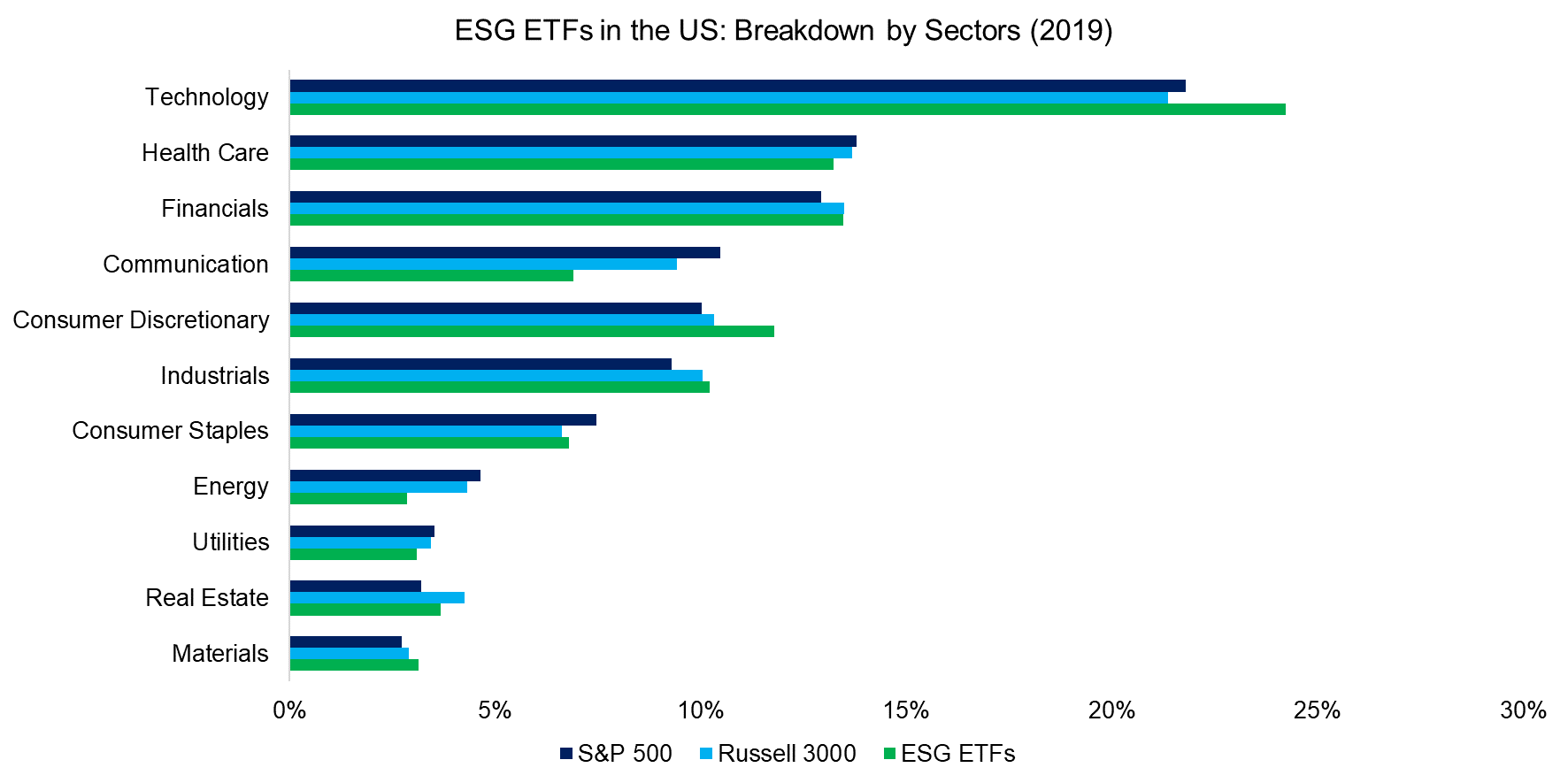

- Structural sector bets: Certain sectors like energy rank structurally low on ESG given industry characteristics, which implies that investing in ESG strategies results in sector biases. Specifically, this results in a structural overweight in technology and underweight in energy stocks. Technology stocks have fallen out of favor before while energy stocks tend to benefit from geopolitical tensions that increase the oil price.

Naturally, some of these considerations apply to all strategies that deviate from a benchmark index like the S&P 500, but are worth highlighting.

Source: FactorResearch

BENCHMARKING ESG ETFS IN THE US

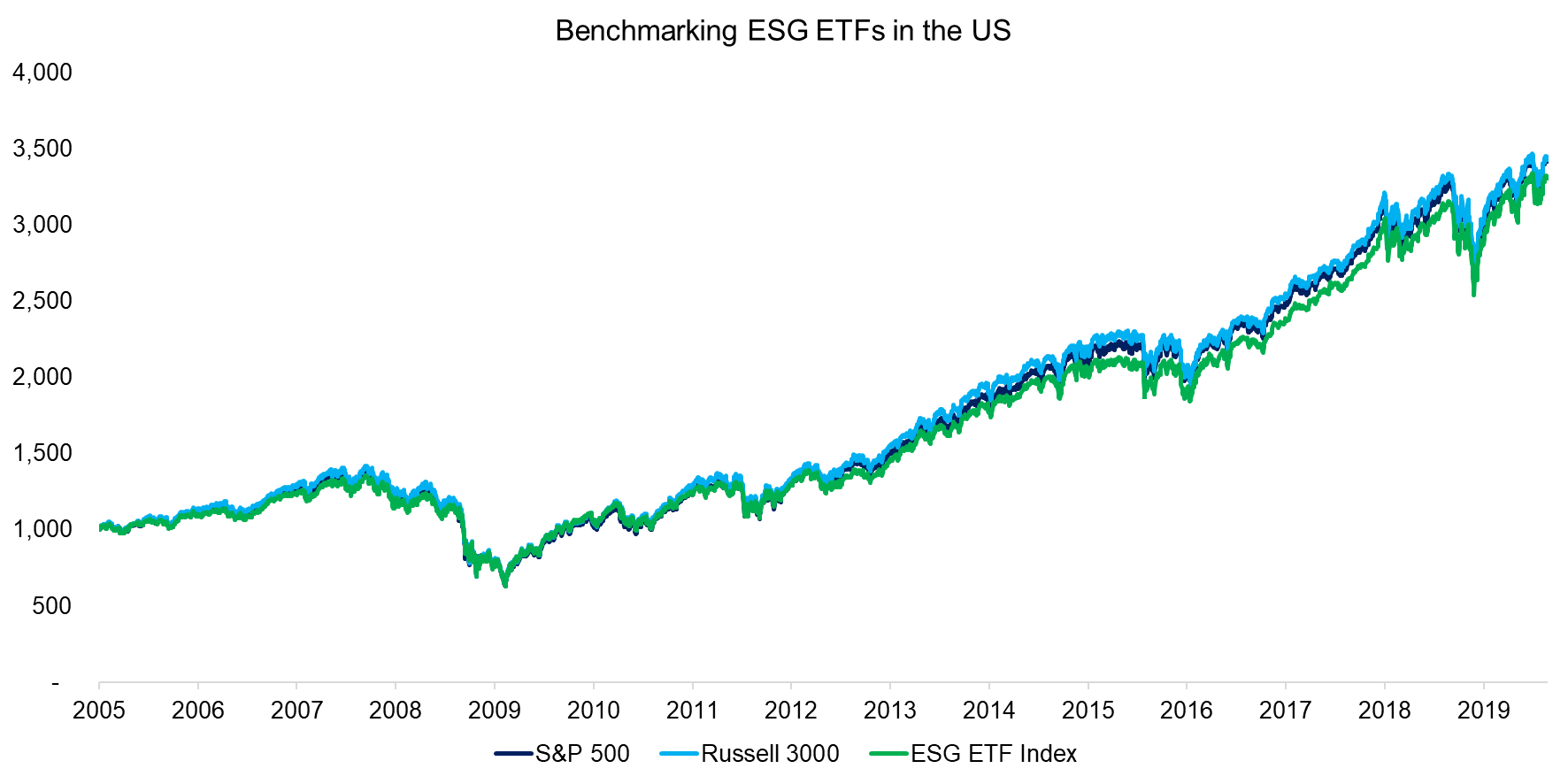

The first ESG-focused ETF in the US stock market was launched in 2005 and many further came thereafter, which provides investors with a full market cycle for benchmarking the performance against equity indices like the S&P 500 or Russell 3000. We observe that an equal-weighted index of ESG ETFs would have slightly underperformed either benchmark index since 2005 (read ESG: What is Under the Hood?).

Source: FactorResearch

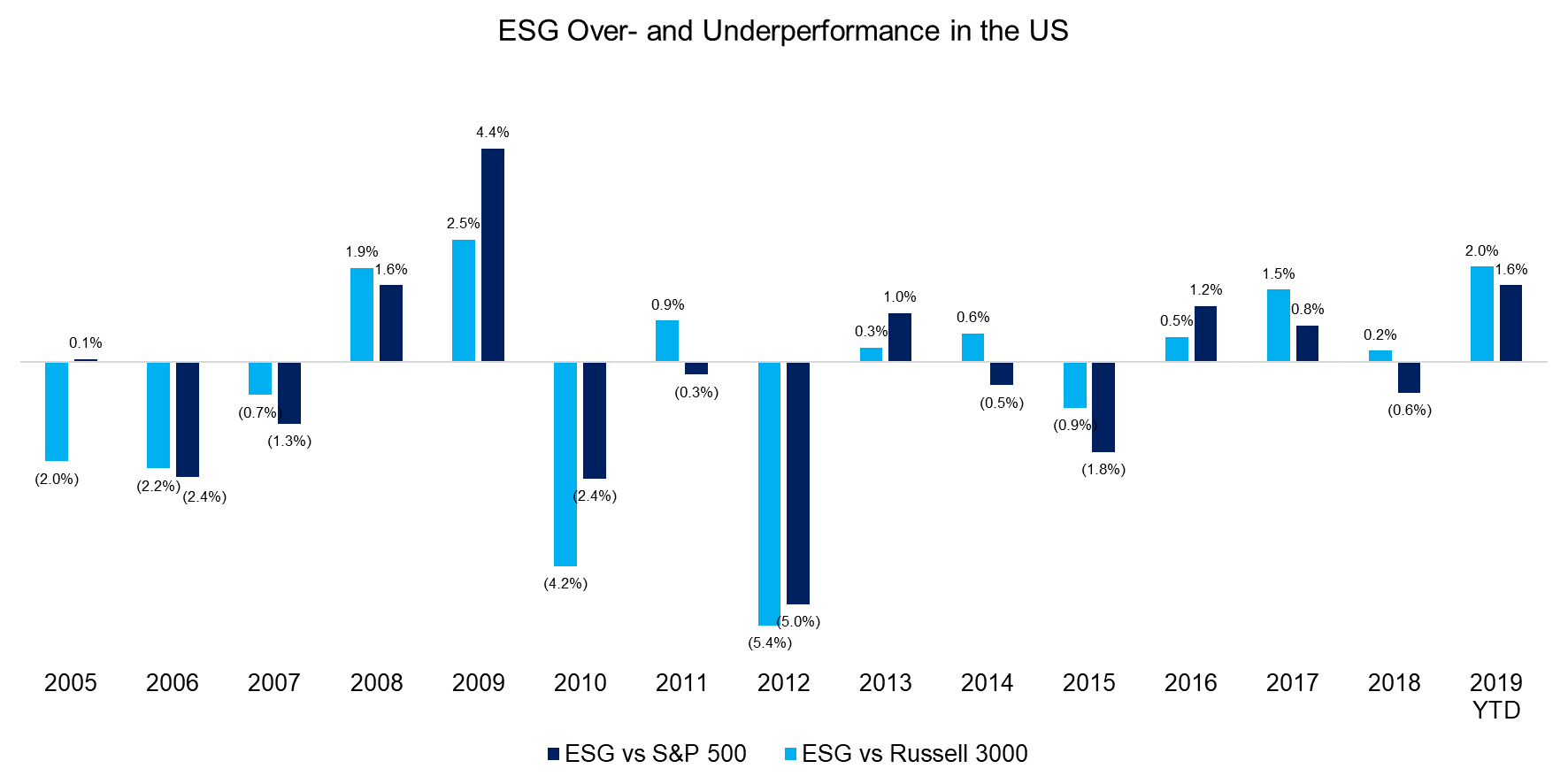

Investors could challenge that ESG-focused ETFs might have fared better, if a different starting point for benchmarking was chosen. However, if we compare the over- or underperformance of ESG ETFs to the S&P 500 or Russell 3000 per calendar year, we observe a rather random picture. ESG investing certainly does not generate consistent outperformance.

Source: FactorResearch

WHY PUBLIC PENSION FUNDS AND MILLENNIALS SHOULD AVOID ESG INVESTING

Anecdotal evidence suggests that public pension funds globally show a keen interest in ESG investing. Given that most members of public pension fund investment committees are deeply ingrained in their local communities, it is natural for them to show support for companies that treat their employees well, aid local schools, and aim to avoid polluting the environment.

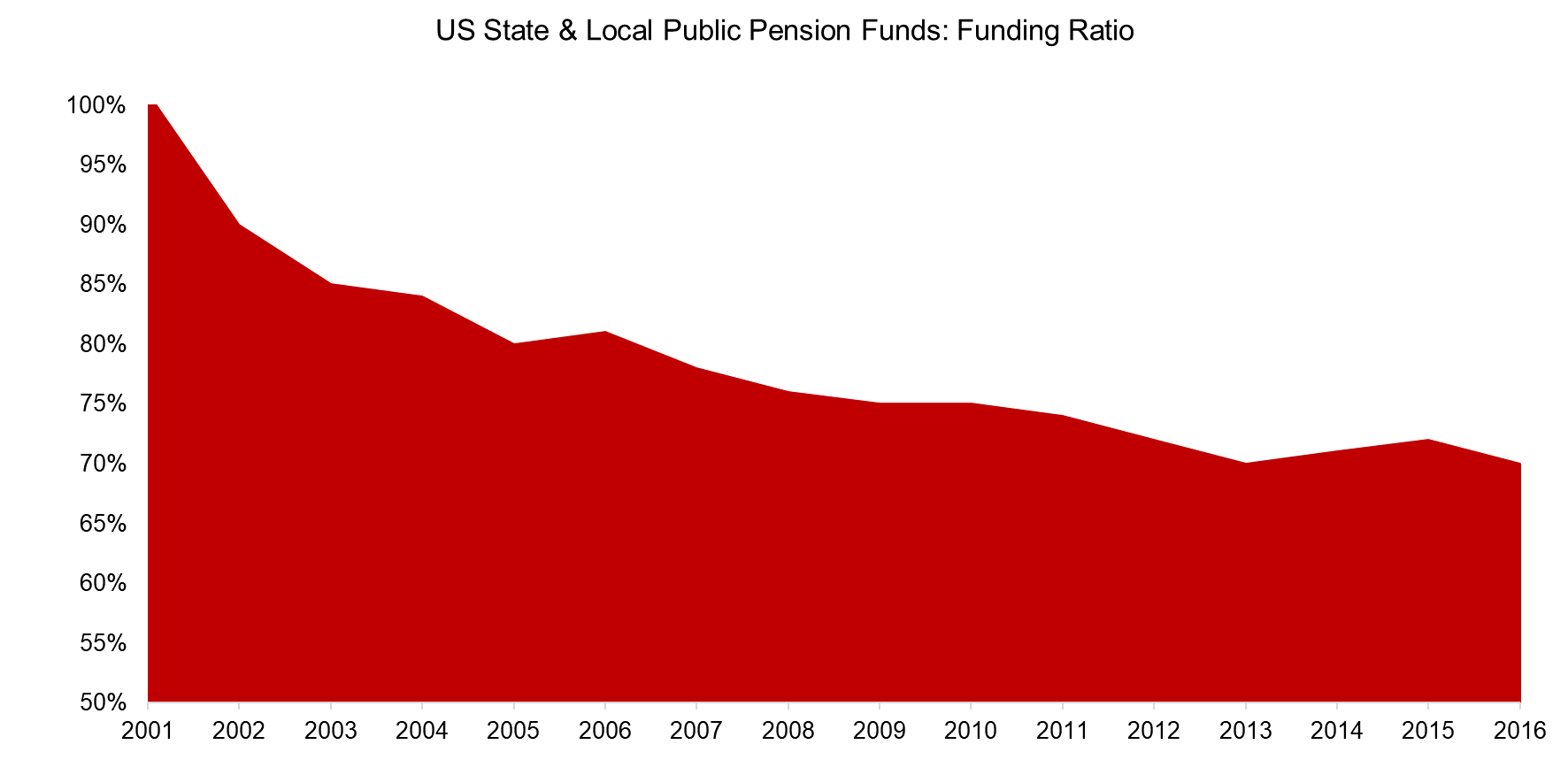

However, in many countries pension funds, public as well as corporate, are significantly underfunded. US state and local pension funds had a funding ratio below 75% in 2016, which is difficult to rectify, especially in a low interest-rate environment. Unfortunately, this implies that most workers that retire in the future will have to accept haircuts on their pensions. Millions will age with reduced living standards or even in poverty.

The only real obligation that pension funds have is to meet their liabilities and pay full pensions to retired workers. With regards to ESG investing there is only one question that is relevant for the investment officers at pension funds: How sure are you that ESG investing will not cost performance?

Unless there is absolute certainty that ESG strategies will not underperform plain beta benchmarks, they should be avoided. Especially considering that the track record of ESG ETFs in the US since 2005 already indicates lower returns, which can be reasonably explained by higher fees, a constrained stock universe, and sector bets.

Source: Public Plans Database

A survey from Bank of America showed that 78% of Millennials review their investment portfolios from an ESG perspective, compared to only 63% from Generation X. Modern investment firms such as robo-advisors like Wealthfront or Betterment, which target Millennials, have therefore integrated ESG in their core product offering.

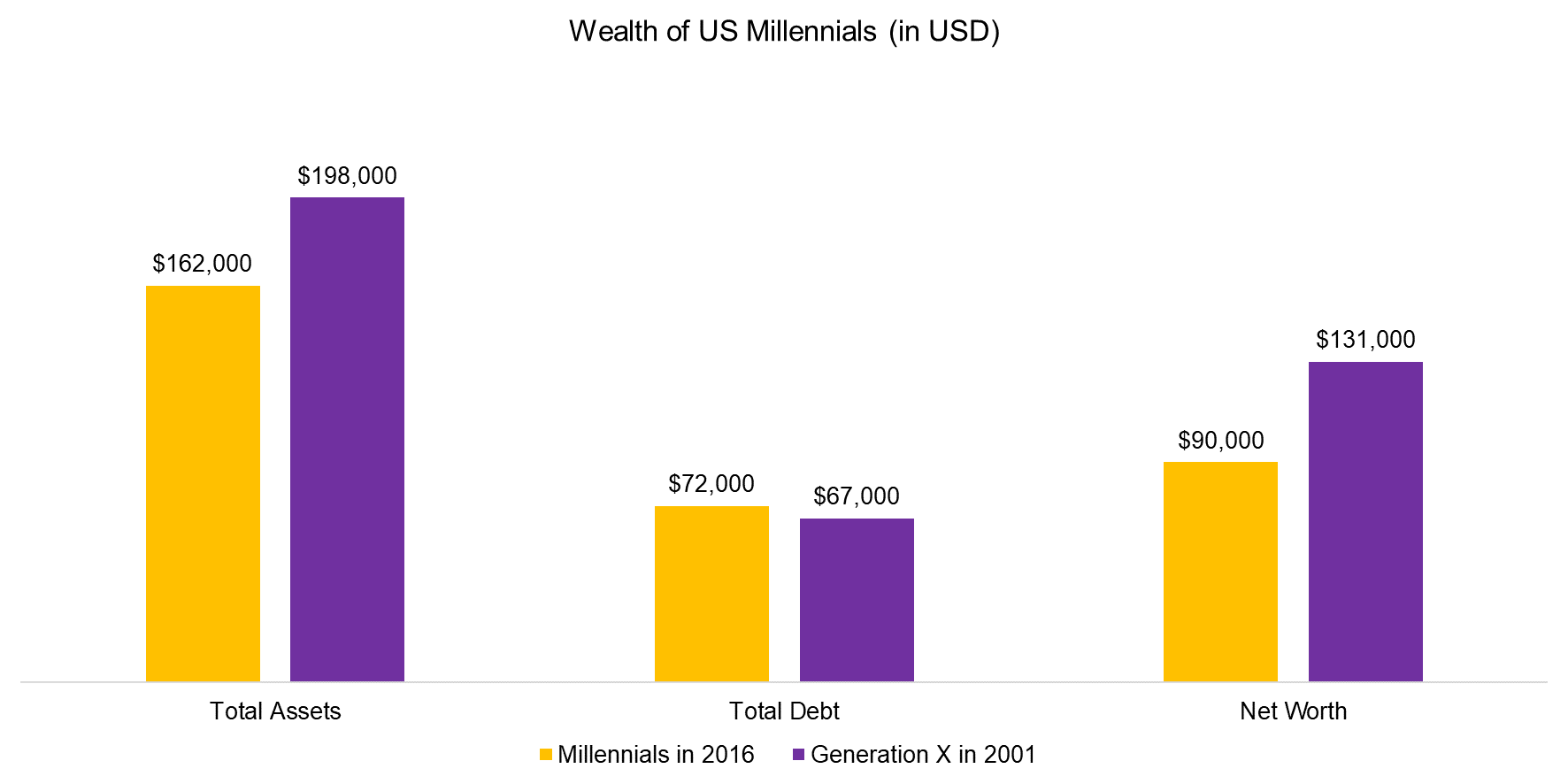

Unfortunately, Millennials are financially in poor shape, similar to public pension funds, although they will benefit from a generational wealth transfer over time. In comparison to Generation X, Millennials have fewer assets and more debt, which results in a lower net worth. It is therefore questionable if Millennials should take the risk of potentially lower equity returns on their investment portfolios. Particularly when they are already facing substantial outstanding student loans and cities where buying a home has become almost unaffordable and requires significantly more debt.

Source: St Louis Fed. Average household with a head between 20 and 35.

FURTHER THOUGHTS

New research on ESG investing is published almost daily, which frequently portrays that making investment portfolios ESG-friendly comes at no costs and sometimes even with benefits. Albeit much of that research is from product providers, which should be viewed with skepticism given clear conflicts of interests.

There are few free lunches for investors and if an investment strategy or product sounds too good to be true, then it usually is. Investing in good corporate citizens at no additional cost certainly sounds enticing.

ESG investing should be regarded as a luxury. Only go for it, if you can afford it.

RELATED RESEARCH

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.